- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8114

High Insider Ownership Growth Stocks To Watch In September 2024

Reviewed by Simply Wall St

As global markets rebound from recent sell-offs and inflation data shows mixed signals, growth stocks have outperformed, particularly in the technology sector. In this dynamic environment, companies with high insider ownership often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 94.1% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Underneath we present a selection of stocks filtered out by our screen.

DNO (OB:DNO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DNO ASA is involved in the exploration, development, and production of oil and gas assets across the Middle East, the North Sea, and West Africa with a market cap of NOK11.34 billion.

Operations: The company's revenue from oil and gas activities amounts to $659.90 million.

Insider Ownership: 13.1%

DNO ASA, a growth company with high insider ownership, is expanding its footprint in the Norwegian Sea through strategic acquisitions. The recent purchase of stakes in five oil and gas fields from Vår Energi ASA adds over eight million barrels of reserves and resources. Despite forecasted revenue growth of only 3.1% per year, DNO's earnings are expected to grow significantly at 26.33% annually, outpacing the Norwegian market's average. However, profit margins have decreased from last year’s 24% to 0.2%.

- Navigate through the intricacies of DNO with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility DNO's shares may be trading at a discount.

SDI (TWSE:2351)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SDI Corporation, with a market cap of NT$23.86 billion, manufactures and sells semiconductor lead frames, LED lead frames, stationery and office products, and high precision dies across Taiwan, China, Japan, Malaysia, and internationally.

Operations: SDI generates revenue primarily from electronic product parts (NT$9.52 billion) and stationery supplies (NT$1.92 billion).

Insider Ownership: 24.4%

SDI Corporation, trading below its estimated fair value, has demonstrated stable earnings growth despite recent revenue declines. The company reported Q2 net income of TWD 218.76 million, up from TWD 202.61 million a year ago, though six-month figures show a decrease in both sales and net income compared to last year. Earnings are forecast to grow significantly at 26.87% annually, outpacing the Taiwan market's average growth rate of 18.3%.

- Click here to discover the nuances of SDI with our detailed analytical future growth report.

- Our expertly prepared valuation report SDI implies its share price may be too high.

Posiflex Technology (TWSE:8114)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally, with a market cap of NT$14.74 billion.

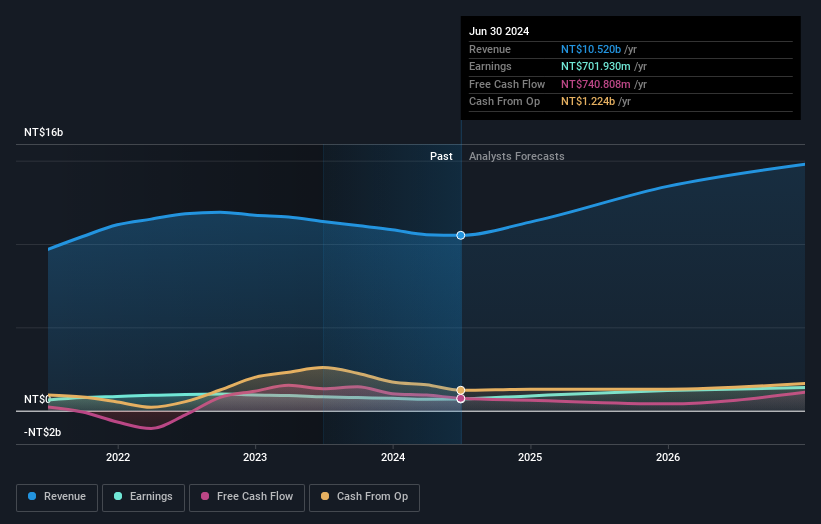

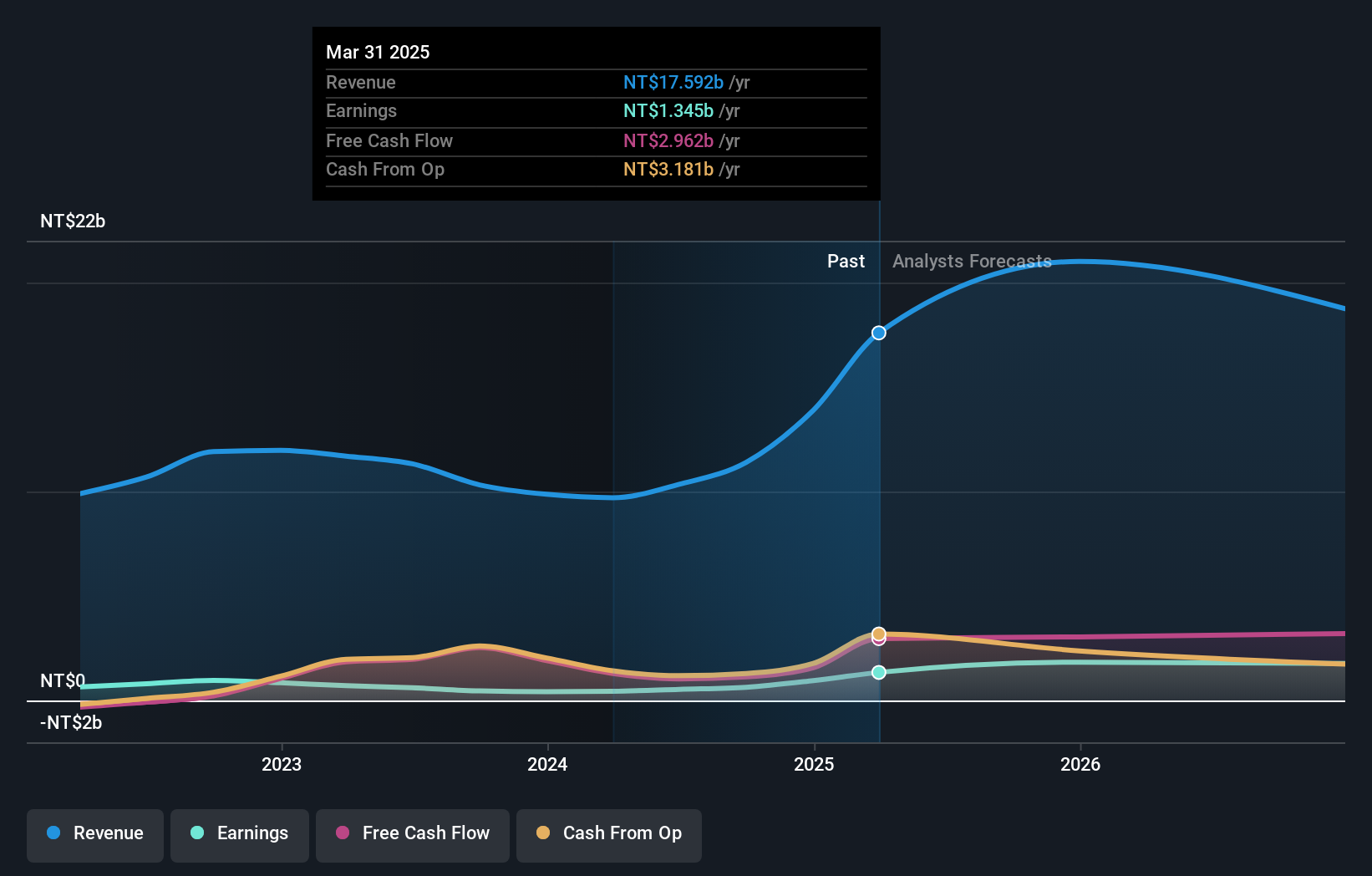

Operations: The company's revenue segments include NT$6.03 billion from the United States and NT$2.48 billion from domestic business operations.

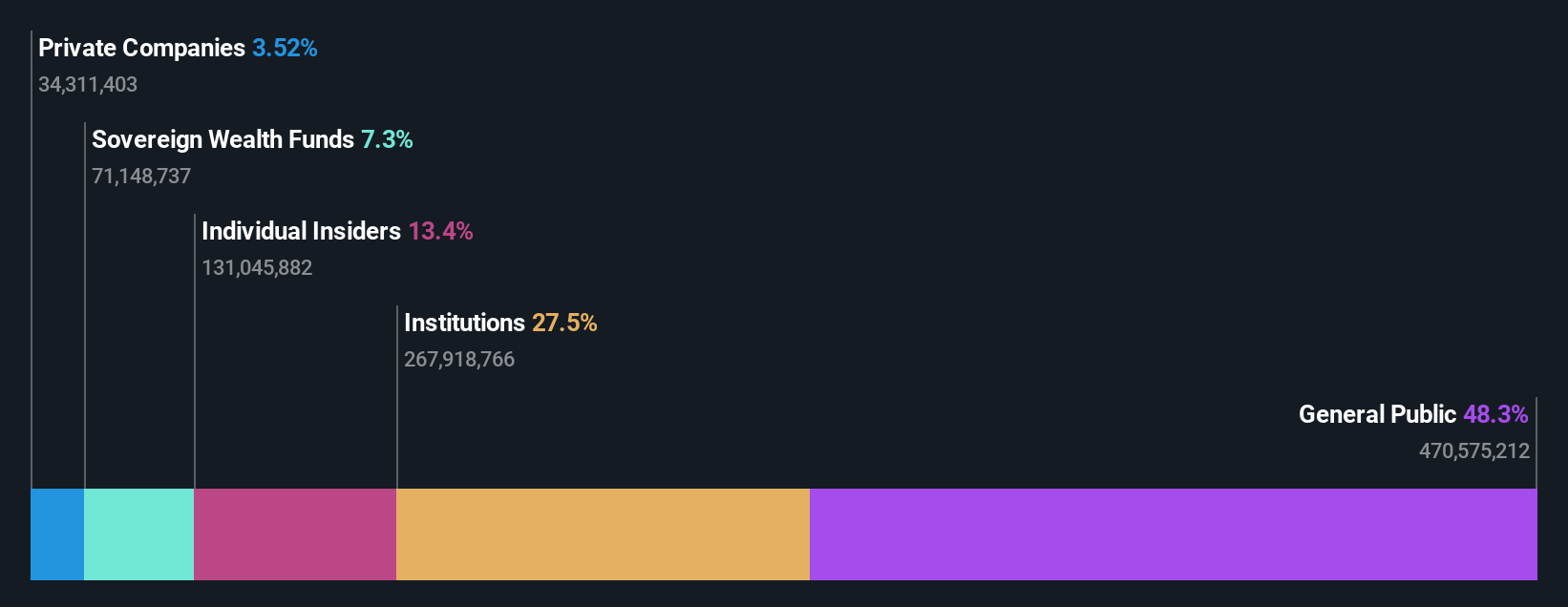

Insider Ownership: 10.2%

Posiflex Technology's earnings are forecast to grow 28.72% annually, outpacing the Taiwan market's average growth rate of 18.3%. Recent Q2 results show sales increased to TWD 3.19 billion from TWD 2.54 billion a year ago, with net income rising to TWD 240.83 million from TWD 135.83 million. Despite having a high level of debt and an unstable dividend track record, Posiflex benefits from strong insider ownership and innovative product releases like the Mozart BT Series POS terminal, enhancing its growth prospects.

- Unlock comprehensive insights into our analysis of Posiflex Technology stock in this growth report.

- The analysis detailed in our Posiflex Technology valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Unlock our comprehensive list of 1508 Fast Growing Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8114

Posiflex Technology

Engages in the manufacture and sale of industrial computers and peripheral equipment in Taiwan, the United States, and internationally.

Flawless balance sheet with high growth potential.