- Belgium

- /

- Entertainment

- /

- ENXTBR:KIN

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record levels, investors are closely monitoring economic indicators that suggest a strong consumer sector despite ongoing manufacturing challenges. In this dynamic environment, high-growth tech stocks stand out as potential opportunities due to their ability to innovate and adapt rapidly, making them worth watching as they navigate both domestic policy shifts and geopolitical factors.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kinepolis Group (ENXTBR:KIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinepolis Group NV operates cinema complexes across several countries including Belgium, the Netherlands, France, Spain, Luxembourg, Switzerland, Poland, Canada, and the United States with a market cap of approximately €991.61 million.

Operations: Kinepolis Group NV generates revenue primarily from box office sales (€294.05 million) and in-theatre sales (€177.61 million), supplemented by real estate and film distribution activities.

Kinepolis Group, navigating through a challenging entertainment landscape, has demonstrated resilience with a forecasted annual earnings growth of 27.8%, significantly outpacing the Belgian market's 20.6% projection. Despite a slower revenue growth rate at 6% compared to the industry average of 7.2%, the company's strategic focus on enhancing viewer experience and expanding its digital offerings underscores its potential to leverage technology for growth. With high-quality past earnings and an anticipated high Return on Equity at 27%, Kinepolis is positioning itself robustly against competitors, even as it manages a higher level of debt which necessitates cautious financial handling going forward.

- Navigate through the intricacies of Kinepolis Group with our comprehensive health report here.

Review our historical performance report to gain insights into Kinepolis Group's's past performance.

PLAIDInc (TSE:4165)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PLAID, Inc. is a Japanese company that develops and operates KARTE, a customer experience SaaS platform, with a market cap of ¥53.62 billion.

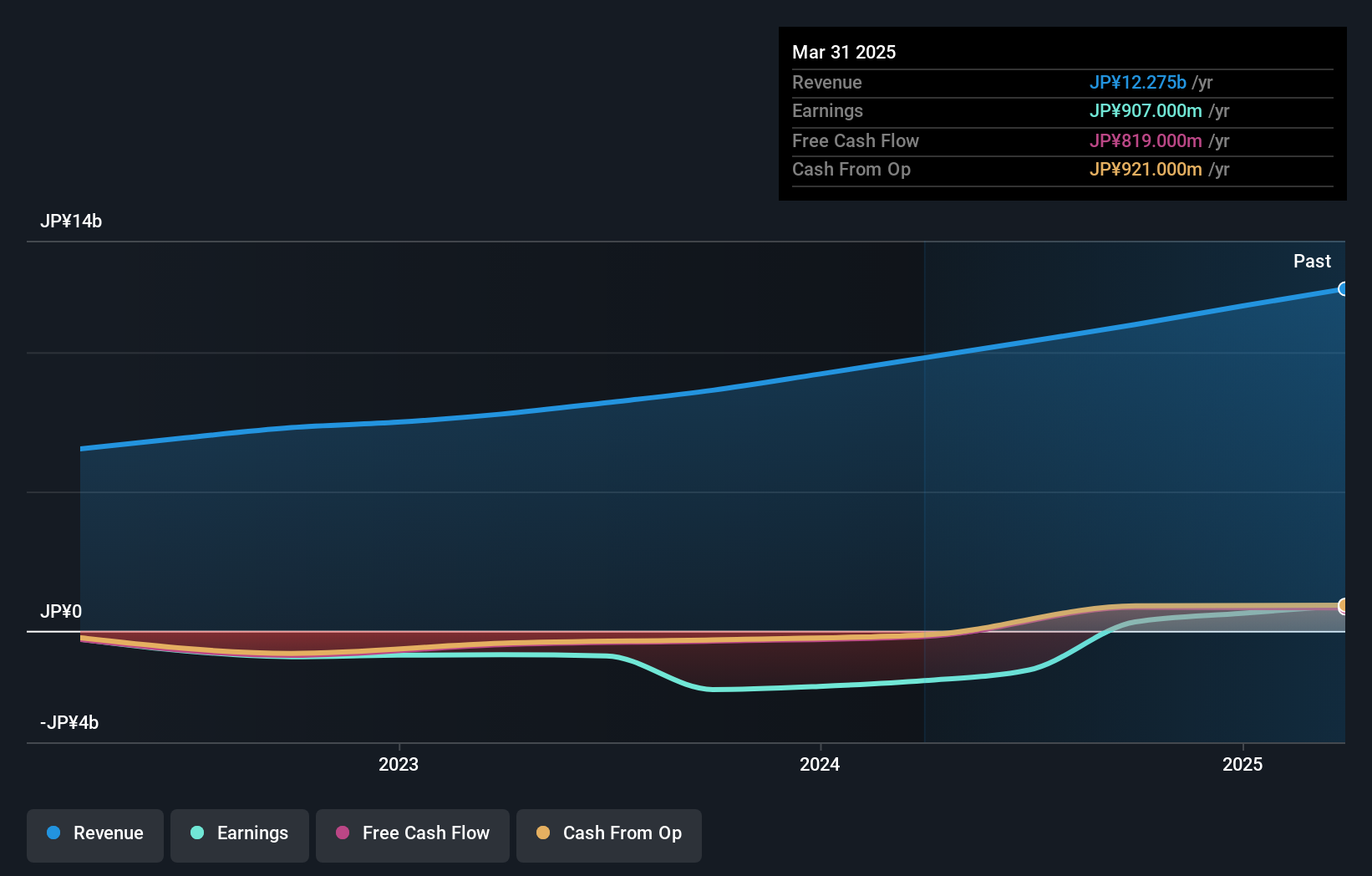

Operations: The company generates revenue primarily through its SaaS Business and The Advertising Business, totaling ¥10.99 billion.

PLAIDInc., amidst a dynamic tech landscape, has revised its earnings guidance upward, reflecting robust operational improvements and a strategic reduction in SG&A expenses. With an impressive forecast of 64.1% annual earnings growth over the next three years—significantly outstripping the Japanese market's 7.9%—PLAIDInc is poised for substantial expansion. Moreover, the company's R&D investment remains a cornerstone of its strategy, fostering innovation that contributes to sustained revenue growth at a rate of 16.7% per year. This focus not only underscores PLAIDInc’s commitment to advancing its technological capabilities but also strategically positions it well ahead of broader market trends.

- Get an in-depth perspective on PLAIDInc's performance by reading our health report here.

Examine PLAIDInc's past performance report to understand how it has performed in the past.

Ennoconn (TWSE:6414)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ennoconn Corporation operates in the research, design, development, manufacturing, and sales of data storage and processing equipment, industrial motherboards, network communication products, and facility electromechanical systems both in Taiwan and internationally with a market capitalization of approximately NT$42.11 billion.

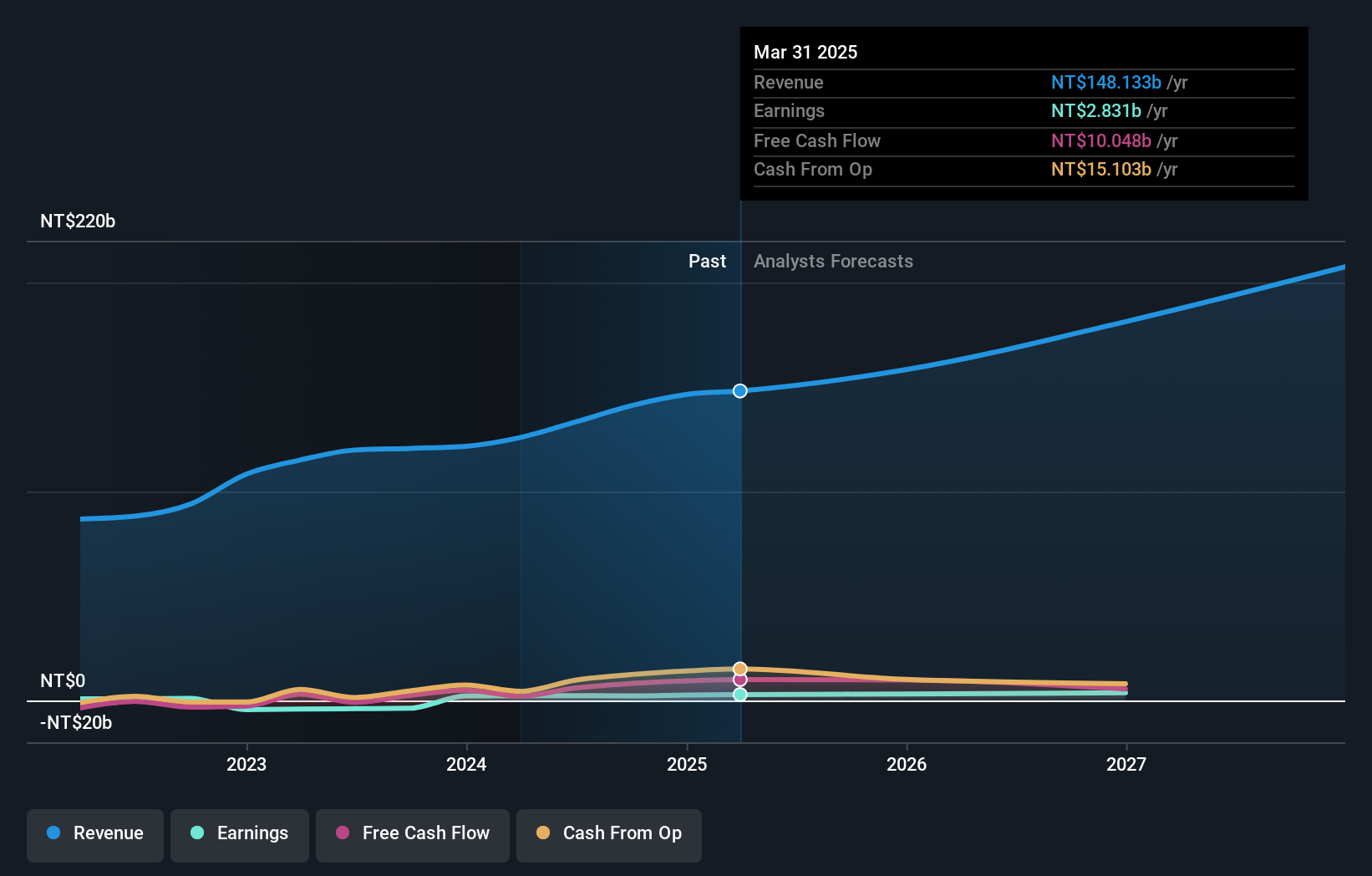

Operations: The company's primary revenue streams are from the Factory System and Electromechanical System Service Business Department, generating NT$60.85 billion, followed by the Information Systems Department with NT$54.61 billion. The Industrial Computer Software and Hardware Sales Department contributes NT$26.93 billion, while the Network Communications Production and Sales department adds NT$4.16 billion to total revenues.

Ennoconn's recent financial performance reveals a mixed picture, with a significant 25.8% year-over-year increase in third-quarter sales to TWD 37.71 billion, reflecting robust market demand. Despite this revenue growth, net income slightly dipped to TWD 690.67 million from TWD 762.63 million previously, indicating some challenges in profitability amidst expansion efforts. The company's commitment to innovation is evident from its R&D investments which are crucial for maintaining competitive advantage in the swiftly evolving tech sector; however, specific figures on R&D spending were not disclosed in the latest reports. This strategic focus on research could be pivotal as Ennoconn navigates market fluctuations and aims for sustained growth with earnings projected to rise by an impressive 22.3% annually.

- Delve into the full analysis health report here for a deeper understanding of Ennoconn.

Understand Ennoconn's track record by examining our Past report.

Key Takeaways

- Discover the full array of 1284 High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinepolis Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:KIN

Kinepolis Group

Operates and manages cinemas in Belgium, France, Canada, Spain, the Netherlands, the United States, Luxembourg, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives