- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6835

We Think That There Are Issues Underlying Complex Micro InterconnectionLtd's (TWSE:6835) Earnings

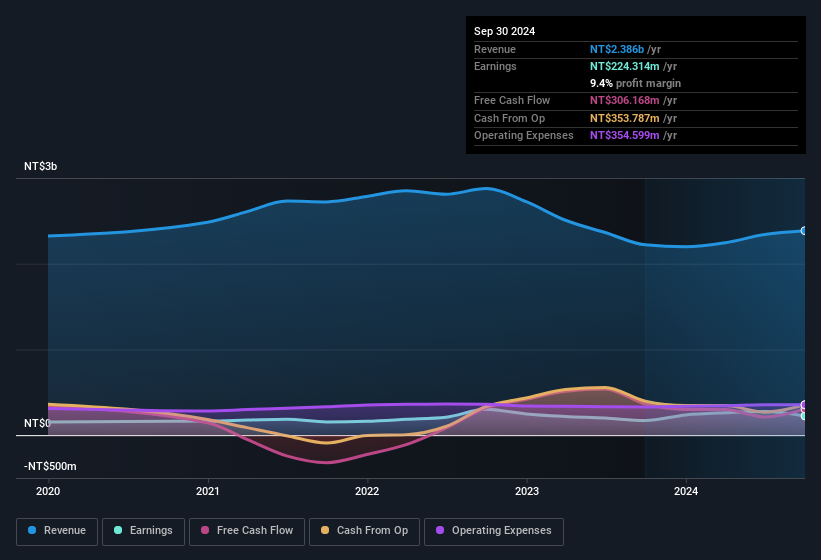

Investors were disappointed with Complex Micro Interconnection Co.,Ltd.'s (TWSE:6835) earnings, despite the strong profit numbers. We did some digging and found some worrying underlying problems.

View our latest analysis for Complex Micro InterconnectionLtd

How Do Unusual Items Influence Profit?

To properly understand Complex Micro InterconnectionLtd's profit results, we need to consider the NT$33m gain attributed to unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Complex Micro InterconnectionLtd doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Complex Micro InterconnectionLtd.

Our Take On Complex Micro InterconnectionLtd's Profit Performance

Arguably, Complex Micro InterconnectionLtd's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Complex Micro InterconnectionLtd's true underlying earnings power is actually less than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 28% over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you want to do dive deeper into Complex Micro InterconnectionLtd, you'd also look into what risks it is currently facing. Case in point: We've spotted 1 warning sign for Complex Micro InterconnectionLtd you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Complex Micro InterconnectionLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6835

Complex Micro InterconnectionLtd

Manufactures and sells flexible circuit boards and cables in Taiwan, China, and Thailand.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

BWX Technologies (BWXT): Powering the Nuclear Renaissance from Naval Depths to Medical Frontiers.

Merck & Co. (MRK): Scaling the "Post-Keytruda Hill" Through Diversified Blockbusters.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks