- South Korea

- /

- Communications

- /

- KOSDAQ:A094360

High Growth Tech Stocks To Watch This February 2025

Reviewed by Simply Wall St

As global markets navigate the uncertainty surrounding new tariffs and mixed economic indicators, investors are paying close attention to the performance of key indices such as the S&P 500, which experienced a slight decline amid these tensions. With manufacturing activity showing signs of recovery and earnings reports largely surpassing expectations, identifying high-growth tech stocks that can thrive in this complex environment requires a focus on companies with strong fundamentals and innovative potential.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Xspray Pharma | 115.81% | 125.11% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.21% | 57.07% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1209 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Chips&Media (KOSDAQ:A094360)

Simply Wall St Growth Rating: ★★★★☆☆

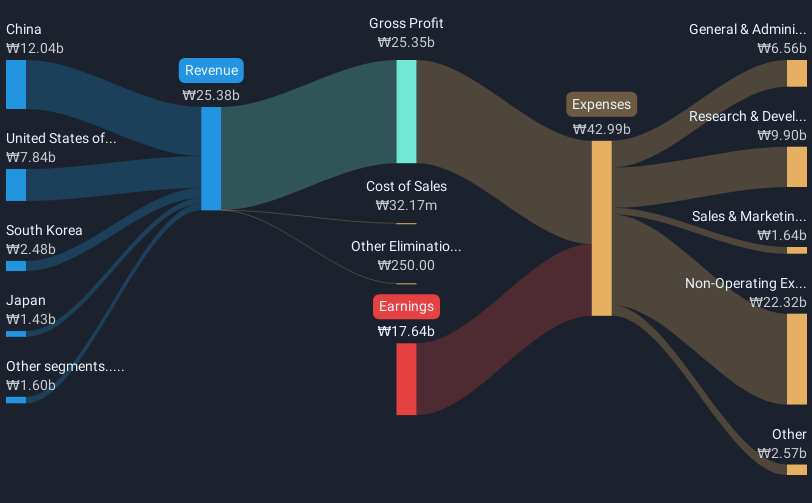

Overview: Chips&Media, Inc. develops and sells multimedia IP in South Korea and internationally, with a market cap of ₩417.32 billion.

Operations: The company generates revenue primarily through selling and licensing semiconductor design assets (IP), amounting to ₩25.38 billion.

Chips&Media, amidst a volatile market, showcases robust future prospects with an expected annual revenue growth of 14%, outpacing the Korean market's 8.8%. This growth is underpinned by significant R&D investments, aligning with industry shifts towards more advanced tech solutions. The company's strategic share repurchases, totaling 0.92% of shares for KRW 2.991 billion recently, reflect a commitment to shareholder value despite current unprofitability. With earnings projected to surge by approximately 84.45% annually, Chips&Media is positioning itself as a potentially profitable entity within three years, indicating a promising turnaround from its present financial status.

- Take a closer look at Chips&Media's potential here in our health report.

Gain insights into Chips&Media's past trends and performance with our Past report.

NEXON Games (KOSDAQ:A225570)

Simply Wall St Growth Rating: ★★★★☆☆

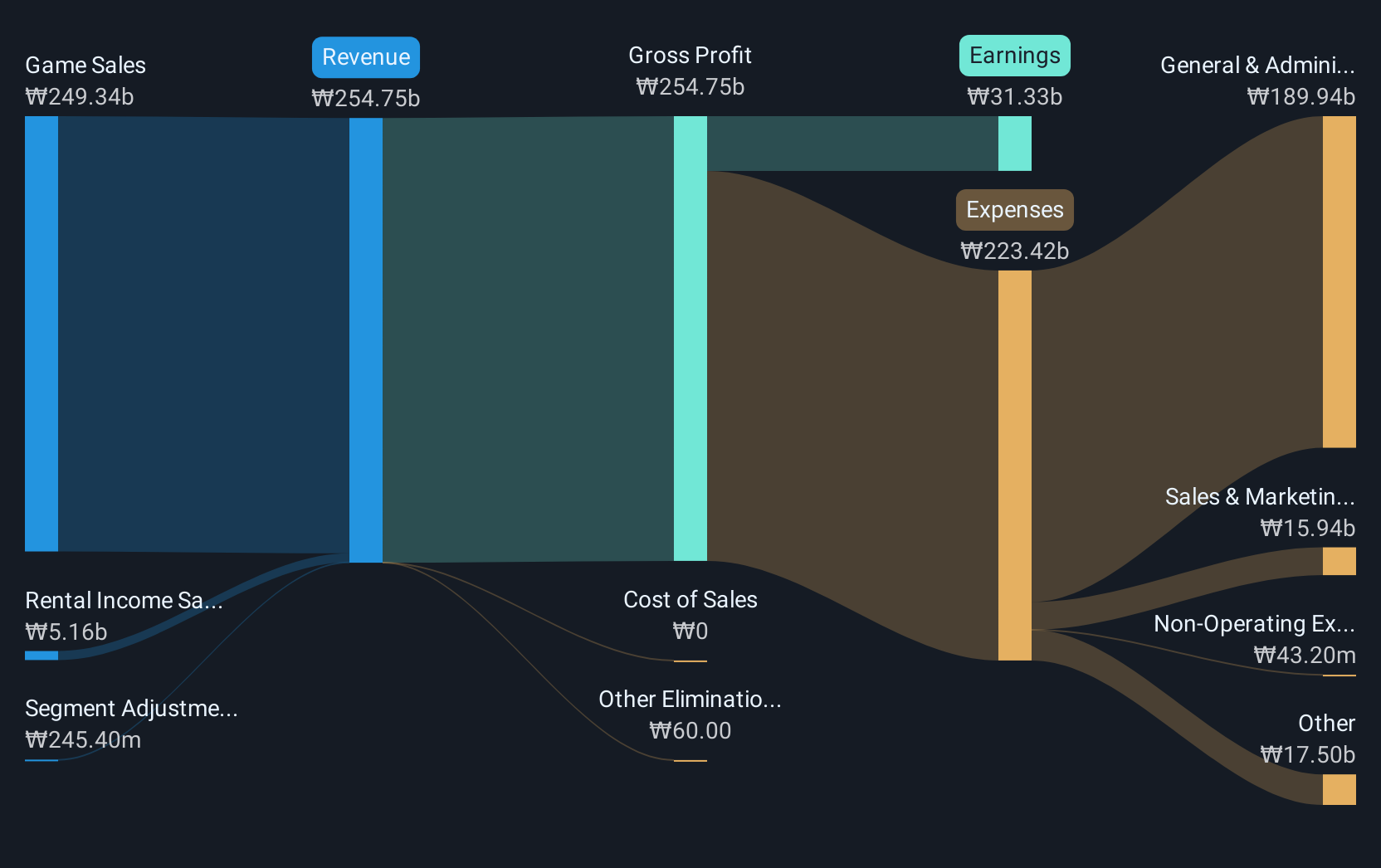

Overview: NEXON Games Co., Ltd. is a South Korean game developer with international operations and a market capitalization of approximately ₩896.21 billion.

Operations: The company primarily generates revenue from game sales, amounting to ₩245.04 billion. It operates in both domestic and international markets as a game developer.

NEXON Games, with a notable annual revenue growth of 13.3% and earnings surge forecasted at 53.8% per year, is carving out a significant niche in the gaming sector. This performance is bolstered by an aggressive R&D strategy, where expenses have scaled up to support innovative gaming technologies and content development—vital for staying competitive against industry giants. Additionally, the company has repurchased shares worth $1 billion last year, underscoring its commitment to enhancing shareholder value amidst its expansion efforts. With these strategic moves, NEXON is not just keeping pace but setting benchmarks in a rapidly evolving digital entertainment landscape.

- Click to explore a detailed breakdown of our findings in NEXON Games' health report.

Evaluate NEXON Games' historical performance by accessing our past performance report.

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★☆☆

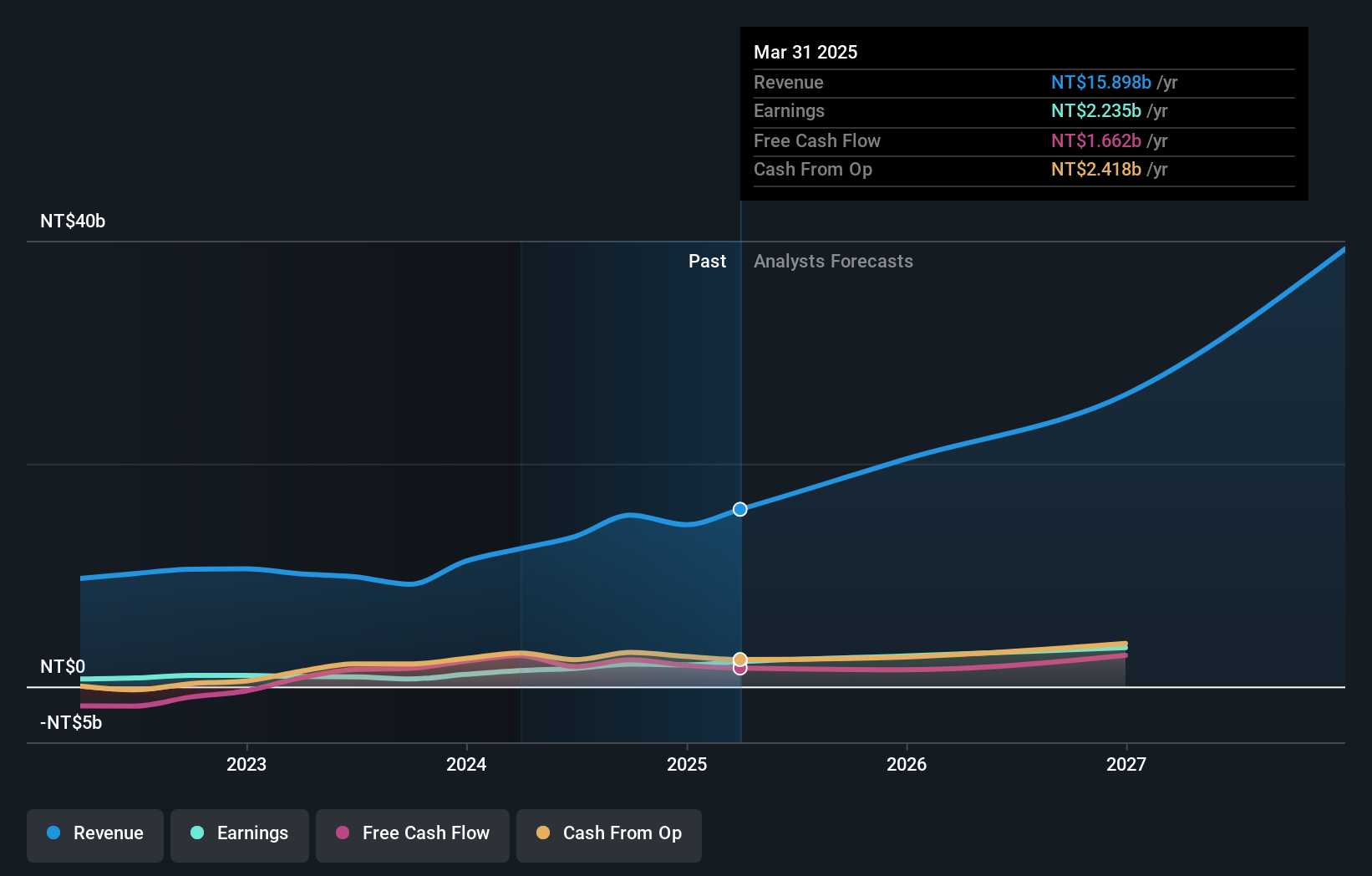

Overview: Chenbro Micom Co., Ltd. is involved in the research, design, manufacture, and trading of computer peripherals and systems globally, with a market cap of NT$34.84 billion.

Operations: The company focuses on the development and trading of computer peripherals, generating revenue primarily from this segment, which amounts to NT$15.38 billion.

Chenbro Micom, demonstrating robust growth in a competitive sector, has seen its revenue surge by 20.1% annually, outpacing the industry average. This growth is complemented by a significant annual earnings increase of 15.7%, reflecting efficient operational execution and market expansion strategies. Notably, the firm's commitment to innovation is underscored by its R&D spending which constitutes a substantial portion of its revenue, fostering developments that keep it at the forefront of technological advancements. With these dynamics at play, Chenbro Micom is well-positioned to leverage emerging tech trends, despite a highly volatile share price in recent months and earnings growth projections slightly below the broader market's pace.

- Navigate through the intricacies of Chenbro Micom with our comprehensive health report here.

Review our historical performance report to gain insights into Chenbro Micom's's past performance.

Taking Advantage

- Click through to start exploring the rest of the 1206 High Growth Tech and AI Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A094360

Chips&Media

Develops and sells multimedia IP in South Korea and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion