- Taiwan

- /

- Telecom Services and Carriers

- /

- TPEX:6561

Are Chief Telecom Inc.'s (GTSM:6561) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

With its stock down 4.6% over the past month, it is easy to disregard Chief Telecom (GTSM:6561). However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. Specifically, we decided to study Chief Telecom's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Chief Telecom

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chief Telecom is:

21% = NT$591m ÷ NT$2.8b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.21 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Chief Telecom's Earnings Growth And 21% ROE

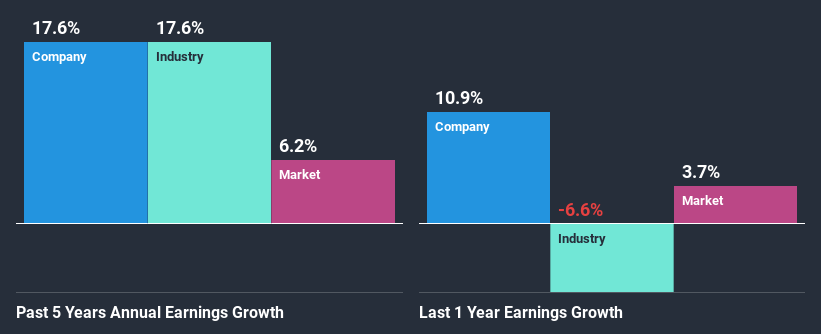

Firstly, we acknowledge that Chief Telecom has a significantly high ROE. Second, a comparison with the average ROE reported by the industry of 9.0% also doesn't go unnoticed by us. Probably as a result of this, Chief Telecom was able to see a decent net income growth of 18% over the last five years.

Next, on comparing Chief Telecom's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 18% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Chief Telecom's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Chief Telecom Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 98% (or a retention ratio of 2.1%) for Chief Telecom suggests that the company's growth wasn't really hampered despite it returning most of its income to its shareholders.

Additionally, Chief Telecom has paid dividends over a period of three years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

Overall, we feel that Chief Telecom certainly does have some positive factors to consider. Specifically, its high ROE which likely led to the growth in earnings. Bear in mind, the company reinvests little to none of its profits, which means that investors aren't necessarily reaping the full benefits of the high rate of return. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Chief Telecom's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you’re looking to trade Chief Telecom, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6561

Chief Telecom

Provides network integration, internet data center, communications integration, and cloud application services in Taiwan and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.