- Taiwan

- /

- Tech Hardware

- /

- TWSE:8210

Global Growth Companies With High Insider Ownership September 2025

Reviewed by Simply Wall St

In the current global market landscape, characterized by mixed economic signals and fluctuating indices, investors are closely watching central bank policies and labor market data for cues on future growth prospects. Amid these conditions, companies with high insider ownership often attract attention as they may signal strong confidence from those who know the business best. In this article, we explore three global growth companies where insiders hold significant stakes, potentially aligning their interests with shareholders and providing a compelling investment narrative in today's uncertain environment.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 34.1% | 84.6% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.9% | 91.9% |

Here we highlight a subset of our preferred stocks from the screener.

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system products globally, with a market cap of approximately CN¥19.88 billion.

Operations: Electric Connector Technology Co., Ltd. generates revenue through the production and sale of micro electronic connectors and interconnection system related products across various regions including China, North America, Europe, Japan, Asia Pacific, and other international markets.

Insider Ownership: 39.3%

Earnings Growth Forecast: 30.4% p.a.

Electric Connector Technology has shown robust earnings growth of 16% annually over the past five years, with future earnings projected to rise significantly by 30.4% per year, outpacing the CN market. Despite trading at a substantial discount to its estimated fair value and exhibiting strong revenue growth forecasts, challenges include a low forecasted return on equity and a dividend yield of 0.94% that is not well covered by free cash flows. Recent changes in company bylaws could impact governance structures moving forward.

- Delve into the full analysis future growth report here for a deeper understanding of Electric Connector Technology.

- The valuation report we've compiled suggests that Electric Connector Technology's current price could be quite moderate.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates globally in e-commerce, fintech, digital content, and communications services with a market cap of ¥1.96 trillion.

Operations: The company's revenue is primarily derived from its Internet Services segment at ¥1.32 trillion, followed by Fin Tech at ¥880.53 billion and Mobile services contributing ¥468.73 billion.

Insider Ownership: 12%

Earnings Growth Forecast: 78% p.a.

Rakuten Group is forecast to achieve profitability within three years, with earnings expected to grow 78.04% annually, surpassing market averages. Despite a low return on equity projection of 10.4%, the company trades significantly below its estimated fair value. Revenue growth is projected at 6.5% per year, outpacing the JP market's average but below high-growth benchmarks. Recent early redemption of JPY 16.8 billion in bonds reflects strategic financial management amidst ongoing expansion efforts.

- Take a closer look at Rakuten Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Rakuten Group shares in the market.

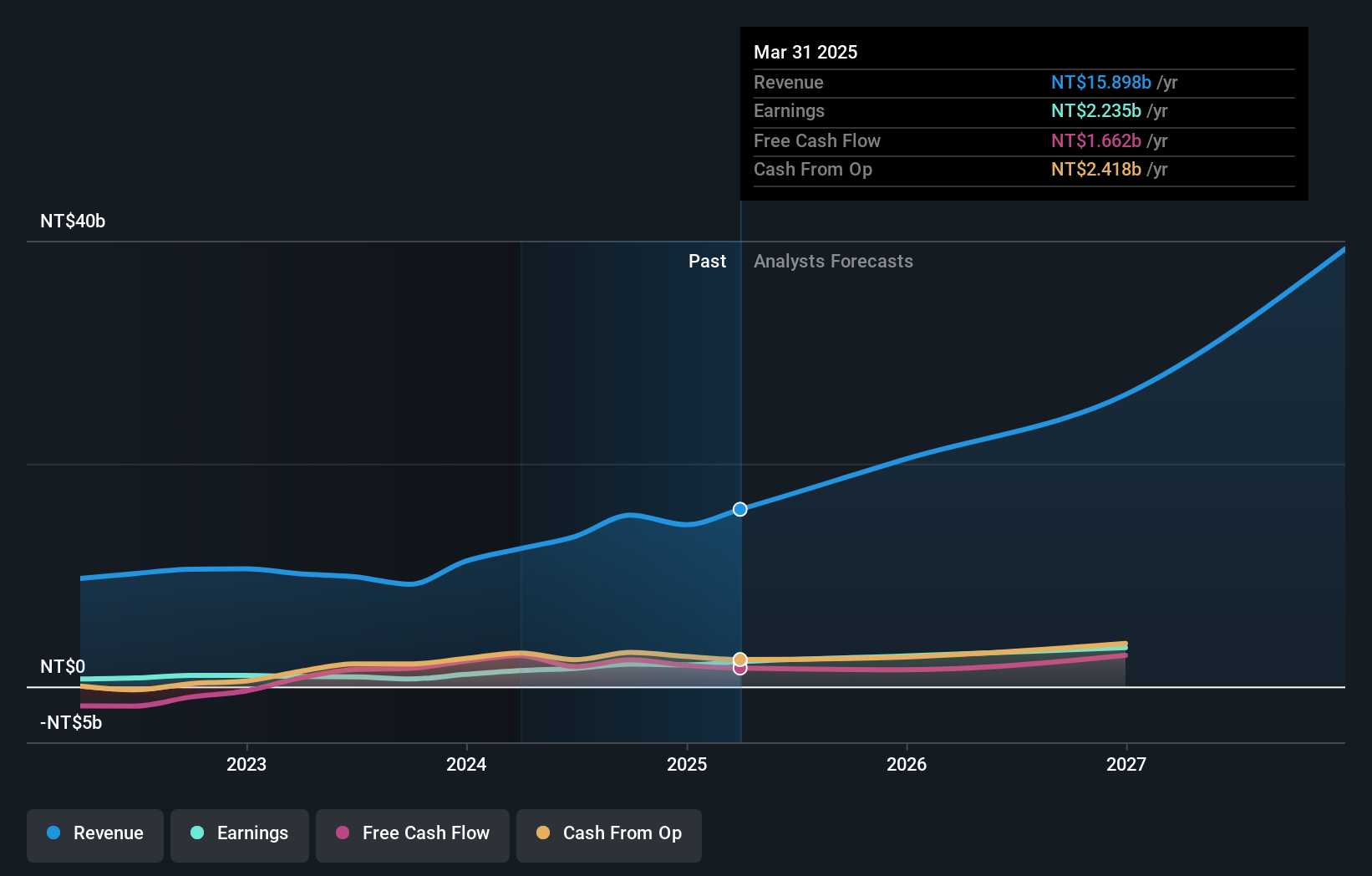

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★★★

Overview: Chenbro Micom Co., Ltd. is involved in the R&D, design, manufacturing, processing, and trading of computer peripherals and expendable systems across the United States, China, Taiwan, Singapore, and other international markets with a market cap of NT$71.62 billion.

Operations: The company's revenue is primarily derived from its computer peripherals segment, which accounted for NT$17.73 billion.

Insider Ownership: 24.8%

Earnings Growth Forecast: 20.6% p.a.

Chenbro Micom's recent earnings report reveals significant growth, with net income rising to TWD 828.94 million for Q2 2025 from TWD 453.32 million the previous year. Its revenue is forecast to grow at a robust 25% annually, outpacing the TW market's average. Despite high volatility in share price recently, Chenbro shows no substantial insider trading activity over three months and is expected to maintain strong earnings growth above market averages.

- Click here to discover the nuances of Chenbro Micom with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Chenbro Micom is priced higher than what may be justified by its financials.

Taking Advantage

- Delve into our full catalog of 845 Fast Growing Global Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8210

Chenbro Micom

Engages in the research and development, design, manufacture, processing, and trading of computer peripherals and system of expendables in the United States, China, Taiwan, Europe, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion