- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (LCID) Forms Minerals Collaboration Boosting US National Competitiveness

Reviewed by Simply Wall St

Lucid Group (LCID) recently announced significant moves, including partnering with key mineral producers and updating the 2026 Lucid Air lineup, which may have contributed to its 21% share price increase over the last month. The formation of the Minerals for National Automotive Competitiveness Collaboration (MINAC) and partnerships with companies like Graphite One and Electric Metals highlight a push towards securing domestic mineral resources, aligning with the U.S. policy focus. Despite broader market fluctuations marked by tariff uncertainties and weak job growth reports, Lucid's strategic partnerships and product enhancements likely offset general market trends, providing resilience and driving positive investor sentiment.

Lucid Group has 3 risks (and 1 which is concerning) we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

The recent announcement of Lucid Group's partnerships and product updates potentially sets a robust foundation for future growth. The alignment with key mineral producers through initiatives like MINAC underscores a strategic push towards securing essential resources, which could mitigate supply chain vulnerabilities and support long-term revenue growth. The introduction of the updated 2026 Lucid Air lineup might bolster sales prospects, reflecting positively on future earnings forecasts. These developments aim to enhance operational efficiency and product appeal, critical factors in driving revenue growth expectations.

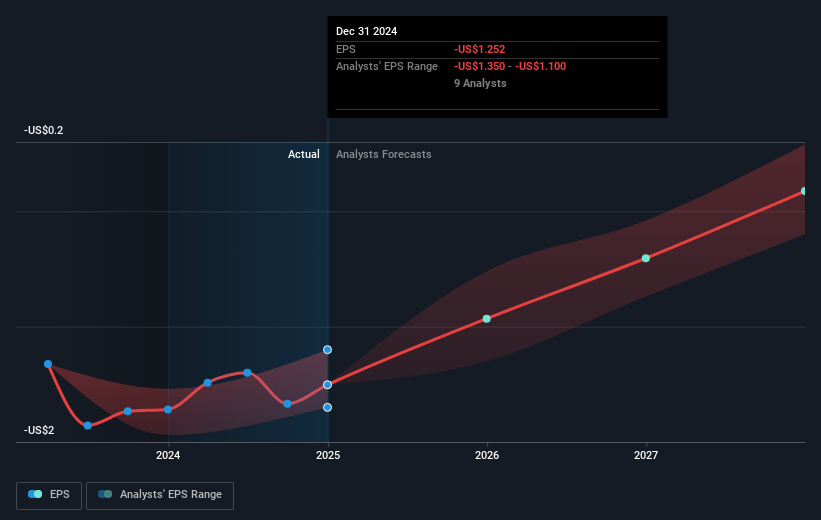

Over the past year, Lucid's total shareholder return, including share price and dividends, was a 24.77% decline. This longer-term performance contrasts with the more favorable 21% share price increase over the last month, suggesting a recovery from previous lows. Relative to the broader market and the US Auto industry, Lucid underperformed, with the market returning 16.8% and the industry 34% over the same period. Despite the recent upturn, the share price remains below consensus expectations, with the current price of US$2.46 slightly under the analyst target of US$2.68. This price movement reflects investor caution, possibly due to ongoing profitability challenges and market uncertainties. As Lucid continues to enhance its lineup and secure strategic resources, aligning with expected revenue growth, investors will likely monitor these dynamics closely.

Learn about Lucid Group's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives