- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6835

Complex Micro InterconnectionLtd (TWSE:6835) Has Announced A Dividend Of NT$2.00

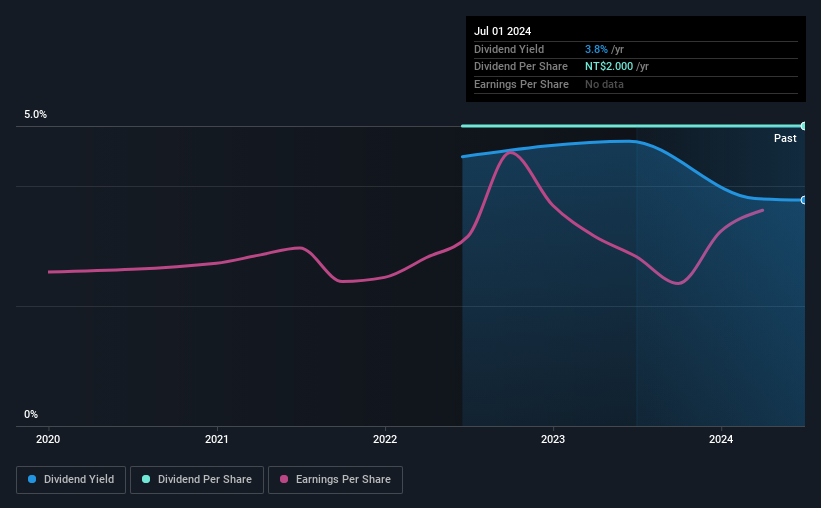

Complex Micro Interconnection Co.,Ltd. (TWSE:6835) will pay a dividend of NT$2.00 on the 31st of July. This payment means that the dividend yield will be 3.8%, which is around the industry average.

View our latest analysis for Complex Micro InterconnectionLtd

Complex Micro InterconnectionLtd's Dividend Is Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, Complex Micro InterconnectionLtd was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Looking forward, earnings per share could rise by 7.0% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 47%, which is in the range that makes us comfortable with the sustainability of the dividend.

Complex Micro InterconnectionLtd Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. There hasn't been much of a change in the dividend over the last 2 years. Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Complex Micro InterconnectionLtd Could Grow Its Dividend

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see that Complex Micro InterconnectionLtd has been growing its earnings per share at 7.0% a year over the past five years. The company is paying a reasonable amount of earnings to shareholders, and is growing earnings at a decent rate so we think it could be a decent dividend stock.

Our Thoughts On Complex Micro InterconnectionLtd's Dividend

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Complex Micro InterconnectionLtd that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6835

Complex Micro InterconnectionLtd

Manufactures and sells flexible circuit boards and cables in Taiwan, China, and Thailand.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

LVMH - A Fundamental and Historical Valuation

Bad management practices jeopardize long-term future of VRSN

Hims & Hers Health - Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.