- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2637

Wisdom Marine Lines Co., Limited (Cayman) (TWSE:2637) Surges 25% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, Wisdom Marine Lines Co., Limited (Cayman) (TWSE:2637) shares have been powering on, with a gain of 25% in the last thirty days. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

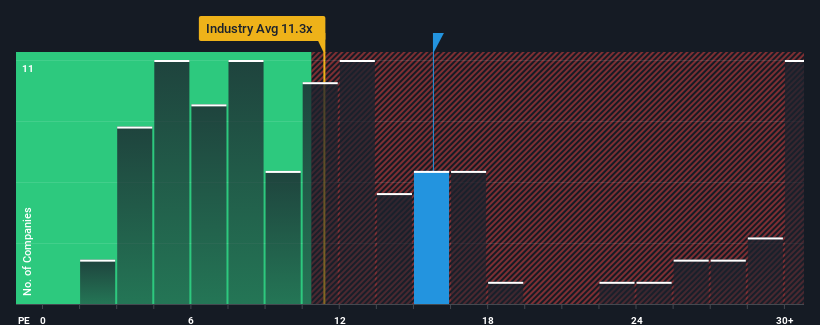

Although its price has surged higher, given about half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 24x, you may still consider Wisdom Marine Lines Limited (Cayman) as an attractive investment with its 15.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Wisdom Marine Lines Limited (Cayman) has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Wisdom Marine Lines Limited (Cayman)

How Is Wisdom Marine Lines Limited (Cayman)'s Growth Trending?

In order to justify its P/E ratio, Wisdom Marine Lines Limited (Cayman) would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 70%. Still, the latest three year period has seen an excellent 2,613% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 20% as estimated by the sole analyst watching the company. That's shaping up to be materially lower than the 27% growth forecast for the broader market.

With this information, we can see why Wisdom Marine Lines Limited (Cayman) is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Wisdom Marine Lines Limited (Cayman)'s shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Wisdom Marine Lines Limited (Cayman) maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Wisdom Marine Lines Limited (Cayman) has 4 warning signs (and 2 which are potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on Wisdom Marine Lines Limited (Cayman), explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wisdom Marine Lines Limited (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2637

Wisdom Marine Lines Limited (Cayman)

Provides marine cargo transportation services in Singapore, the Netherlands, Germany, Panama, Denmark, Japan, and internationally.

Proven track record average dividend payer.