- United Arab Emirates

- /

- Industrials

- /

- DFM:DIC

3 Leading Dividend Stocks To Consider With Up To 5.5% Yield

Reviewed by Simply Wall St

Amid global market fluctuations driven by tariff uncertainties and mixed economic data, investors are increasingly seeking stability in dividend stocks. In this environment, a good dividend stock can offer consistent income and potential resilience against market volatility, making them an attractive consideration for those looking to balance risk and reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.51% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally, with a market cap of AED9.35 billion.

Operations: Dubai Investments PJSC generates revenue from three primary segments: Property (AED2.21 billion), Manufacturing, Contracting and Services (AED1.24 billion), and Investments (AED330.77 million).

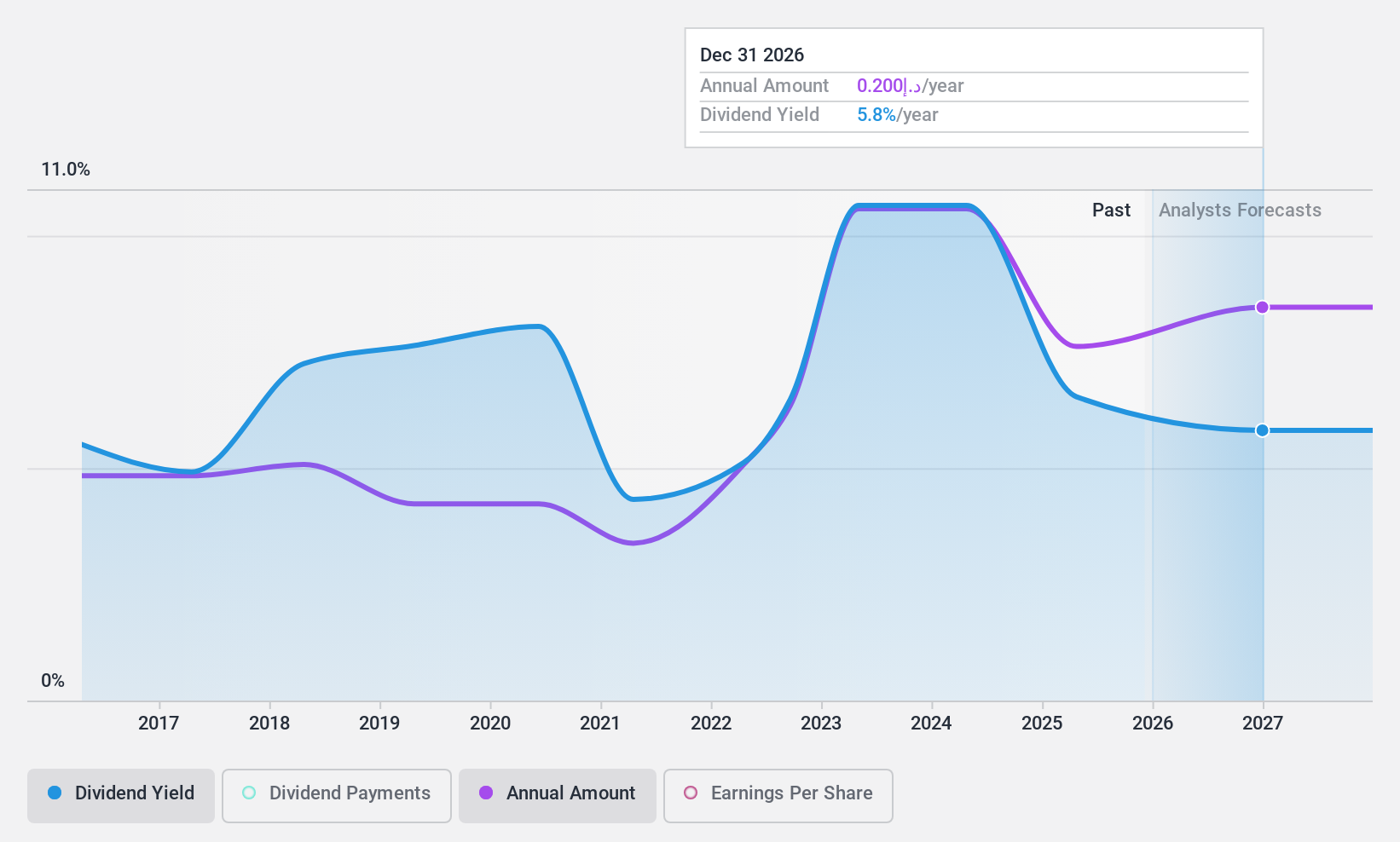

Dividend Yield: 5.5%

Dubai Investments PJSC offers a dividend payout covered by both earnings and cash flows, with payout ratios of 55.1% and 52.6%, respectively. Despite a history of volatile dividends over the past decade, the company has managed to increase its dividend payments during this period. However, its current yield of 5.53% is below the top quartile in the AE market. The stock's price-to-earnings ratio of 10x suggests it may be undervalued compared to peers at 13.3x.

- Click here and access our complete dividend analysis report to understand the dynamics of Dubai Investments PJSC.

- Our comprehensive valuation report raises the possibility that Dubai Investments PJSC is priced higher than what may be justified by its financials.

Hanwha Life Insurance (KOSE:A088350)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanwha Life Insurance Co., Ltd. offers a range of insurance products to both individual and corporate clients across South Korea, Vietnam, China, Indonesia, and other international markets, with a market cap of ₩1.89 trillion.

Operations: Hanwha Life Insurance Co., Ltd.'s revenue segments include ₩20.36 trillion from Insurance, ₩2.03 trillion from Certificate, ₩2.69 trillion from Non-financial services, and ₩206.63 billion from Other Finance.

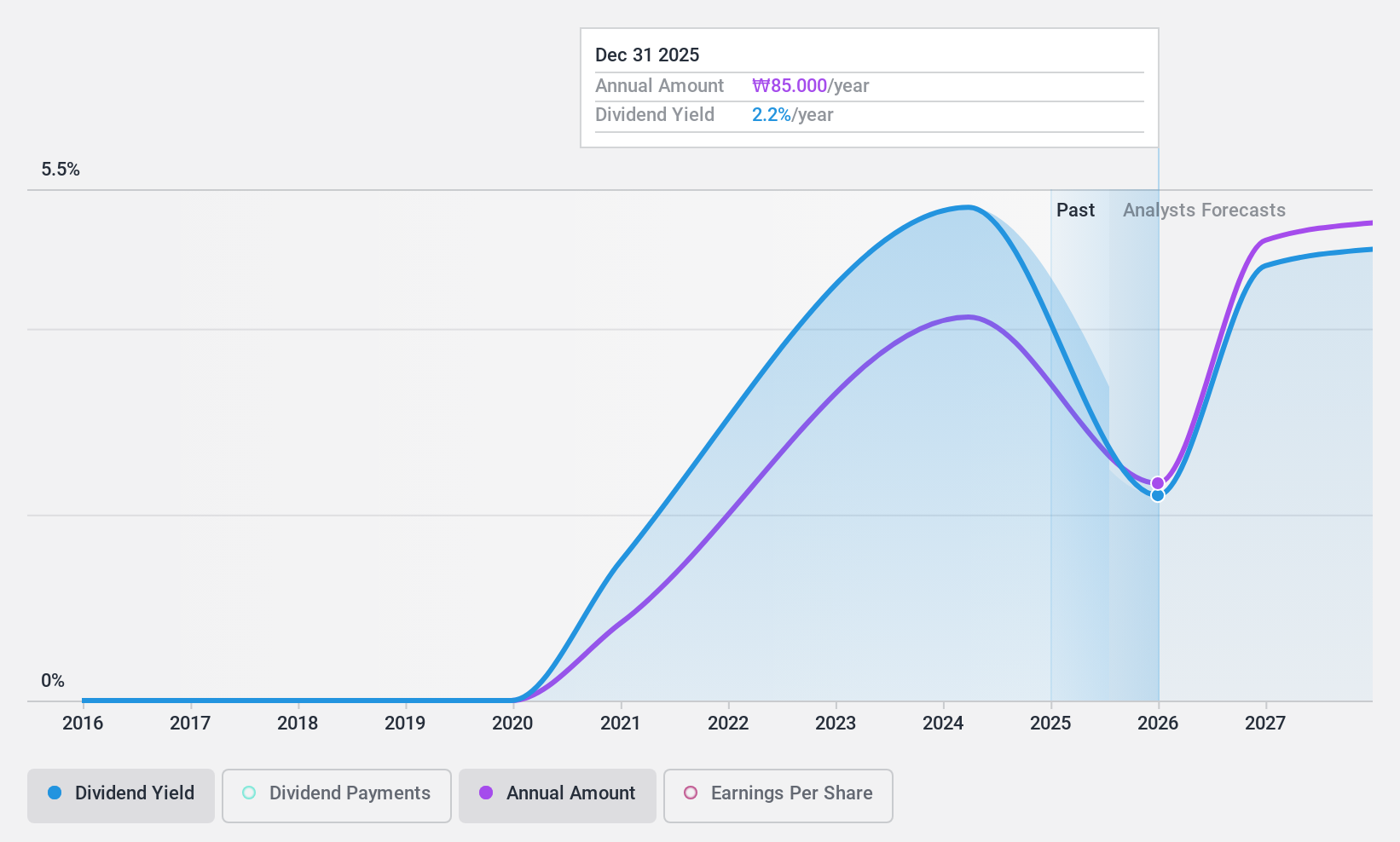

Dividend Yield: 5.5%

Hanwha Life Insurance's dividend yield of 5.55% places it in the top quartile among KR market peers, supported by a low payout ratio of 20.7% and a cash payout ratio of just 2.2%, indicating strong coverage by both earnings and cash flows. Although dividends have been stable and growing, they have only been paid for five years. The stock trades at a significant discount to its estimated fair value, enhancing its appeal as a dividend investment option.

- Get an in-depth perspective on Hanwha Life Insurance's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Hanwha Life Insurance is trading behind its estimated value.

Taiwan Navigation (TWSE:2617)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Navigation Co., Ltd., along with its subsidiaries, offers shipping services in Taiwan and has a market cap of NT$12.18 billion.

Operations: Taiwan Navigation Co., Ltd. generates its revenue primarily from Cargo Transportation and Shipping Agency services, amounting to NT$4.38 billion.

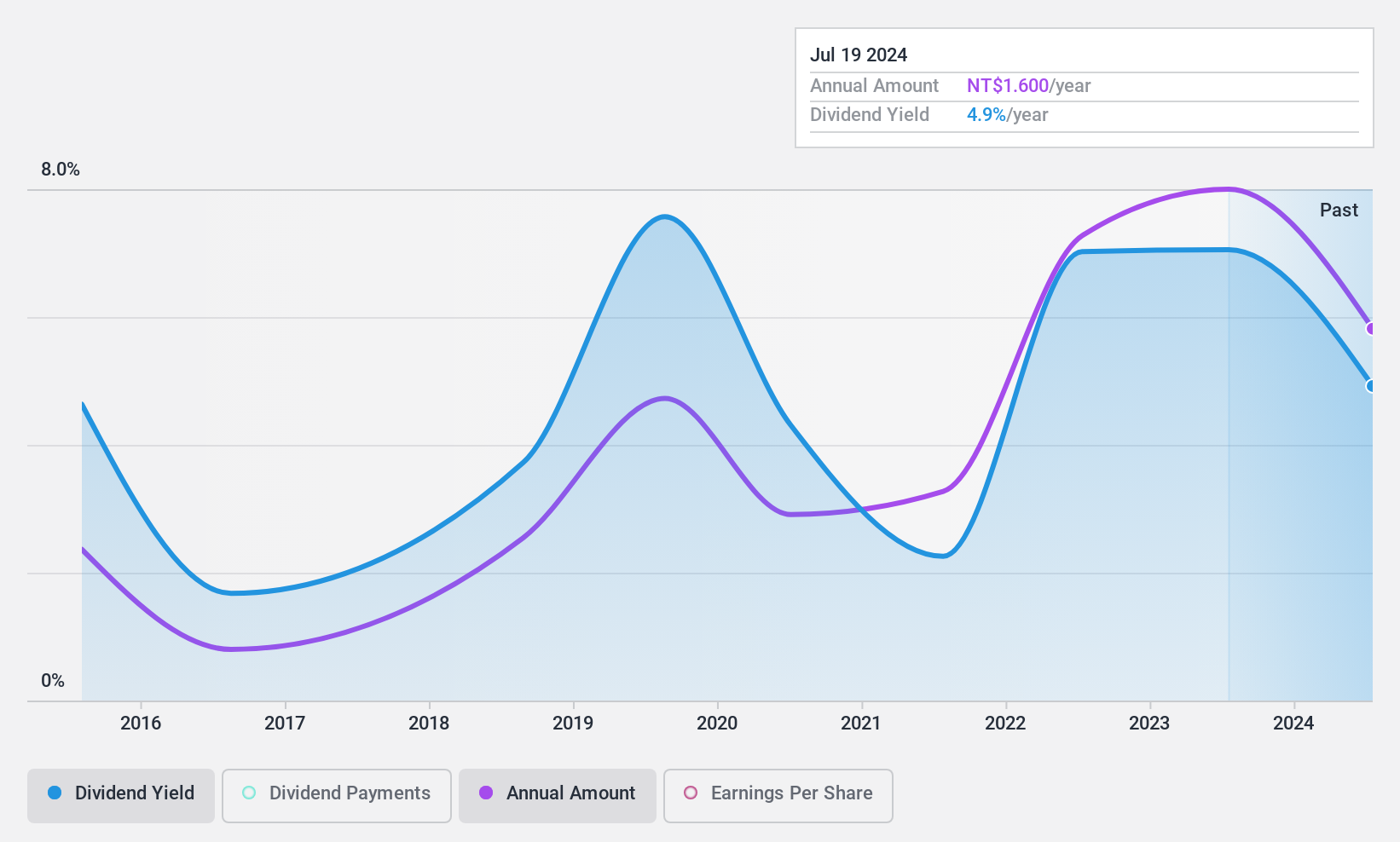

Dividend Yield: 5.3%

Taiwan Navigation's dividend yield of 5.27% ranks in the top quartile of the TW market, but it's not well covered by free cash flows, despite a reasonable payout ratio of 54.4%. The company's dividends have been volatile over the past decade, with periods of significant drops. Recent earnings reports show declining net income and profit margins compared to last year, which may impact future dividend sustainability and reliability amid ongoing executive changes.

- Delve into the full analysis dividend report here for a deeper understanding of Taiwan Navigation.

- Insights from our recent valuation report point to the potential overvaluation of Taiwan Navigation shares in the market.

Taking Advantage

- Navigate through the entire inventory of 1973 Top Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIC

Dubai Investments PJSC

Engages in property, investment, manufacturing, contracting, and services businesses in the United Arab Emirates and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives