Top Dividend Stocks Including China National Gold Group Gold JewelleryLtd

Reviewed by Simply Wall St

Amidst a backdrop of tariff uncertainties and mixed economic signals, global markets have experienced fluctuations, with U.S. indices like the S&P 500 showing resilience despite recent declines. As investors navigate these turbulent waters, dividend stocks continue to attract attention for their potential to provide steady income streams; this article explores three prominent options, including China National Gold Group Gold Jewellery Ltd., highlighting key characteristics that make them appealing in today's market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.08% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.39% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

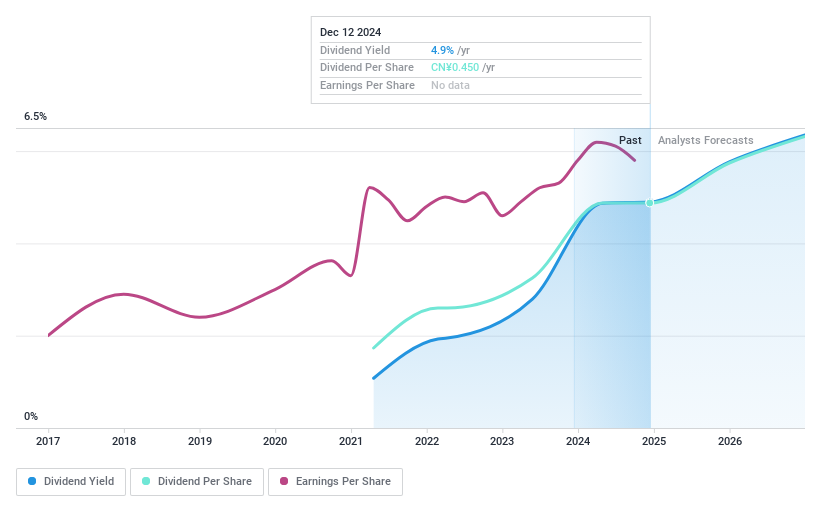

China National Gold Group Gold JewelleryLtd (SHSE:600916)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China National Gold Group Gold Jewellery Co., Ltd. operates in the gold jewelry industry and has a market cap of CN¥14.52 billion.

Operations: I'm sorry, but the information provided does not include any specific revenue segments for China National Gold Group Gold Jewellery Co., Ltd. If you have additional details on their revenue breakdown, I would be happy to help summarize it.

Dividend Yield: 4.7%

China National Gold Group Gold Jewellery Ltd. offers a compelling dividend profile with a payout ratio of 77.6%, indicating dividends are well-covered by earnings and cash flows, given the low cash payout ratio of 24.5%. The dividend yield is in the top 25% within its market, though it's been paid for only four years, limiting its historical reliability. Trading significantly below estimated fair value enhances its appeal as a value investment among peers.

- Dive into the specifics of China National Gold Group Gold JewelleryLtd here with our thorough dividend report.

- Our valuation report unveils the possibility China National Gold Group Gold JewelleryLtd's shares may be trading at a discount.

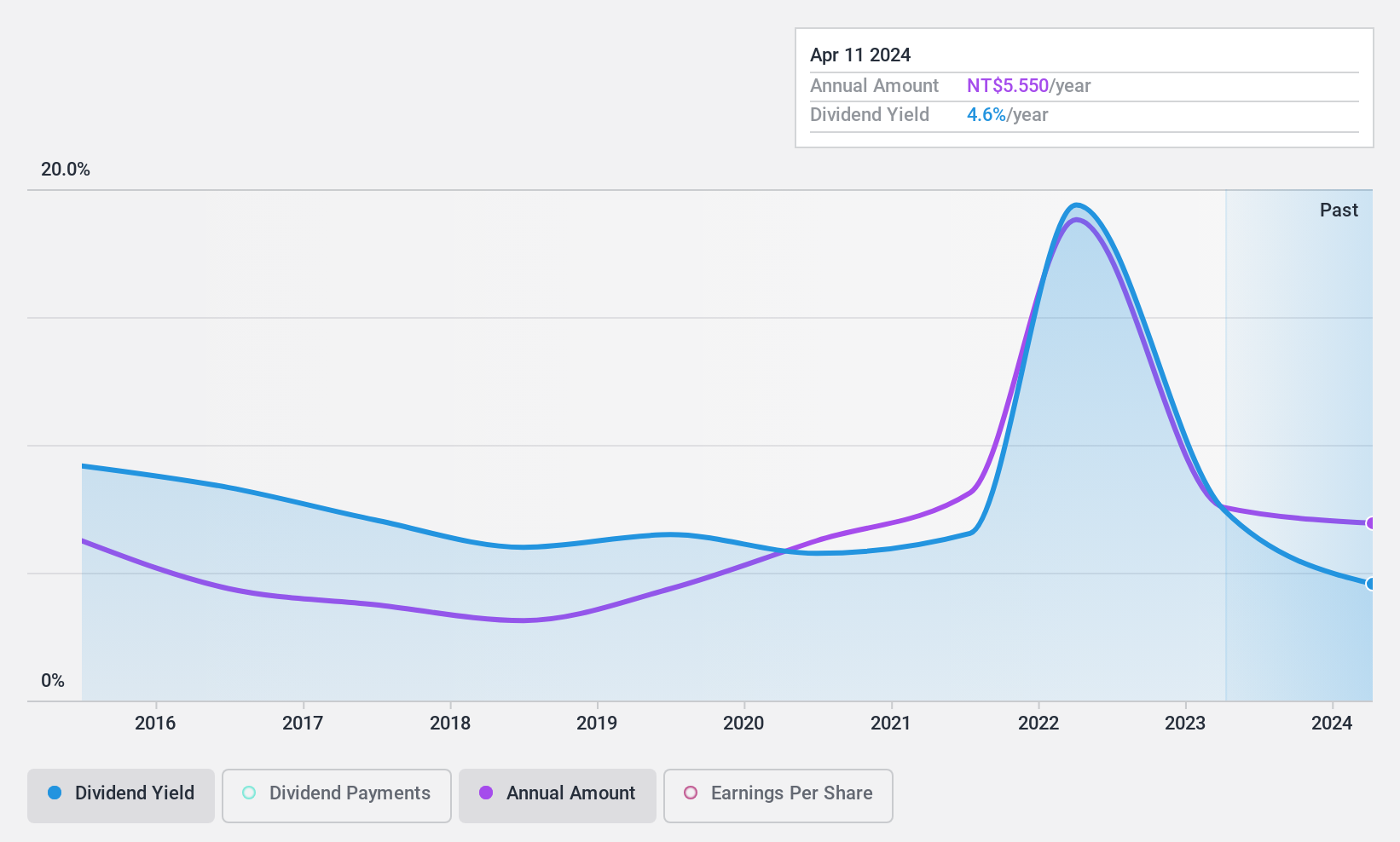

Dynapack International Technology (TPEX:3211)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dynapack International Technology Corporation manufactures and sells lithium-ion battery packs in Taiwan, the United States, and internationally, with a market cap of NT$28.08 billion.

Operations: Dynapack International Technology Corporation's revenue from the production and sales of hammer battery packs amounts to NT$15.41 billion.

Dividend Yield: 3%

Dynapack International Technology's dividend profile shows a mixed picture. The payout ratio of 30.1% suggests dividends are well-covered by earnings, while a cash payout ratio of 45.9% indicates solid coverage by cash flows. However, the dividend yield is lower than the top tier in the Taiwan market, and historical payments have been volatile and unreliable over the past decade despite recent growth in payouts. Earnings surged significantly last year, but share price volatility remains high.

- Delve into the full analysis dividend report here for a deeper understanding of Dynapack International Technology.

- Our comprehensive valuation report raises the possibility that Dynapack International Technology is priced higher than what may be justified by its financials.

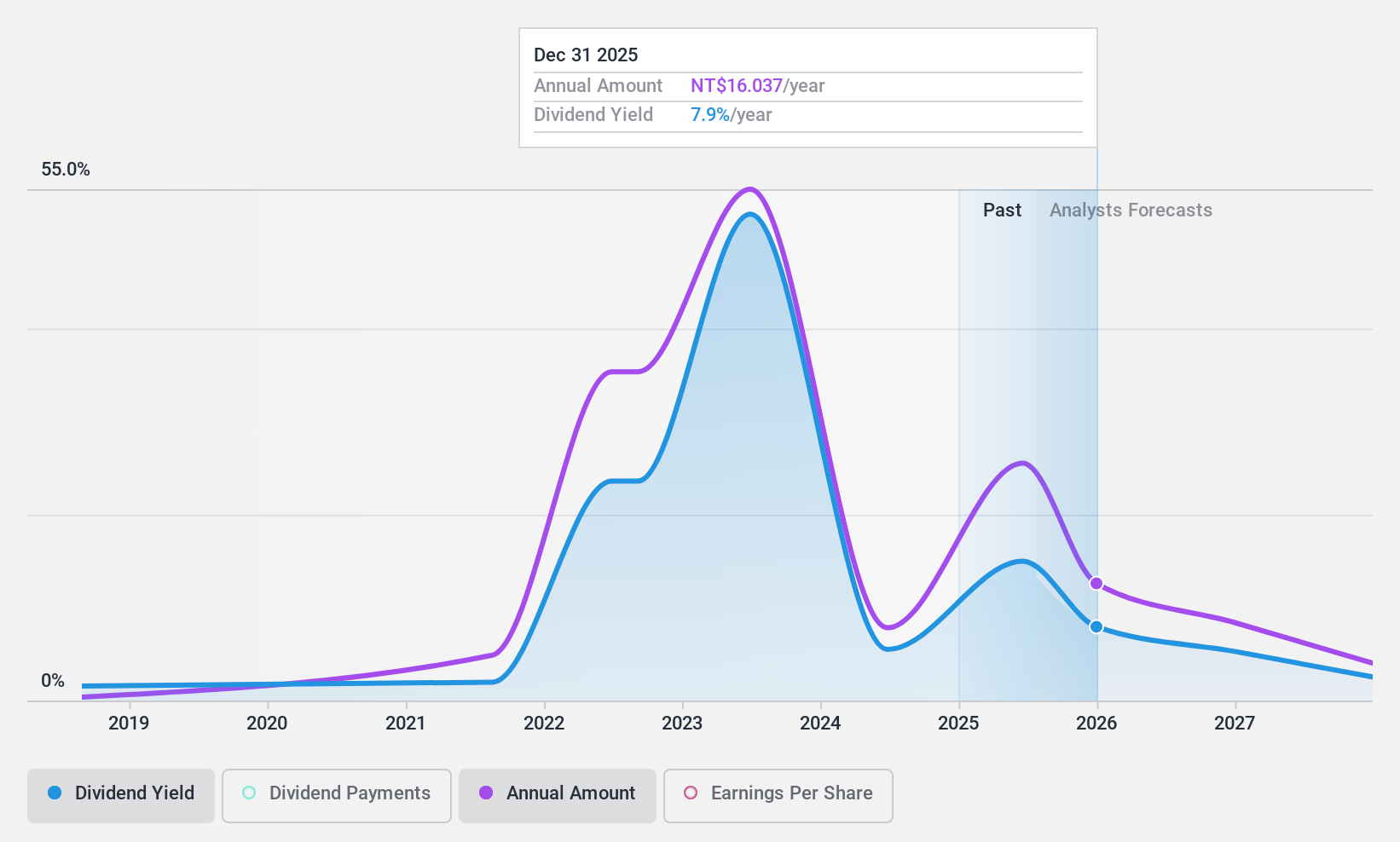

Evergreen Marine Corporation (Taiwan) (TWSE:2603)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Evergreen Marine Corporation (Taiwan) Ltd., along with its subsidiaries, operates in marine transportation, shipping agency, and commercial port area ship repair services, with a market cap of NT$448.16 billion.

Operations: Evergreen Marine Corporation (Taiwan) Ltd.'s revenue is primarily derived from its Transportation Division, which accounts for NT$519.76 billion.

Dividend Yield: 4.7%

Evergreen Marine Corporation's dividends are well-supported by a low payout ratio of 19% and a cash payout ratio of 17.6%, reflecting strong coverage by earnings and free cash flow. The dividend yield is competitive within the Taiwan market's top quartile. Despite this, the company has an unstable dividend history with volatility over the past decade. Recent earnings growth shows robust figures, with Q3 net income reaching TWD 61.91 billion, but future earnings are forecasted to decline significantly.

- Navigate through the intricacies of Evergreen Marine Corporation (Taiwan) with our comprehensive dividend report here.

- Our valuation report here indicates Evergreen Marine Corporation (Taiwan) may be undervalued.

Taking Advantage

- Dive into all 1959 of the Top Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600916

China National Gold Group Gold JewelleryLtd

China National Gold Group Gold Jewellery Co.,Ltd.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives