- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2612

Does Chinese Maritime Transport's (TPE:2612) Share Price Gain of 91% Match Its Business Performance?

A diverse portfolio of stocks will always have winners and losers. But if you're going to beat the market overall, you need to have individual stocks that outperform. One such company is Chinese Maritime Transport Ltd. (TPE:2612), which saw its share price increase 91% in the last year, slightly above the market return of around 76% (not including dividends). Having said that, the longer term returns aren't so impressive, with stock gaining just 20% in three years.

Check out our latest analysis for Chinese Maritime Transport

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, Chinese Maritime Transport actually shrank its EPS by 11%.

So we don't think that investors are paying too much attention to EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Chinese Maritime Transport's revenue actually dropped 16% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

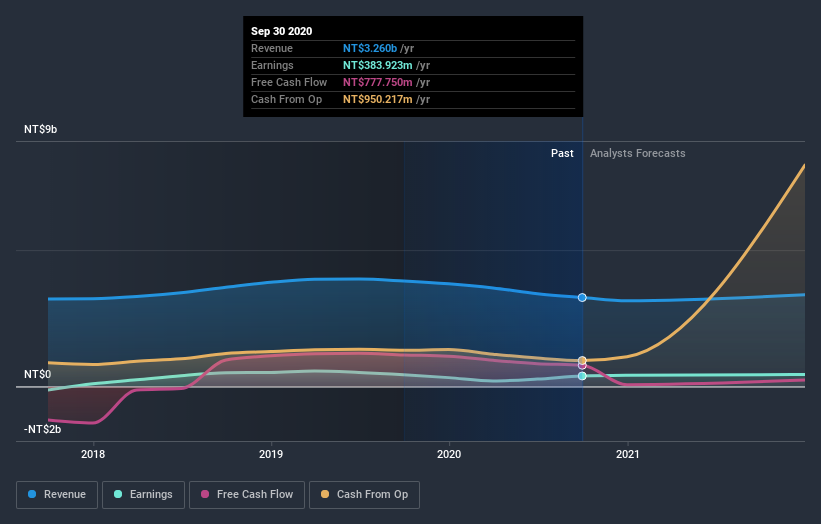

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Chinese Maritime Transport's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Chinese Maritime Transport, it has a TSR of 97% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Chinese Maritime Transport has rewarded shareholders with a total shareholder return of 97% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 6% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Chinese Maritime Transport (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Of course Chinese Maritime Transport may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Chinese Maritime Transport, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2612

Chinese Maritime Transport

Operates bulk carriers, and inland container transportation and terminals in Asia, the United States, Europe, and Oceania.

Proven track record slight.

Market Insights

Community Narratives