- United States

- /

- Auto Components

- /

- NasdaqGS:FOXF

Getting In Cheap On Fox Factory Holding Corp. (NASDAQ:FOXF) Is Unlikely

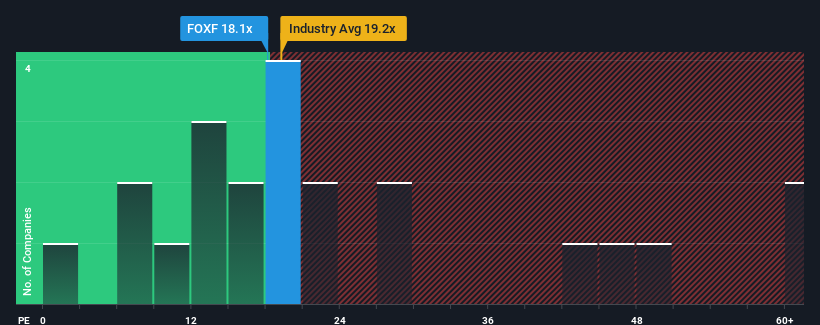

There wouldn't be many who think Fox Factory Holding Corp.'s (NASDAQ:FOXF) price-to-earnings (or "P/E") ratio of 18.1x is worth a mention when the median P/E in the United States is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Fox Factory Holding has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Fox Factory Holding

Is There Some Growth For Fox Factory Holding?

Fox Factory Holding's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 28% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings growth is heading into negative territory, declining 38% over the next year. Meanwhile, the broader market is forecast to expand by 11%, which paints a poor picture.

With this information, we find it concerning that Fox Factory Holding is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Fox Factory Holding's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Fox Factory Holding you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FOXF

Fox Factory Holding

Designs, engineers, manufactures, and markets performance-defining products and system worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives