- Taiwan

- /

- Electrical

- /

- TPEX:6290

Top Asian Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a period of cautious optimism, with key indices such as Japan's Nikkei 225 and China's CSI 300 Index posting gains. In this environment, dividend stocks in Asia offer an appealing opportunity for investors seeking stable income streams amidst global economic uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.60% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.95% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.89% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.41% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.14% | ★★★★★★ |

Click here to see the full list of 1193 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

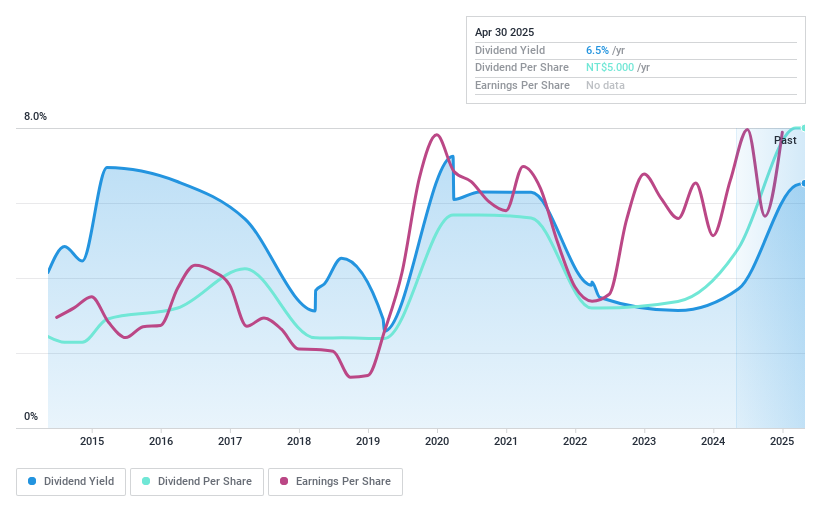

Longwell (TPEX:6290)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Longwell Company manufactures and sells power cords, cable assemblies, and charger plugs in Taiwan, China, the United States, Japan, and internationally with a market cap of NT$12.23 billion.

Operations: Longwell Company's revenue primarily comes from its Electronic Components & Parts segment, which generated NT$8.04 billion.

Dividend Yield: 6.5%

Longwell's recent earnings report shows a significant increase in net income to TWD 1.01 billion, supporting its dividend strategy. The company announced a cash dividend of TWD 5 per share, totaling TWD 795.39 million, despite having no free cash flow coverage and a payout ratio of 78.1%. While dividends have grown over the past decade, they remain volatile and unreliable. Longwell's price-to-earnings ratio of 12.1x suggests it is undervalued compared to the TW market average of 17.8x.

- Dive into the specifics of Longwell here with our thorough dividend report.

- According our valuation report, there's an indication that Longwell's share price might be on the expensive side.

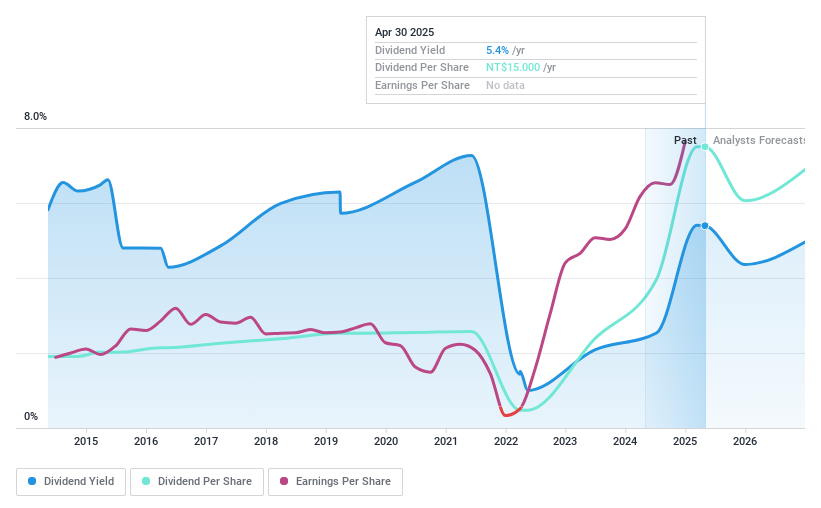

Cyber Power Systems (TWSE:3617)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cyber Power Systems, Inc. designs, manufactures, and sells power protection products and computer peripheral accessories worldwide with a market cap of NT$26.23 billion.

Operations: The company's revenue primarily comes from its Electric Equipment segment, which generated NT$12.49 billion.

Dividend Yield: 5.4%

Cyber Power Systems' dividend is covered by earnings and cash flows, with payout ratios of 60.6% and 57.9%, respectively, despite a history of volatility over the past decade. Recent earnings growth of 55.5% supports its proposed cash dividend of TWD 15 per share for 2024, totaling TWD 1.41 billion. Trading at a significant discount to its estimated fair value enhances its appeal, though the inconsistent dividend track record remains a concern for investors seeking stability in Asia's market.

- Unlock comprehensive insights into our analysis of Cyber Power Systems stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Cyber Power Systems is priced lower than what may be justified by its financials.

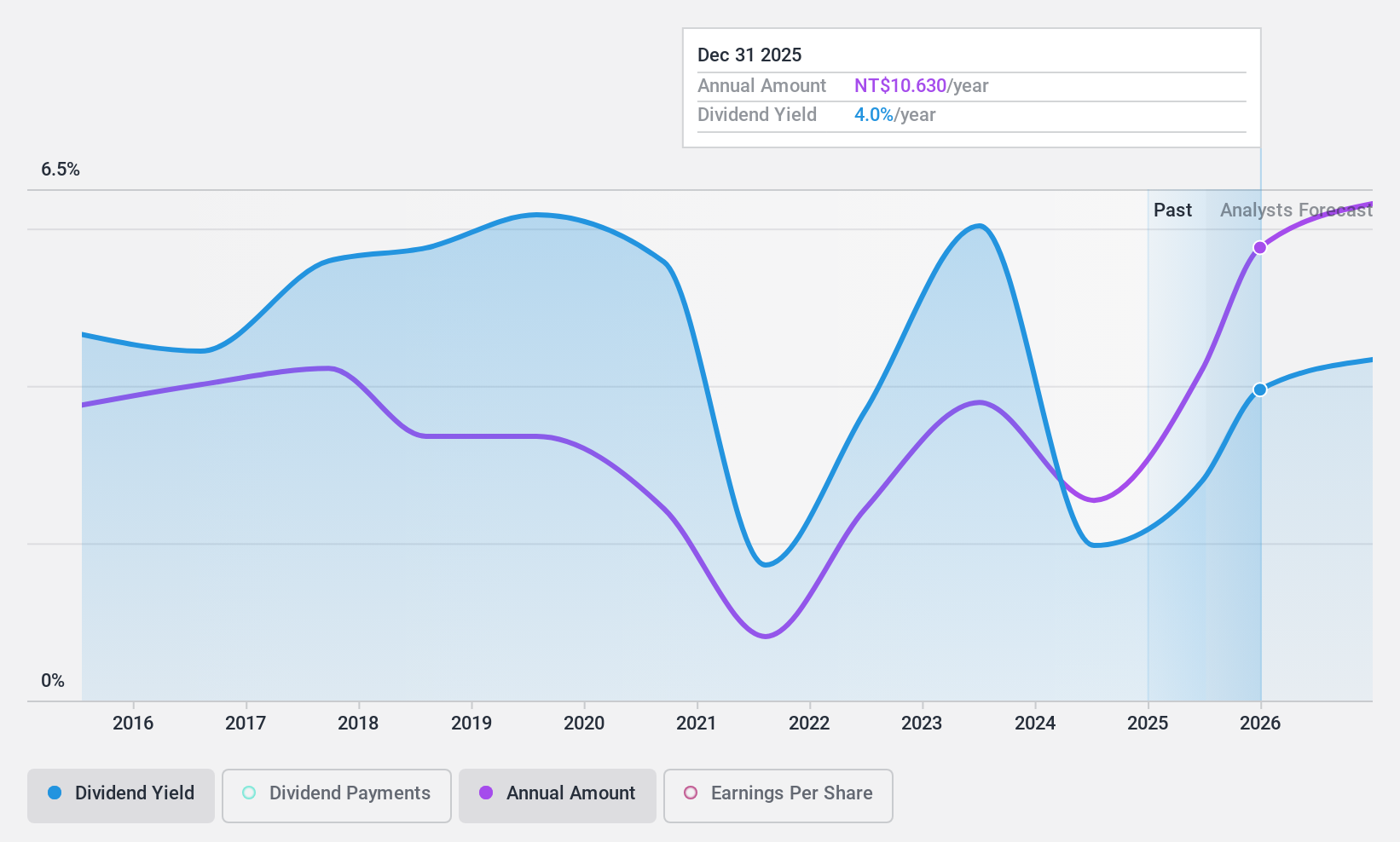

Posiflex Technology (TWSE:8114)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally, with a market cap of NT$27.61 billion.

Operations: Posiflex Technology, Inc. generates revenue primarily from the United States (NT$9.57 billion) and its Domestic Business in Taiwan (NT$2.43 billion).

Dividend Yield: 3%

Posiflex Technology's dividend, covered by earnings and cash flows with payout ratios of 61.9% and 53.4%, respectively, has been volatile over the past decade despite recent growth in earnings by 126.8%. Trading at a discount to its fair value may attract investors, but the unstable dividend history poses concerns for those prioritizing consistency. The company's recent product innovations could support future performance, yet potential investors should weigh these factors carefully against their income stability preferences.

- Click here to discover the nuances of Posiflex Technology with our detailed analytical dividend report.

- Our valuation report unveils the possibility Posiflex Technology's shares may be trading at a premium.

Key Takeaways

- Investigate our full lineup of 1193 Top Asian Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6290

Longwell

Manufactures and sells power cords, cable assemblies, and charger plugs in Taiwan, China, the United States, Japan, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives