- Taiwan

- /

- Tech Hardware

- /

- TWSE:6715

Lintes Technology's (TWSE:6715) Sluggish Earnings Might Be Just The Beginning Of Its Problems

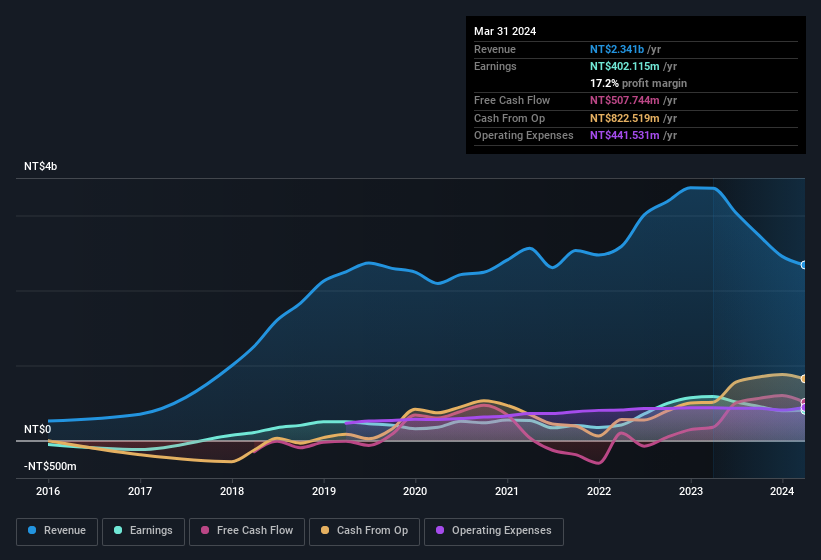

The subdued market reaction suggests that Lintes Technology Co., Ltd.'s (TWSE:6715) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

View our latest analysis for Lintes Technology

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Lintes Technology expanded the number of shares on issue by 6.1% over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Lintes Technology's historical EPS growth by clicking on this link.

A Look At The Impact Of Lintes Technology's Dilution On Its Earnings Per Share (EPS)

Lintes Technology has improved its profit over the last three years, with an annualized gain of 50% in that time. But EPS was only up 37% per year, in the exact same period. Net income was down 31% over the last twelve months. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 33%. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Lintes Technology's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Lintes Technology's Profit Performance

Over the last year Lintes Technology issued new shares and so, there's a noteworthy divergence between EPS and net income growth. Because of this, we think that it may be that Lintes Technology's statutory profits are better than its underlying earnings power. Nonetheless, it's still worth noting that its earnings per share have grown at 37% over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Lintes Technology at this point in time. In terms of investment risks, we've identified 3 warning signs with Lintes Technology, and understanding them should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Lintes Technology's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6715

Lintes Technology

Research, designs, develops, produces, manufactures, and sells high-speed transmission cables in Taiwan and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026