- United States

- /

- Auto Components

- /

- NasdaqGS:LAZR

Recent 8.0% pullback isn't enough to hurt long-term Luminar Technologies (NASDAQ:LAZR) shareholders, they're still up 15% over 1 year

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if when you choose to buy stocks, some of them will be below average performers. Over the last year the Luminar Technologies, Inc. (NASDAQ:LAZR) share price is up 15%, but that's less than the broader market return. We'll need to follow Luminar Technologies for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Luminar Technologies

Given that Luminar Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Luminar Technologies grew its revenue by 27% last year. We respect that sort of growth, no doubt. The share price gain of 15% in that time is better than nothing, but far from outlandish Arguably, the market (previously) expected stronger growth from the company. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

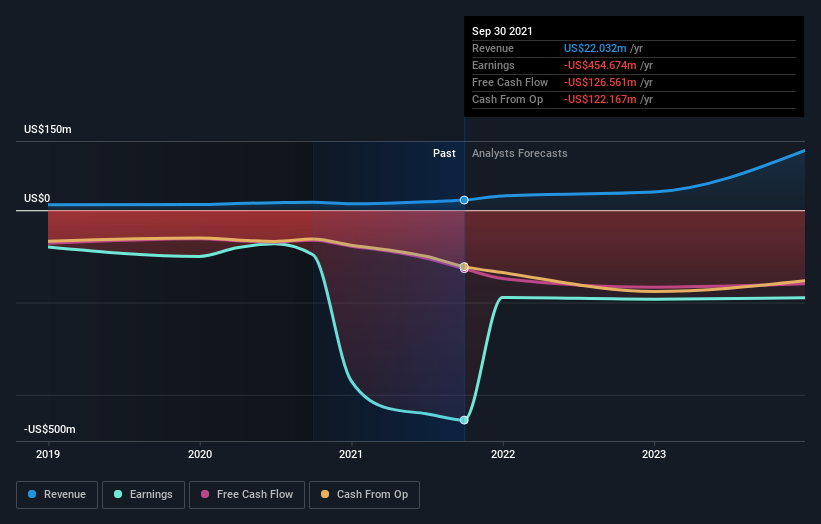

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Luminar Technologies will earn in the future (free profit forecasts).

A Different Perspective

Luminar Technologies shareholders have gained 15% for the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 23%. The last three months haven't been so kind to Luminar Technologies, with the share price gaining just 2.9%. It's not uncommon to see a company's share price between updates to shareholders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Luminar Technologies has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:LAZR

Luminar Technologies

An automotive technology company, provides sensor technologies and software for passenger cars and commercial trucks in North America, the Asia Pacific, Europe, and the Middle East.

Medium-low risk with concerning outlook.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026