- Sweden

- /

- Auto Components

- /

- OM:BULTEN

Top Dividend Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and concerns over consumer spending, major indices have experienced fluctuations, with the S&P 500 reaching record highs before ending the week lower. Amid these uncertainties, investors often turn to dividend stocks for their potential to provide steady income streams and resilience in volatile market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2011 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) manufactures and distributes fasteners and related solutions for various industries, including automotive and electronics, across multiple international markets, with a market cap of approximately SEK1.43 billion.

Operations: Bulten AB (publ) generates its revenue primarily from the Bulten segment, which accounted for SEK5.81 billion.

Dividend Yield: 3.9%

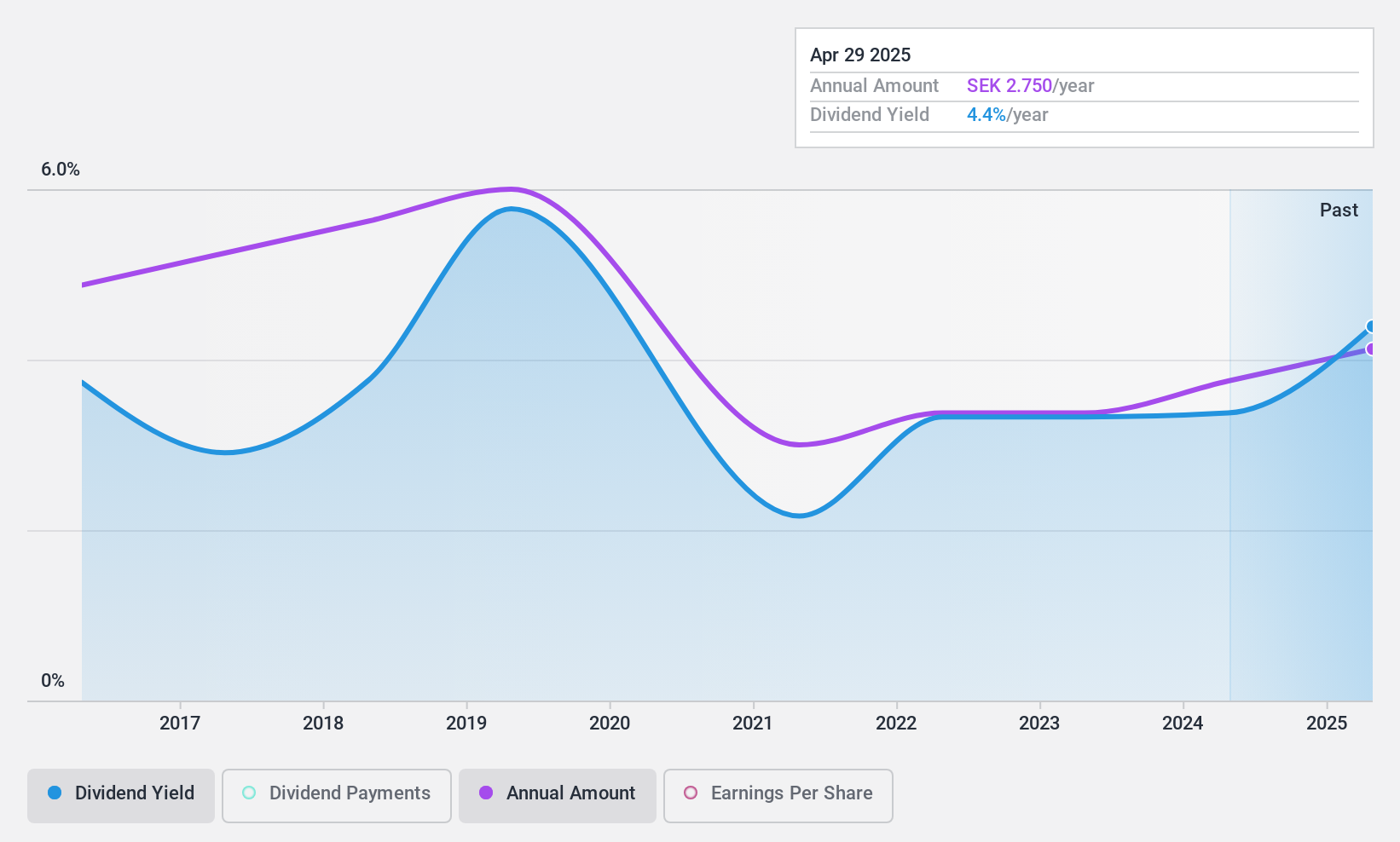

Bulten's dividend payments have been volatile over the past decade, though they have shown growth during this period. Recent earnings results indicate a decline in fourth-quarter sales and earnings per share. Despite this, Bulten's dividends are well-covered by both earnings and cash flows, with reasonable payout ratios of 42.8% and 50.2%, respectively. The company proposed a dividend increase to SEK 2.75 per share for 2024, signaling confidence despite its high debt levels and recent financial performance challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Bulten.

- Insights from our recent valuation report point to the potential overvaluation of Bulten shares in the market.

Evergreen International Storage & Transport (TWSE:2607)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evergreen International Storage & Transport Corporation, along with its subsidiaries, offers inland container transport and container terminal operations in Taiwan, America, and internationally, with a market cap of NT$32.76 billion.

Operations: Evergreen International Storage & Transport Corporation generates revenue primarily from cargo shipment (NT$15.52 billion), international sea transportation (NT$2.87 billion), inland transport (NT$1.87 billion), container yard operations (NT$958.26 million), and gas stations (NT$425.33 million).

Dividend Yield: 3.6%

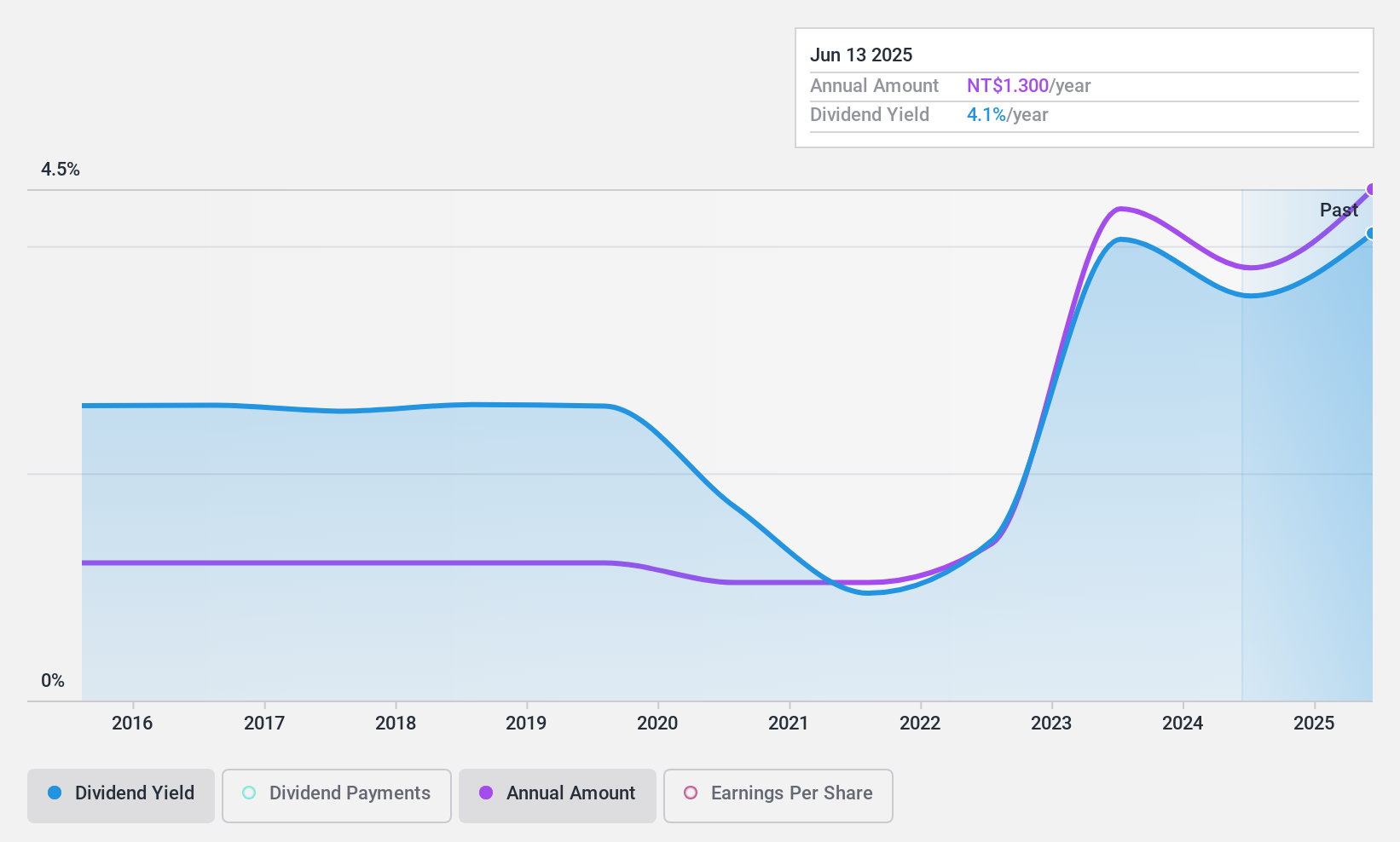

Evergreen International Storage & Transport's dividend payments have been reliable and stable over the past decade, showing consistent growth. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 49.1% and 38.1%, respectively. Despite a decrease in profit margins from last year, Evergreen maintains a dividend yield of 3.58%, which is below the top tier in the TW market but reflects its commitment to sustainable payouts while trading at US$10 million below estimated fair value.

- Click to explore a detailed breakdown of our findings in Evergreen International Storage & Transport's dividend report.

- According our valuation report, there's an indication that Evergreen International Storage & Transport's share price might be on the expensive side.

VERBUND (WBAG:VER)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VERBUND AG, along with its subsidiaries, is involved in generating, trading, and selling electricity to various markets and customers, with a market cap of €24.72 billion.

Operations: VERBUND AG's revenue segments include Grid (€1.74 billion), Hydro (€3.58 billion), Sales (€4.94 billion), and New Renewables (€328 million).

Dividend Yield: 5.8%

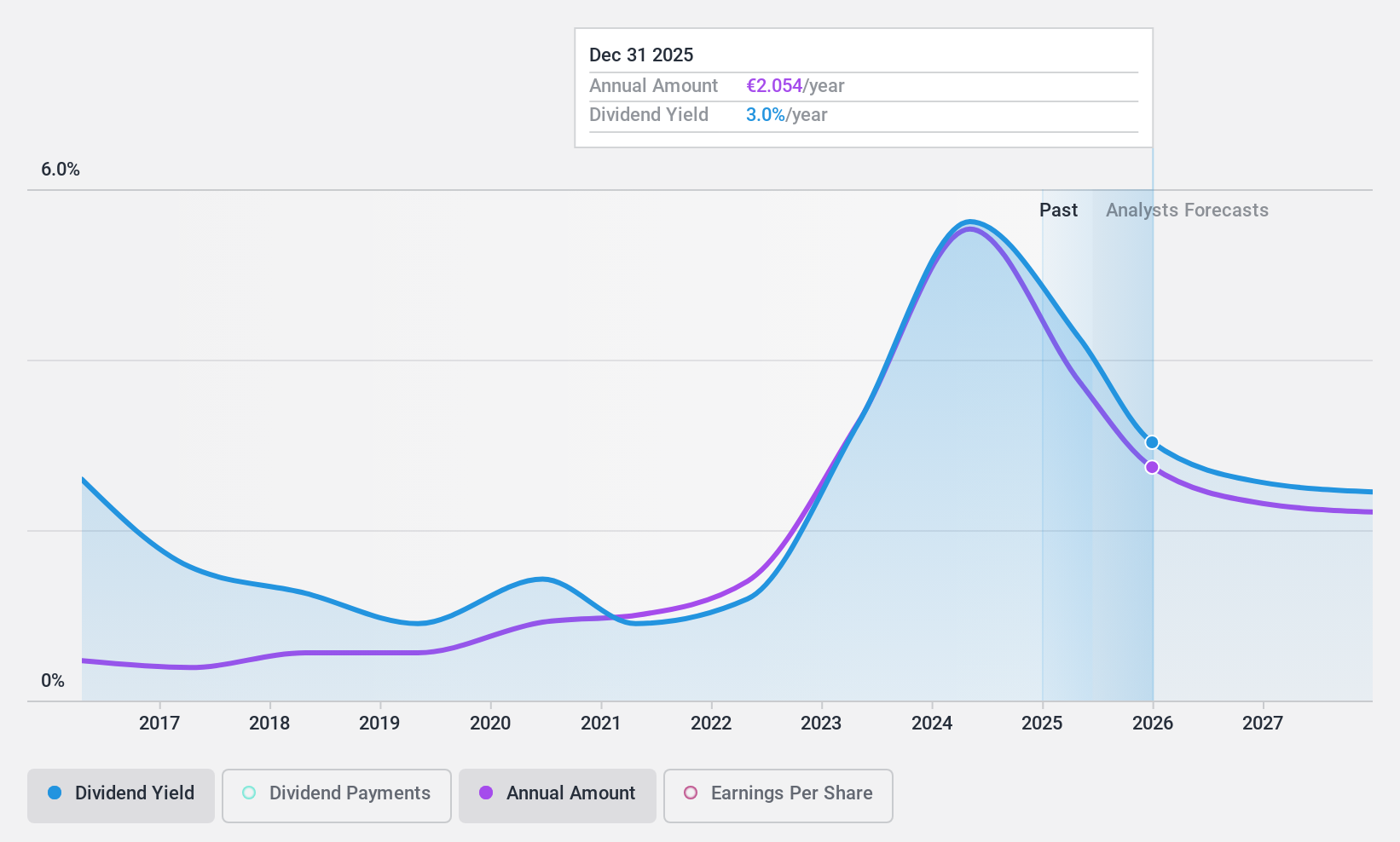

VERBUND's dividend yield of 5.77% ranks in the top 25% of Austrian payers, supported by earnings and cash flow coverage with payout ratios of 70.6% and 65.6%, respectively. However, its dividends have been volatile over the past decade despite overall growth, indicating an unstable track record. Earnings are projected to decline by an average of 8.3% annually over the next three years, which may impact future dividend sustainability.

- Get an in-depth perspective on VERBUND's performance by reading our dividend report here.

- The analysis detailed in our VERBUND valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 2008 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bulten might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BULTEN

Bulten

Manufactures and distributes fasteners in Sweden, Poland, Germany, the United Kingdom, rest of Europe, the United States, China, and internationally.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives