- Taiwan

- /

- Tech Hardware

- /

- TWSE:6414

3 Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets have shown volatility, with major indices like the S&P 500 and Nasdaq Composite experiencing fluctuations. Amidst these movements, investors are increasingly looking for opportunities in stocks that might be trading below their estimated value, as they seek to navigate the current complex market environment. Identifying undervalued stocks often involves assessing companies with strong fundamentals that may not yet be fully recognized by the market, especially during times of economic uncertainty or shifts in investor sentiment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1979.00 | ¥3936.25 | 49.7% |

| On the Beach Group (LSE:OTB) | £1.522 | £3.03 | 49.8% |

| SEI Medical (SET:SEI) | THB5.80 | THB11.54 | 49.7% |

| SciDev (ASX:SDV) | A$0.615 | A$1.23 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.88 | €5.74 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.01 | US$545.05 | 49.9% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1418.00 | ₩2821.10 | 49.7% |

| Orascom Development Holding (SWX:ODHN) | CHF3.90 | CHF7.79 | 49.9% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.90 | CN¥127.14 | 49.7% |

| Cellnex Telecom (BME:CLNX) | €32.50 | €64.80 | 49.8% |

Let's dive into some prime choices out of the screener.

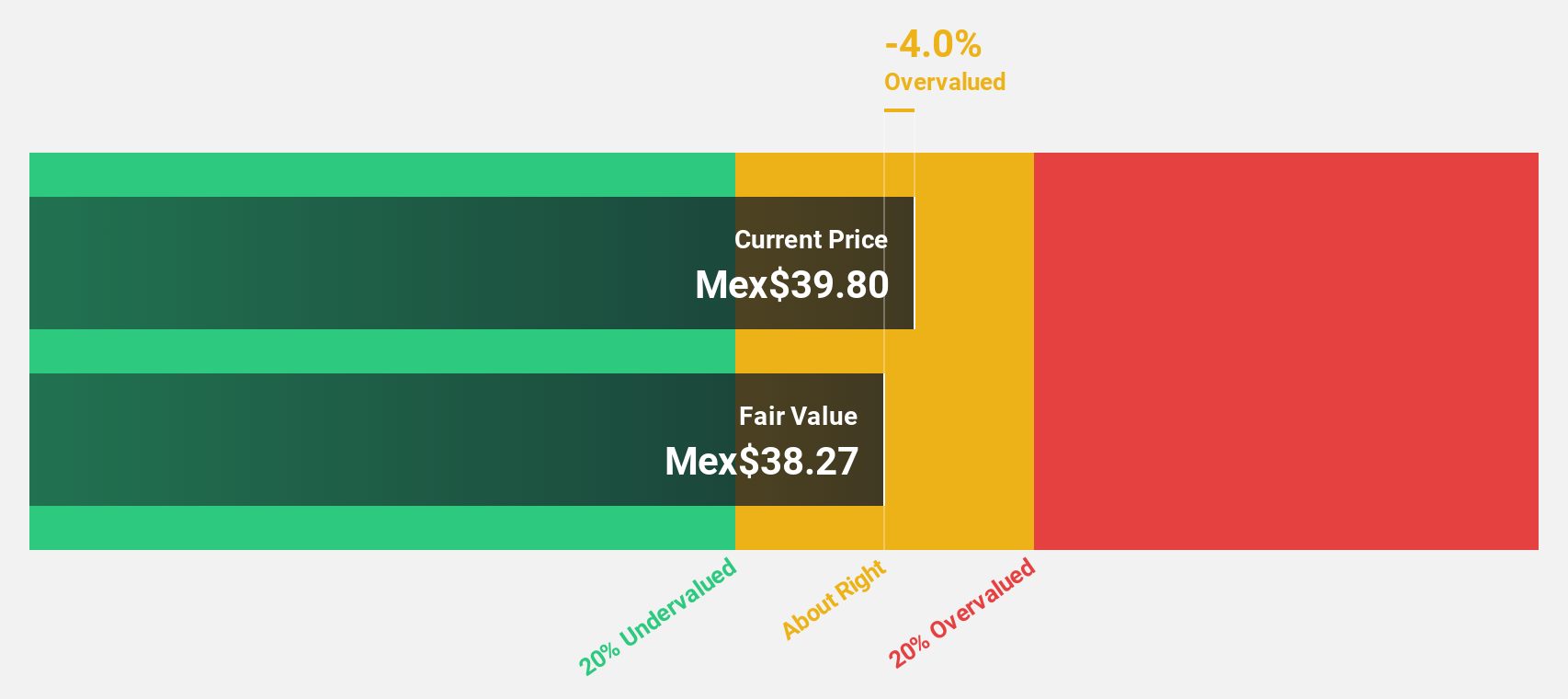

Gentera. de (BMV:GENTERA *)

Overview: Gentera, S.A.B. de C.V. offers a range of financial products and services in Mexico and Peru, with a market cap of MX$40.08 billion.

Operations: Gentera's revenue segments include various financial products and services offered in Mexico and Peru.

Estimated Discount To Fair Value: 18.4%

Gentera is trading at MX$26.29, below its estimated fair value of MX$32.23, representing an 18.4% discount. Its revenue is expected to grow at 20.4% annually, outpacing the Mexican market's growth rate of 7.1%. Despite a high level of bad loans at 3.5%, Gentera's earnings are forecast to rise by 15.6% per year, above the market average of 11.2%. Recent earnings show increased net income and interest income compared to last year.

- Our comprehensive growth report raises the possibility that Gentera. de is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Gentera. de stock in this financial health report.

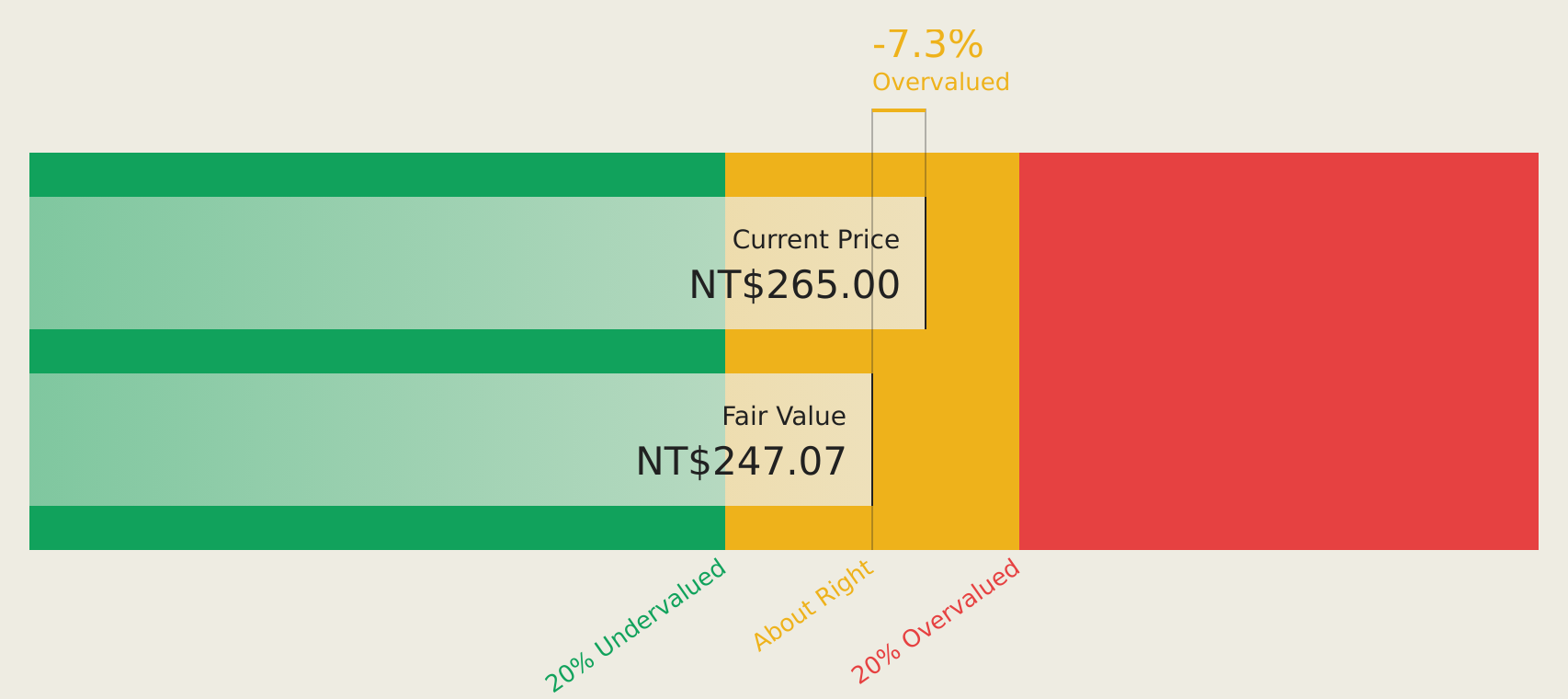

Ennoconn (TWSE:6414)

Overview: Ennoconn Corporation engages in the research, design, development, manufacturing, and sale of data storage and processing equipment, industrial motherboards, network communication products, and facility electromechanical systems both in Taiwan and internationally with a market cap of NT$42.63 billion.

Operations: The company's revenue segments include NT$49.78 billion from the Information Systems Department, NT$26.69 billion from Industrial Computer Software and Hardware Sales, NT$3.96 billion from Network Communication Production and Marketing, and NT$58.79 billion from Factory System and Electromechanical System Services.

Estimated Discount To Fair Value: 14.4%

Ennoconn is trading at NT$311, slightly undervalued compared to its fair value of NT$363.47. Despite a low forecasted return on equity of 11.5% in three years, earnings are expected to grow significantly at 22.5% annually, surpassing the Taiwan market's growth rate. Recent results show a rise in sales but a decline in net income and earnings per share compared to last year, reflecting mixed financial performance amidst strong projected profit growth.

- In light of our recent growth report, it seems possible that Ennoconn's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Ennoconn.

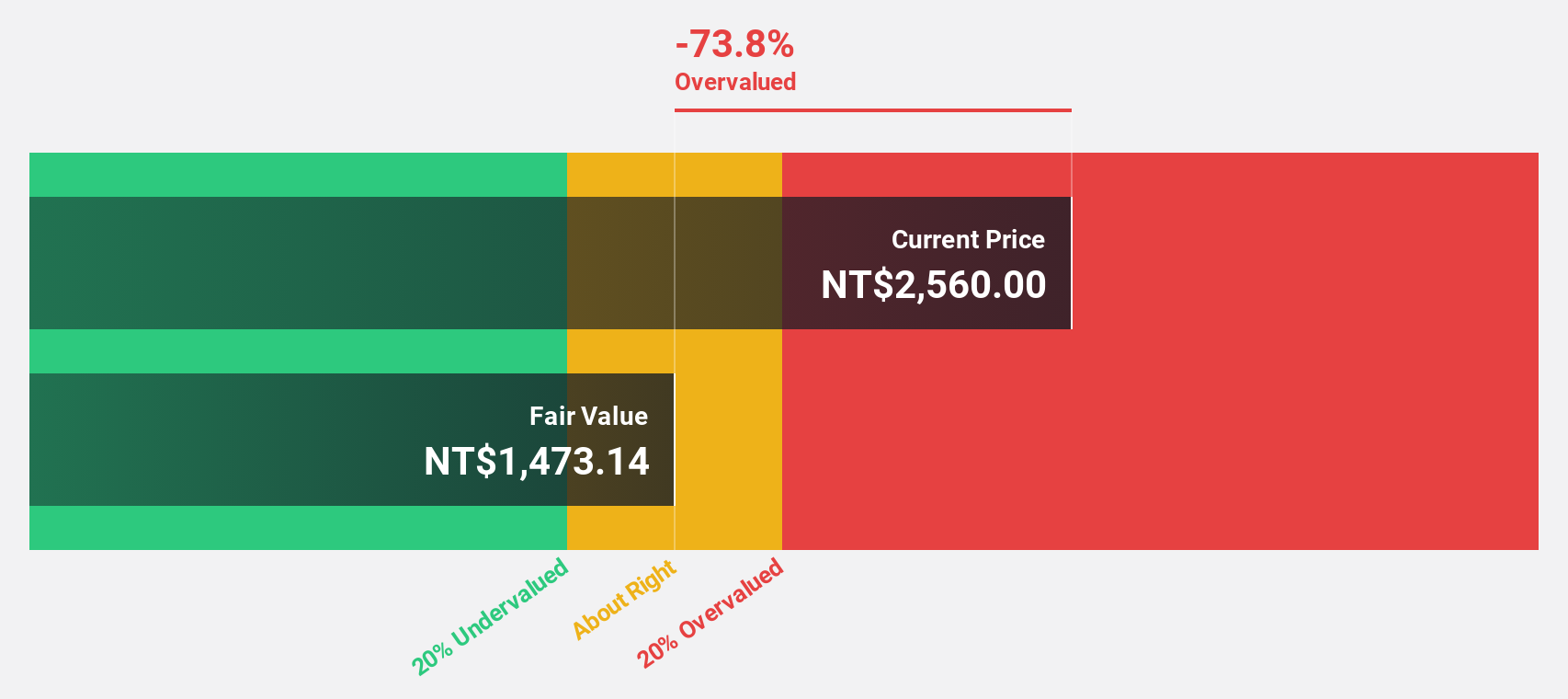

Wiwynn (TWSE:6669)

Overview: Wiwynn Corporation manufactures and sells servers and storage products for cloud infrastructure and hyperscale data centers globally, with a market cap of NT$369.82 billion.

Operations: The company's revenue is derived from its Computer Hardware segment, amounting to NT$258.48 billion.

Estimated Discount To Fair Value: 30%

Wiwynn, trading at NT$1990, is significantly undervalued with a fair value estimate of NT$2842.82. Analysts forecast robust revenue growth of 30.4% annually, outpacing the Taiwan market's 12.3%. Earnings are expected to grow significantly at 25% per year. Recent earnings reports show strong performance with sales rising from TWD 56 billion to TWD 77 billion and net income nearly doubling year-over-year despite past shareholder dilution and a volatile share price.

- Our expertly prepared growth report on Wiwynn implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Wiwynn with our detailed financial health report.

Where To Now?

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 933 more companies for you to explore.Click here to unveil our expertly curated list of 936 Undervalued Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ennoconn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6414

Ennoconn

Manufactures and sells data storage, processing equipment, industrial motherboards, and network communications in Taiwan, China, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives