- Taiwan

- /

- Telecom Services and Carriers

- /

- TWSE:3682

Imagine Owning Asia Pacific TelecomLtd (TPE:3682) While The Price Tanked 56%

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. To wit, the Asia Pacific Telecom Co.,Ltd. (TPE:3682) share price managed to fall 56% over five long years. That's an unpleasant experience for long term holders. We also note that the stock has performed poorly over the last year, with the share price down 37%. The silver lining is that the stock is up 3.8% in about a week.

View our latest analysis for Asia Pacific TelecomLtd

Because Asia Pacific TelecomLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last five years Asia Pacific TelecomLtd saw its revenue shrink by 1.3% per year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 15% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

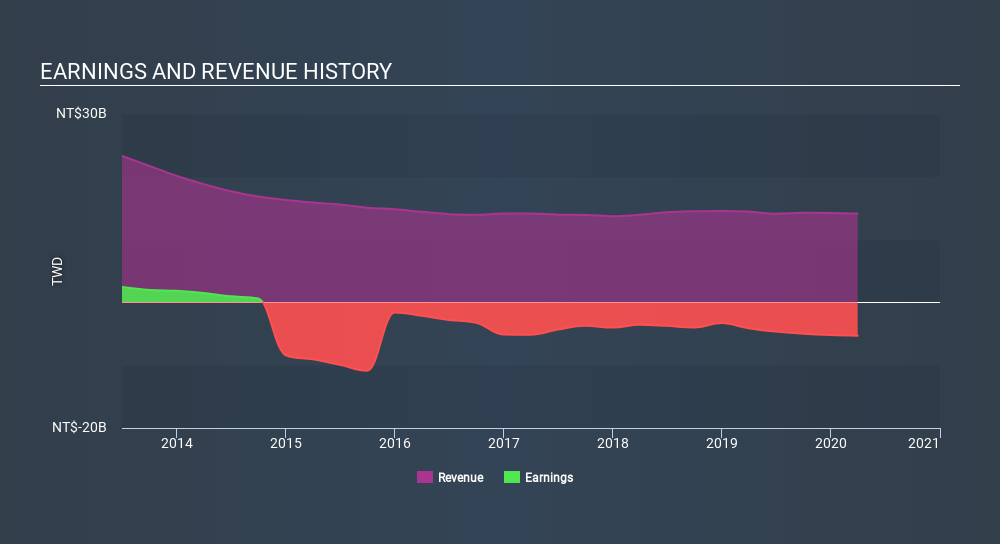

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Asia Pacific TelecomLtd's earnings, revenue and cash flow.

A Different Perspective

Asia Pacific TelecomLtd shareholders are down 37% for the year, but the market itself is up 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 15% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Asia Pacific TelecomLtd that you should be aware of before investing here.

Of course Asia Pacific TelecomLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TWSE:3682

Asia Pacific Telecom

Asia Pacific Telecom Co., Ltd., together with its subsidiaries, provides telecommunication services to personal and business users primarily in Taiwan.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives