- Thailand

- /

- Marine and Shipping

- /

- SET:RCL

Undiscovered Gems And 2 Other Small Cap Opportunities With Strong Foundations

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, major indices like the S&P 500 and Russell 2000 experienced declines, reflecting broader market apprehensions. Despite these challenges, manufacturing activity in the U.S. showed signs of recovery for the first time in over two years, offering a glimmer of hope for small-cap stocks that are often more sensitive to domestic economic conditions. Amidst this backdrop, identifying stocks with strong foundations becomes crucial as they can potentially weather market volatility better. In this article, we explore three small-cap opportunities that stand out due to their robust fundamentals and potential resilience in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Regional Container Lines (SET:RCL)

Simply Wall St Value Rating: ★★★★★★

Overview: Regional Container Lines Public Company Limited operates feeder and vessel services across Thailand, Singapore, Hong Kong, and China with a market capitalization of THB19.39 billion.

Operations: RCL generates revenue primarily from its feeder and vessel operations, amounting to THB31.74 billion.

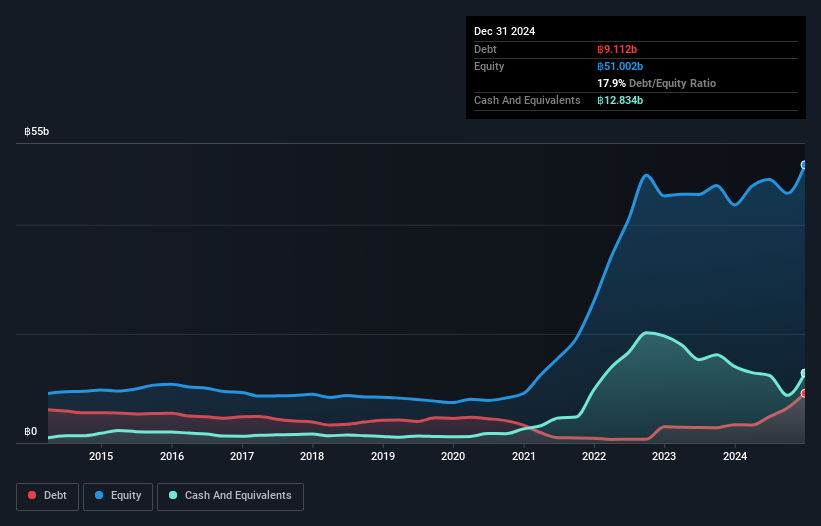

Regional Container Lines, a small cap player in the shipping industry, showcases notable financial metrics. The company's price-to-earnings ratio of 4x is well below the Thai market average of 12.6x, indicating potential undervaluation. Over the past year, earnings grew by 12.6%, surpassing the industry's 4.1% growth rate and highlighting strong performance relative to peers. RCL's debt situation has improved significantly with a reduction in its debt-to-equity ratio from 60.3% to just 14% over five years, suggesting prudent financial management and reduced leverage risk moving forward.

- Navigate through the intricacies of Regional Container Lines with our comprehensive health report here.

Learn about Regional Container Lines' historical performance.

Genesis Technology (TPEX:6221)

Simply Wall St Value Rating: ★★★★★★

Overview: Genesis Technology, Inc., along with its subsidiaries, offers information system integration services and solutions in Taiwan with a market capitalization of NT$9.63 billion.

Operations: Genesis Technology's primary revenue streams are derived from its Integration Business Group, contributing NT$4.40 billion, and the Professional Business Group, adding NT$608.44 million. The company's financial performance is impacted by adjustments and write-offs amounting to -NT$84.64 million.

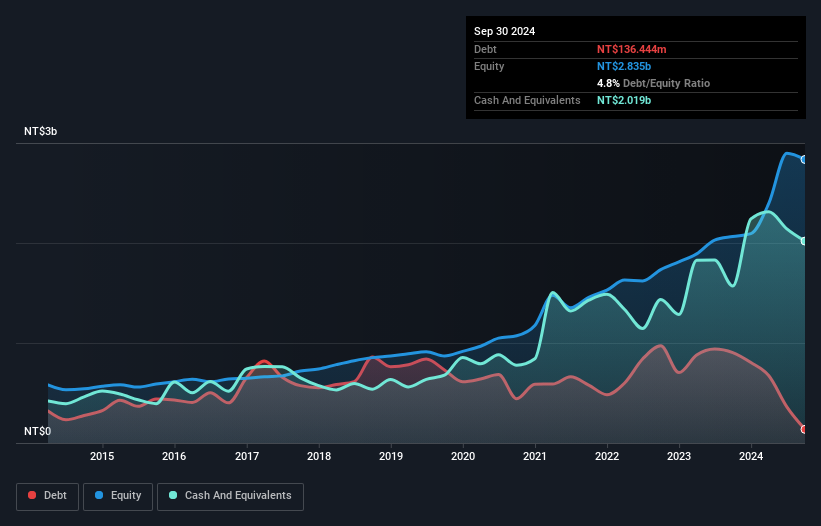

Genesis Technology stands out with a strong financial position, boasting cash levels surpassing total debt and a significant reduction in its debt-to-equity ratio from 84% to 4.8% over five years. The company's earnings growth of 27.1% over the past year outpaced the software industry average of 16.8%, highlighting robust performance despite sales dipping to TWD 3,505 million for nine months compared to TWD 4,016 million previously. Recent executive changes, including the resignation of Cheng Shu-Fang as principal financial officer and subsequent temporary replacement by Chen Mei-Hu, might impact strategic directions moving forward.

- Click here to discover the nuances of Genesis Technology with our detailed analytical health report.

Understand Genesis Technology's track record by examining our Past report.

Sincere Navigation (TWSE:2605)

Simply Wall St Value Rating: ★★★★★★

Overview: Sincere Navigation Corporation is a shipping transportation company that owns and operates bulk cargo vessels in Taiwan with a market capitalization of NT$14.60 billion.

Operations: Sincere Navigation generates revenue primarily from its Bulk Wheel and Tanker segments, with NT$3.21 billion and NT$1.44 billion respectively. The company's financial performance is largely driven by these core operations, reflecting the significant contribution of bulk cargo transportation to its overall revenue model.

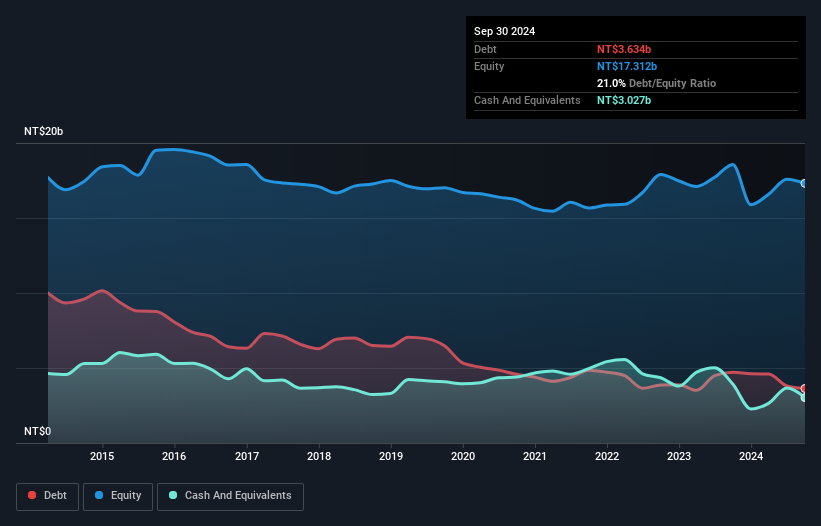

Sincere Navigation, a smaller player in the shipping industry, shows promising financial health with high-quality past earnings and positive free cash flow. The company’s net debt to equity ratio stands at a satisfactory 3.5%, reflecting prudent financial management. Earnings growth over the past year reached an impressive 115.4%, outpacing the industry average of 88.9%. Trading at 79% below its estimated fair value, it seems undervalued in the market. Recent discussions on its market outlook suggest potential for continued growth, with earnings forecasted to grow annually by 16.6%, indicating strong future prospects within its sector.

- Dive into the specifics of Sincere Navigation here with our thorough health report.

Evaluate Sincere Navigation's historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 4710 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:RCL

Regional Container Lines

Engages in the feeder and vessel operations in Thailand, Singapore, Hong Kong, the People’s Republic of China, Taiwan, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)