- United States

- /

- Auto

- /

- NasdaqGS:LCID

Why Lucid Group (LCID) Is Down 5.7% After “EV Winter” Concerns Deepen Around Gravity SUV Launch

Reviewed by Sasha Jovanovic

- Earlier this month, Lucid Group’s interim CEO Marc Winterhoff used the 53rd Annual Nasdaq Investor Conference in London to acknowledge slowing electric-vehicle demand in the US and Europe, partly linked to the loss of US federal tax credits, even as the company prepares Gravity SUV deliveries and expands programs like Lucid Recharged.

- At the same time, Morgan Stanley’s downgrade of Lucid and warning of an extended “EV winter” have sharpened investor focus on the company’s liquidity, production ramp for the Gravity SUV, and long-term reliance on external funding.

- We’ll now examine how this EV demand slowdown and “EV winter” narrative could reshape Lucid’s previously bullish investment case.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Lucid Group Investment Narrative Recap

To own Lucid today, you have to believe it can transition from a high-loss luxury EV niche to a scaled, cash-generative business built around Gravity and its midsize platform. The recent “EV winter” downgrade and management’s admission of softer demand directly test the key near term catalyst, the Gravity SUV ramp, while also heightening the biggest immediate risk: Lucid’s dependence on external funding in the face of persistent losses and a weak share price.

Against that backdrop, the expanded US$2.0 billion delayed draw term loan facility from the Public Investment Fund stands out as the most relevant recent announcement. It reinforces Lucid’s claimed liquidity “runway” and supports the Gravity and midsize programs, but it also underlines how central ongoing external capital remains to the story while the company works through an EV demand slowdown and severe margin pressure.

Yet beneath those reassuring liquidity headlines, investors should also be aware that...

Read the full narrative on Lucid Group (it's free!)

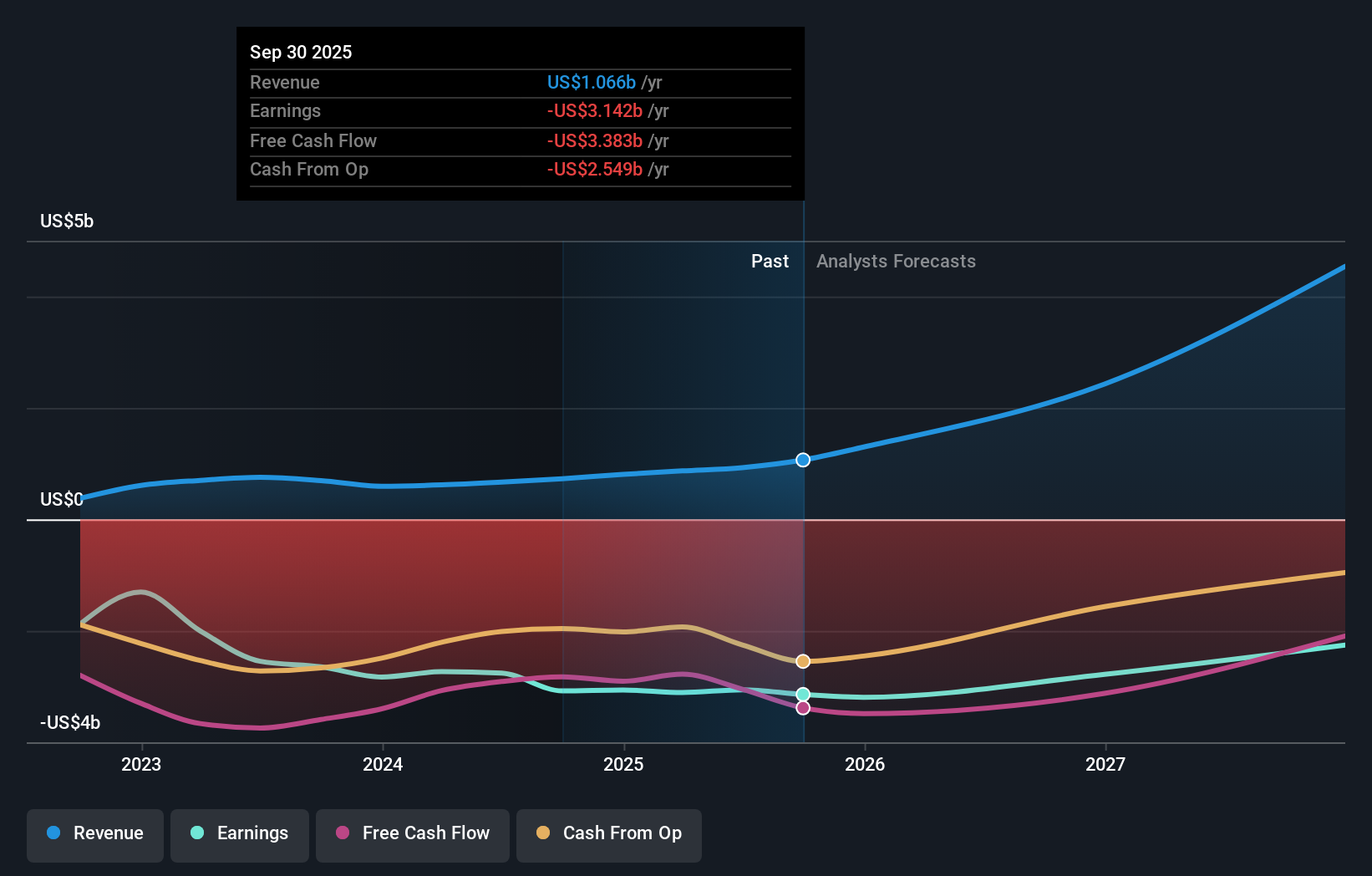

Lucid Group's narrative projects $5.6 billion revenue and $285.8 million earnings by 2028.

Uncover how Lucid Group's forecasts yield a $18.43 fair value, a 56% upside to its current price.

Exploring Other Perspectives

Eighteen fair value estimates from the Simply Wall St Community span roughly US$0.53 to US$28.77 per share, reflecting sharply different expectations. You are weighing these against a business still reliant on substantial external capital and facing an “EV winter,” so it can be useful to compare several of these viewpoints before forming a view on Lucid’s long term potential.

Explore 18 other fair value estimates on Lucid Group - why the stock might be worth over 2x more than the current price!

Build Your Own Lucid Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lucid Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lucid Group's overall financial health at a glance.

No Opportunity In Lucid Group?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion