- United States

- /

- Auto Components

- /

- NasdaqGS:GTX

How Raised 2025 Guidance and Dividend Update Will Impact Garrett Motion (GTX) Investors

Reviewed by Simply Wall St

- Garrett Motion recently reported second quarter results, showing US$913 million in sales and US$87 million in net income, along with a declared US$0.06 per share dividend and an update on its ongoing share repurchase program.

- One standout takeaway is the company’s raised 2025 full-year guidance for both net sales and net income, highlighting an improved outlook supported by positive industry expectations and disciplined capital returns.

- With the company increasing its full-year outlook, we will examine how this guidance raise may shape Garrett Motion’s broader investment narrative.

Garrett Motion Investment Narrative Recap

To be a shareholder in Garrett Motion, you need to believe the company can sustain profit growth while adapting to shifts in the automotive sector, including electrification trends and changing vehicle demand in major markets. The latest results and raised 2025 outlook suggest improving fundamentals, which supports the view that Garrett's cost focus and product diversification could remain key short-term catalysts. The main risk, ongoing softness in traditional vehicle sales, especially in Europe and China, remains material and is not fully offset by current results.

Of the recent announcements, the share buyback update stands out. Completing over US$51 million in repurchases since December 2024 reflects confidence in the company’s own value, which aligns with the goal of enhancing earnings per share. For investors, such capital allocation underscores near-term support but does not eliminate structural risks, especially those linked to demand for conventional drivetrains.

However, investors should be aware that ongoing vehicle sales weakness in key regions remains a risk that could affect the company if...

Read the full narrative on Garrett Motion (it's free!)

Garrett Motion's outlook projects $3.7 billion in revenue and $332.0 million in earnings by 2028. This reflects an anticipated annual revenue growth rate of 2.8% and a $54.0 million increase in earnings from the current $278.0 million.

Uncover how Garrett Motion's forecasts yield a $14.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

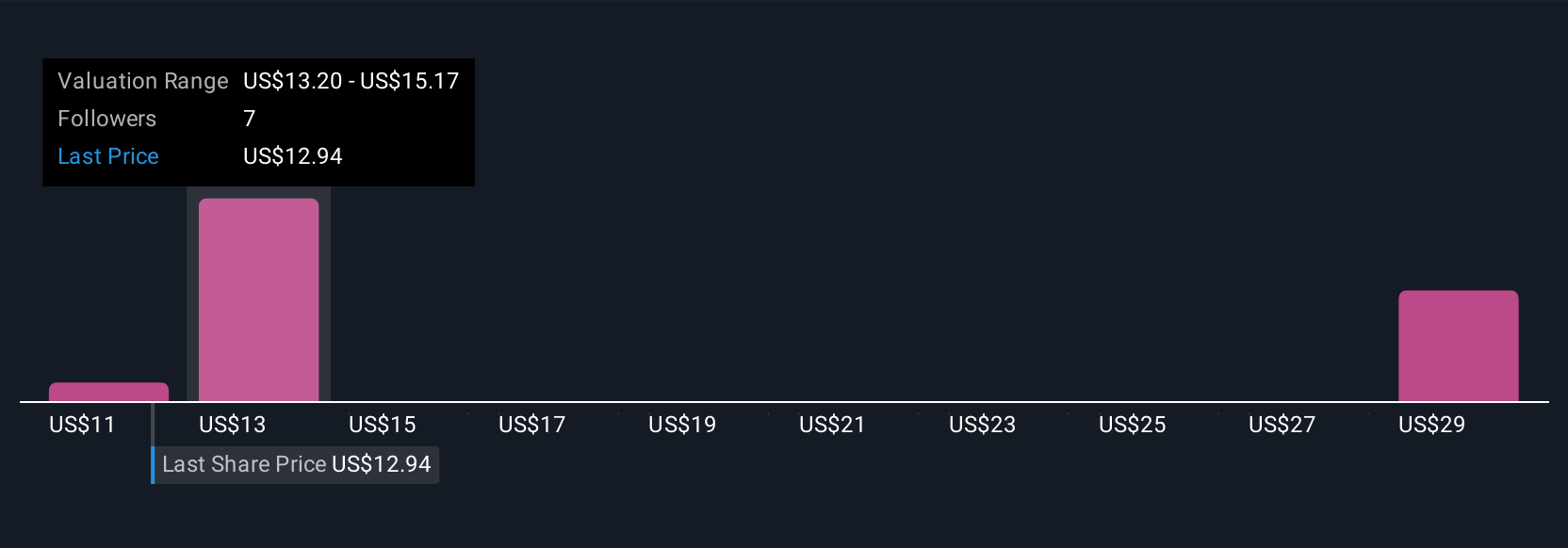

Three Simply Wall St Community fair value estimates for Garrett Motion range from US$11.24 to US$30.20, with views spanning low and high ends. Against this, recent guidance raises highlight that while optimism exists, ongoing market risks are top of mind for many.

Build Your Own Garrett Motion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garrett Motion research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Garrett Motion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garrett Motion's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTX

Garrett Motion

Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives