- United States

- /

- Auto Components

- /

- NasdaqGM:CREV

Carbon Revolution Public Limited Company's (NASDAQ:CREV) Shares Leap 30% Yet They're Still Not Telling The Full Story

Those holding Carbon Revolution Public Limited Company (NASDAQ:CREV) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 92% share price decline over the last year.

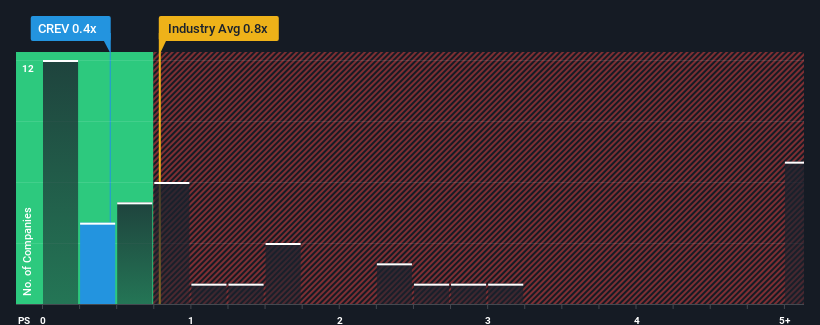

In spite of the firm bounce in price, it's still not a stretch to say that Carbon Revolution's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Auto Components industry in the United States, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Carbon Revolution

What Does Carbon Revolution's P/S Mean For Shareholders?

Recent times have been advantageous for Carbon Revolution as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Carbon Revolution.Is There Some Revenue Growth Forecasted For Carbon Revolution?

In order to justify its P/S ratio, Carbon Revolution would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 42% last year. Pleasingly, revenue has also lifted 59% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 31% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 7.9%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Carbon Revolution's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Carbon Revolution's P/S

Its shares have lifted substantially and now Carbon Revolution's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Carbon Revolution's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 5 warning signs for Carbon Revolution you should be aware of, and 3 of them are significant.

If you're unsure about the strength of Carbon Revolution's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CREV

Carbon Revolution

Manufactures and sells carbon fibre wheels to original equipment vehicle manufacturers for the automotive industry worldwide.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives