- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (NasdaqGS:LCID) Appoints Experienced Executives Strengthening Capabilities

Reviewed by Simply Wall St

Lucid Group (NasdaqGS:LCID) experienced a 23% rise in its stock price over the last week, which might be influenced by its notable business activities and financial improvements. The company's recent opening of a Studio and Service Center in Rutherford, New Jersey, aligns with its strategic expansion plans and strengthens its presence in the Tri-State area. Additionally, the appointment of experienced executives Akerho AK Oghoghomeh and Adrian Price suggests a bolstering of Lucid's marketing and operations capabilities. While these events align with the company's growth trajectory, the broader market also saw positive momentum, which may have amplified the stock's movement.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

The recent developments at Lucid Group, including the new Studio and Service Center in New Jersey and the addition of seasoned executives, are poised to bolster its expansion efforts and operational capabilities in the EV market. These strategic moves could have a positive impact on future revenue, especially with the anticipated demand for the Lucid Gravity SUV. However, it's essential to consider the company's longer-term performance. Over the past year, Lucid's total shareholder return, which includes stock price movements and dividends, saw a decline of 4.83%. Though there was a significant share price appreciation in the last week, performance has been weaker over the full year compared to the broader US Market, which returned 10.6%, and the US Auto industry, which returned 76.3% over the same period.

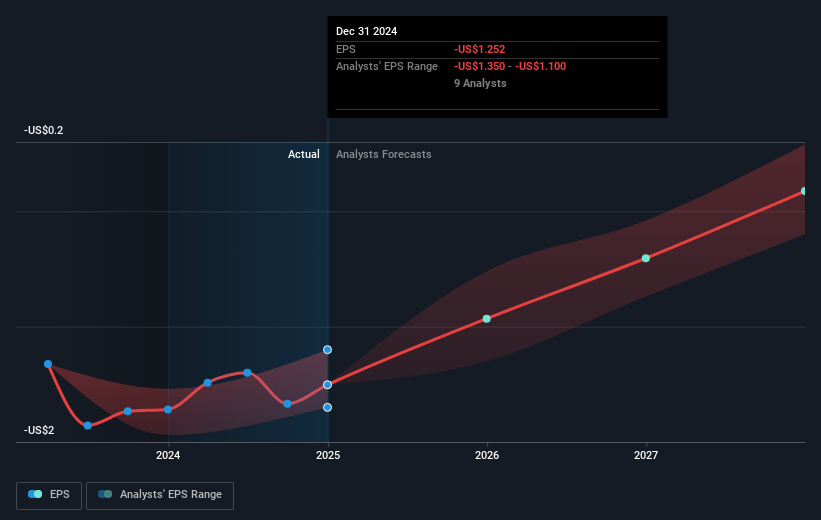

Looking ahead, these recent developments suggest potential revenue growth opportunities due to enhanced market presence and improved operational strategies. However, Lucid remains unprofitable, with analysts not forecasting profitability in the short term. The current share price is US$2.56, slightly above the analyst consensus price target of US$2.53, indicating that the shares might be about fairly valued relative to expectations based on the forecasts. Investors may want to monitor whether these expansions and executive changes translate into improved financial metrics, potentially aligning with or surpassing analyst forecasts in future earnings and revenue projections.

Understand Lucid Group's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives