- United States

- /

- Auto

- /

- NasdaqGS:LCID

The Bull Case For Lucid Group (LCID) Could Change Following Leadership Shakeup and Nvidia Partnership

Reviewed by Sasha Jovanovic

- Earlier this month, Lucid Group completed an US$875 million convertible senior notes offering due 2031, announced major executive changes including the departure of its Chief Engineer, and reported third-quarter revenue of US$336.58 million with a net loss of US$978.43 million.

- The company also revealed a collaboration with Nvidia on Level 4 autonomous driving technology and noted a bolstered liquidity position of US$5.5 billion, signaling a focus on both product innovation and operational funding.

- We'll examine how Lucid Group's leadership changes and Nvidia partnership could affect its outlook for advanced EV technology and growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lucid Group Investment Narrative Recap

Owning Lucid Group shares comes down to believing the company can scale into a global EV leader by building advanced technology and sustaining access to capital through heavy spending cycles. Although the recent convertible note offering and leadership changes bring fresh funding and executive focus, they have not meaningfully shifted the biggest short term catalyst, the commercial launch of transformative autonomous vehicles, or the main risk of ongoing negative gross margins and dilution from new capital raises.

Among recent announcements, Lucid’s expanded partnership with Nvidia on Level 4 autonomous driving stands out, aligning directly with the company’s ambitions in vehicle technology leadership. This move supports the near-term catalyst of capturing new revenue streams from the growing market for advanced driver assistance features, while operational and manufacturing execution risks remain central for investors.

On the other hand, investors should pay close attention to the continued reliance on external financing and the risk that persistent negative margins could pressure the company’s...

Read the full narrative on Lucid Group (it's free!)

Lucid Group's outlook anticipates $5.6 billion in revenue and $285.8 million in earnings by 2028. Achieving this would require an 82.4% annual revenue growth rate and a $3.39 billion increase in earnings from the current level of -$3.1 billion.

Uncover how Lucid Group's forecasts yield a $22.88 fair value, a 38% upside to its current price.

Exploring Other Perspectives

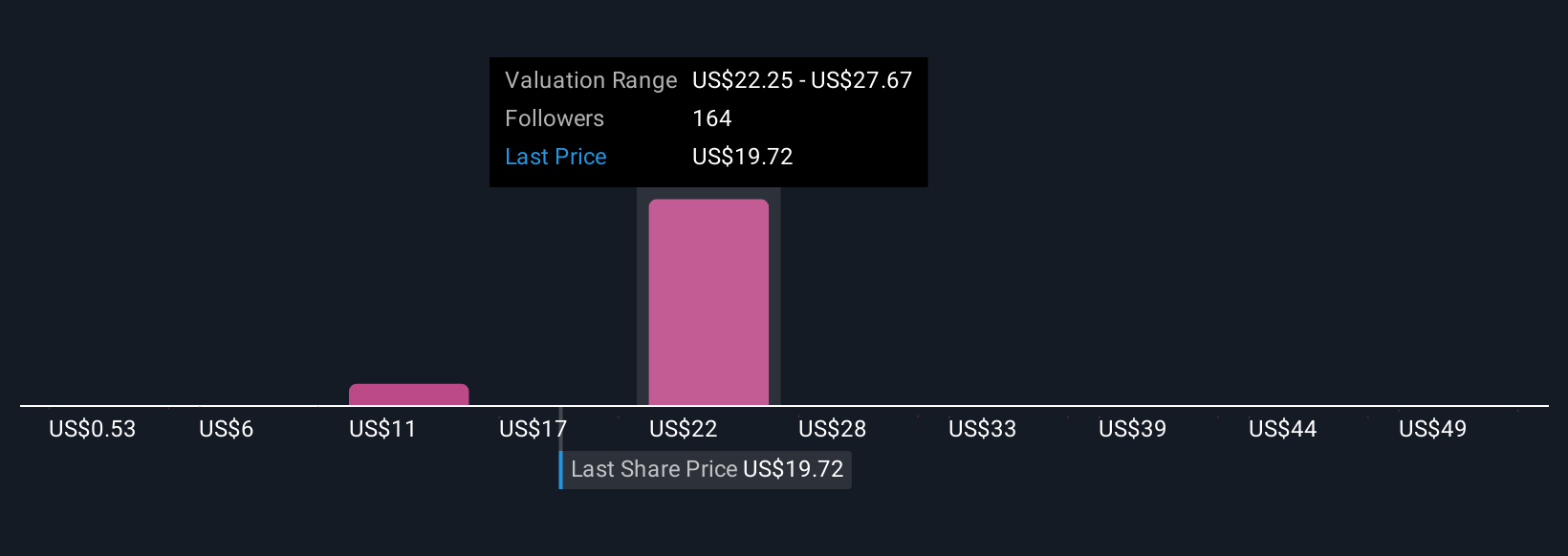

Seventeen fair value targets from the Simply Wall St Community range widely from US$0.53 to US$54.82, revealing highly divergent views. With heavy funding needs and ongoing dilution as a key issue, these differences signal how much opinions can vary, explore diverse viewpoints to better understand the company’s outlook.

Explore 17 other fair value estimates on Lucid Group - why the stock might be worth less than half the current price!

Build Your Own Lucid Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lucid Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lucid Group's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives