- Taiwan

- /

- Infrastructure

- /

- TWSE:2607

3 Dividend Stocks To Consider With Yields Up To 9.5%

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing significant sector shifts, with financials and energy shares benefiting from deregulation hopes while healthcare and EV sectors face challenges. Amidst these dynamics, dividend stocks remain an attractive option for those seeking steady income streams in a fluctuating market environment. A good dividend stock often combines a solid yield with strong fundamentals, offering potential stability even as broader economic conditions evolve.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.59% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.85% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.59% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

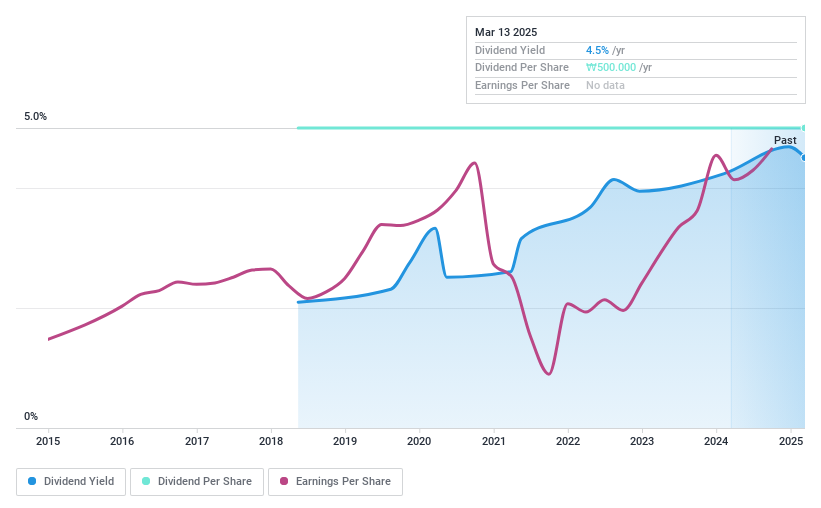

JW Lifescience (KOSE:A234080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JW Lifescience Corporation specializes in providing national infusion solutions both in South Korea and internationally, with a market cap of ₩175.13 billion.

Operations: JW Lifescience Corporation's revenue primarily comes from its pharmaceuticals segment, amounting to ₩214.51 million.

Dividend Yield: 4.4%

JW Lifescience's dividend yield of 4.42% ranks it in the top 25% of dividend payers in South Korea, supported by a low payout ratio of 29.1%, indicating dividends are well-covered by earnings. The cash payout ratio is also sustainable at 47.5%. However, the company's seven-year history of paying dividends has been marked by instability and no growth in payments, raising concerns about reliability despite recent earnings growth of 28.4%.

- Click here and access our complete dividend analysis report to understand the dynamics of JW Lifescience.

- In light of our recent valuation report, it seems possible that JW Lifescience is trading behind its estimated value.

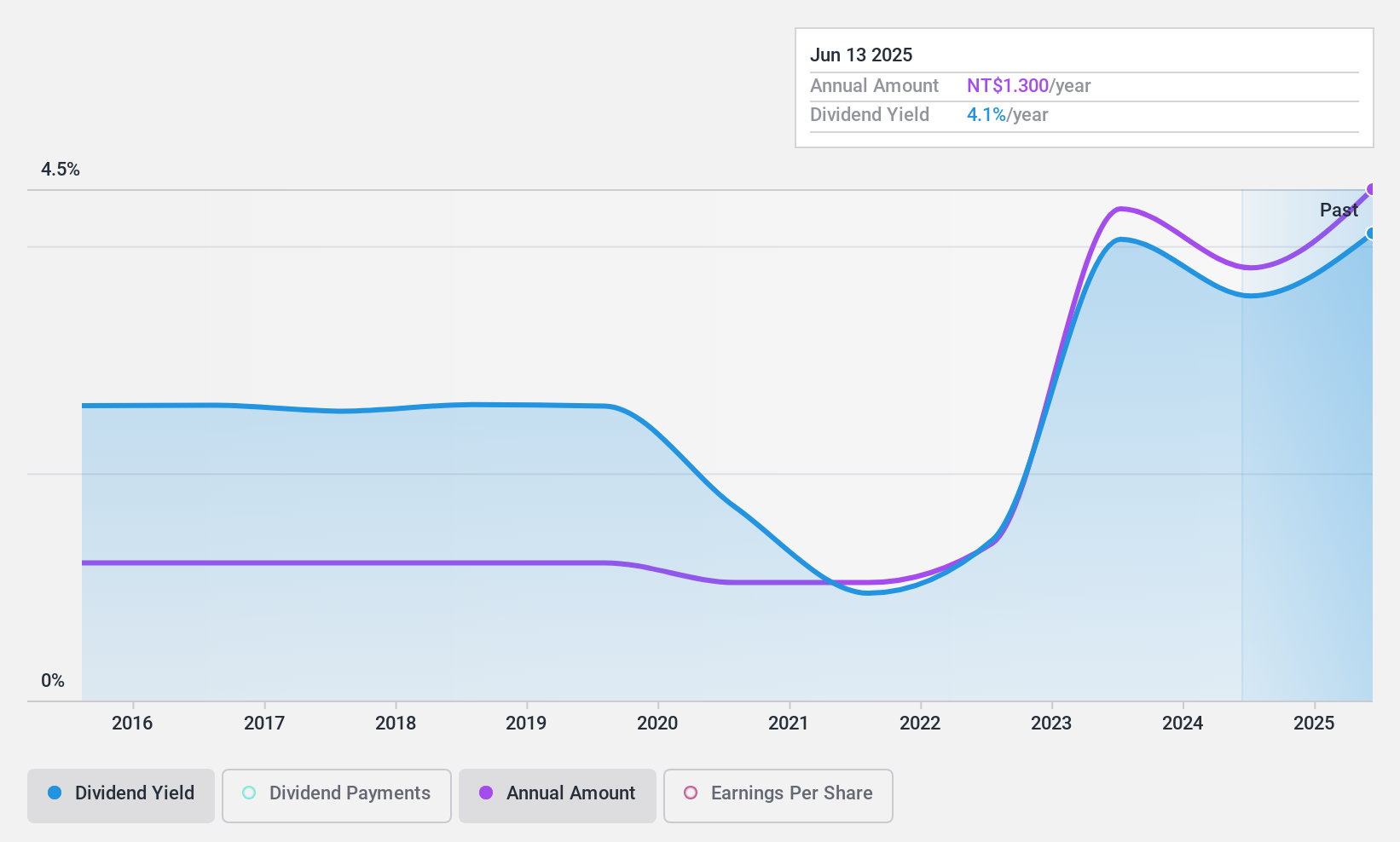

Evergreen International Storage & Transport (TWSE:2607)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evergreen International Storage & Transport Corporation, along with its subsidiaries, offers inland container transport and container terminal operations in Taiwan, America, and internationally, with a market cap of NT$33.45 billion.

Operations: Evergreen International Storage & Transport Corporation's revenue segments include inland container transport and container terminal operations across Taiwan, America, and international markets.

Dividend Yield: 3.5%

Evergreen International Storage & Transport's dividend is supported by a payout ratio of 49.1%, indicating coverage by earnings, and a cash payout ratio of 38.1%, suggesting strong cash flow backing. Despite stable dividends over the past decade and growth in payments, its yield of 3.51% falls short compared to top-tier payers in Taiwan. Recent earnings show sales growth but reduced net profit margins, which may impact future dividend sustainability if trends continue.

- Unlock comprehensive insights into our analysis of Evergreen International Storage & Transport stock in this dividend report.

- The analysis detailed in our Evergreen International Storage & Transport valuation report hints at an inflated share price compared to its estimated value.

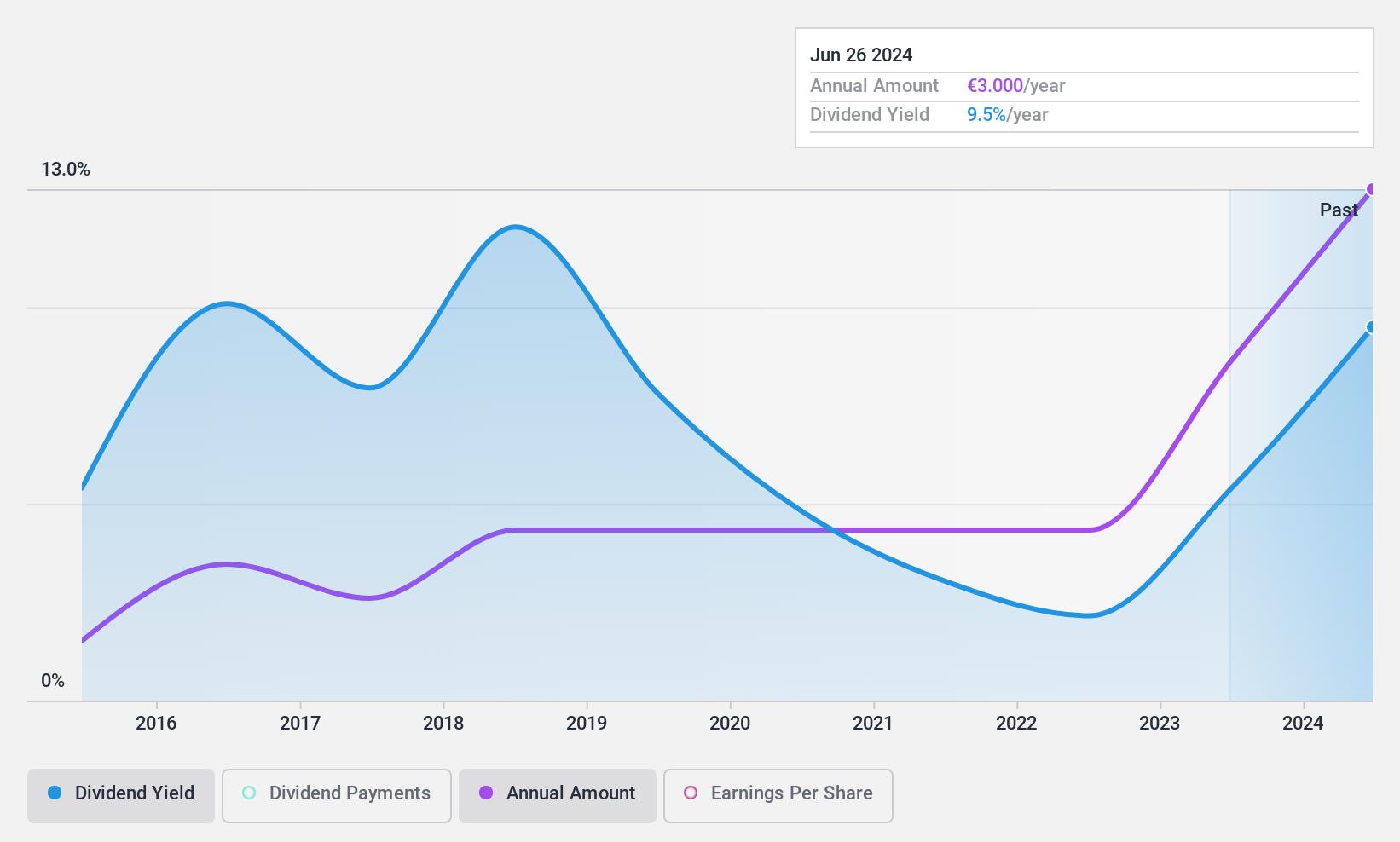

EnviTec Biogas (XTRA:ETG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across several countries, including Germany, Italy, and the United States, with a market cap of €446.99 million.

Operations: EnviTec Biogas AG generates revenue through the manufacture and operation of biogas and biomethane plants in various international markets, including Europe, the United States, and China.

Dividend Yield: 9.6%

EnviTec Biogas offers a high dividend yield of 9.55%, placing it among the top 25% in Germany. However, its dividend track record is unstable and volatile, with past payments experiencing significant drops. While the current payout ratio of 76.2% suggests dividends are covered by earnings, insufficient data prevents assessing coverage by cash flows. Recent earnings show increased sales to EUR 190.62 million but a decline in net income to EUR 22.56 million, highlighting potential sustainability concerns.

- Click to explore a detailed breakdown of our findings in EnviTec Biogas' dividend report.

- Our valuation report here indicates EnviTec Biogas may be undervalued.

Next Steps

- Click this link to deep-dive into the 1976 companies within our Top Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergreen International Storage & Transport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2607

Evergreen International Storage & Transport

Provides inland container transport and container terminal operations in Taiwan, America, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives