Exploring Three High Growth Tech Stocks For Potential Expansion

Reviewed by Simply Wall St

Amidst a backdrop of record highs for major U.S. stock indices and optimism surrounding potential AI investments, the global market is experiencing a renewed focus on growth stocks, particularly in the technology sector. As investors navigate these dynamic conditions, identifying high-growth tech stocks with strong fundamentals and innovative capabilities becomes crucial for those seeking to capitalize on potential expansion opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★★☆

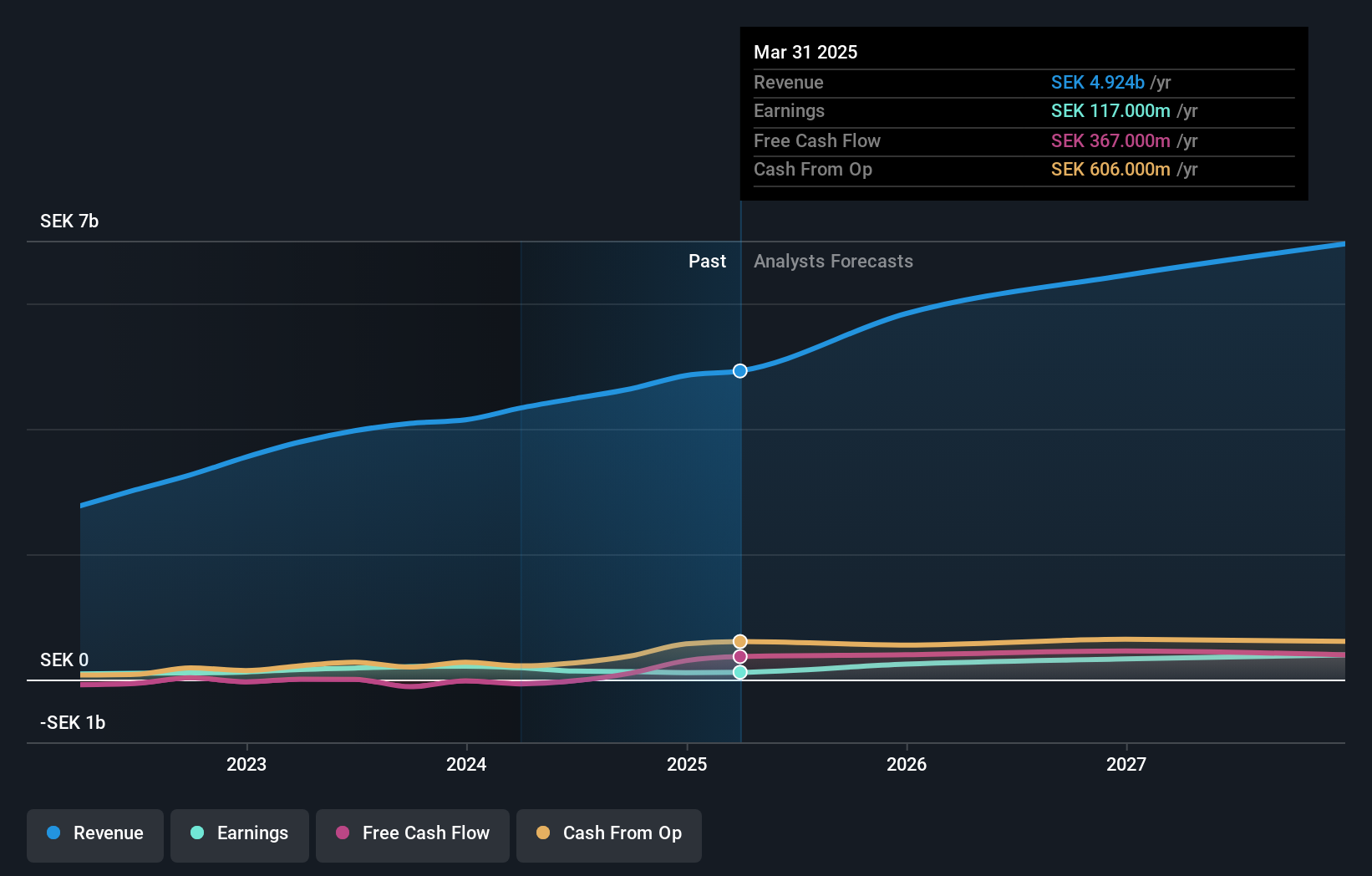

Overview: Hanza AB (publ) offers manufacturing solutions and has a market capitalization of SEK3.49 billion.

Operations: Hanza AB (publ) generates revenue primarily from its Main Markets segment, contributing SEK2.78 billion, and Other Markets segment with SEK1.91 billion. The company also engages in Business Development and Services, adding SEK17 million to its revenue streams.

Despite a challenging economic climate, HANZA has demonstrated resilience and strategic acumen by securing a EUR 1.4 million annual contract to manufacture control cabinets for advanced measurement systems, marking a significant partnership in industries like automotive and aerospace. This move complements their recent expansion into new manufacturing clusters and the strategic bolstering of their management team with key positions aimed at enhancing long-term growth strategies. With an annual revenue growth forecast of 16.3% and an expected earnings surge of 40.9%, HANZA is positioning itself as a robust contender in the tech manufacturing sector, despite current profit margins at 2.7%, down from last year's 5.1%. Their proactive approach in expanding operations and securing high-value contracts showcases their potential to navigate future market dynamics effectively.

- Delve into the full analysis health report here for a deeper understanding of Hanza.

Evaluate Hanza's historical performance by accessing our past performance report.

Ditto (Thailand) (SET:DITTO)

Simply Wall St Growth Rating: ★★★★★☆

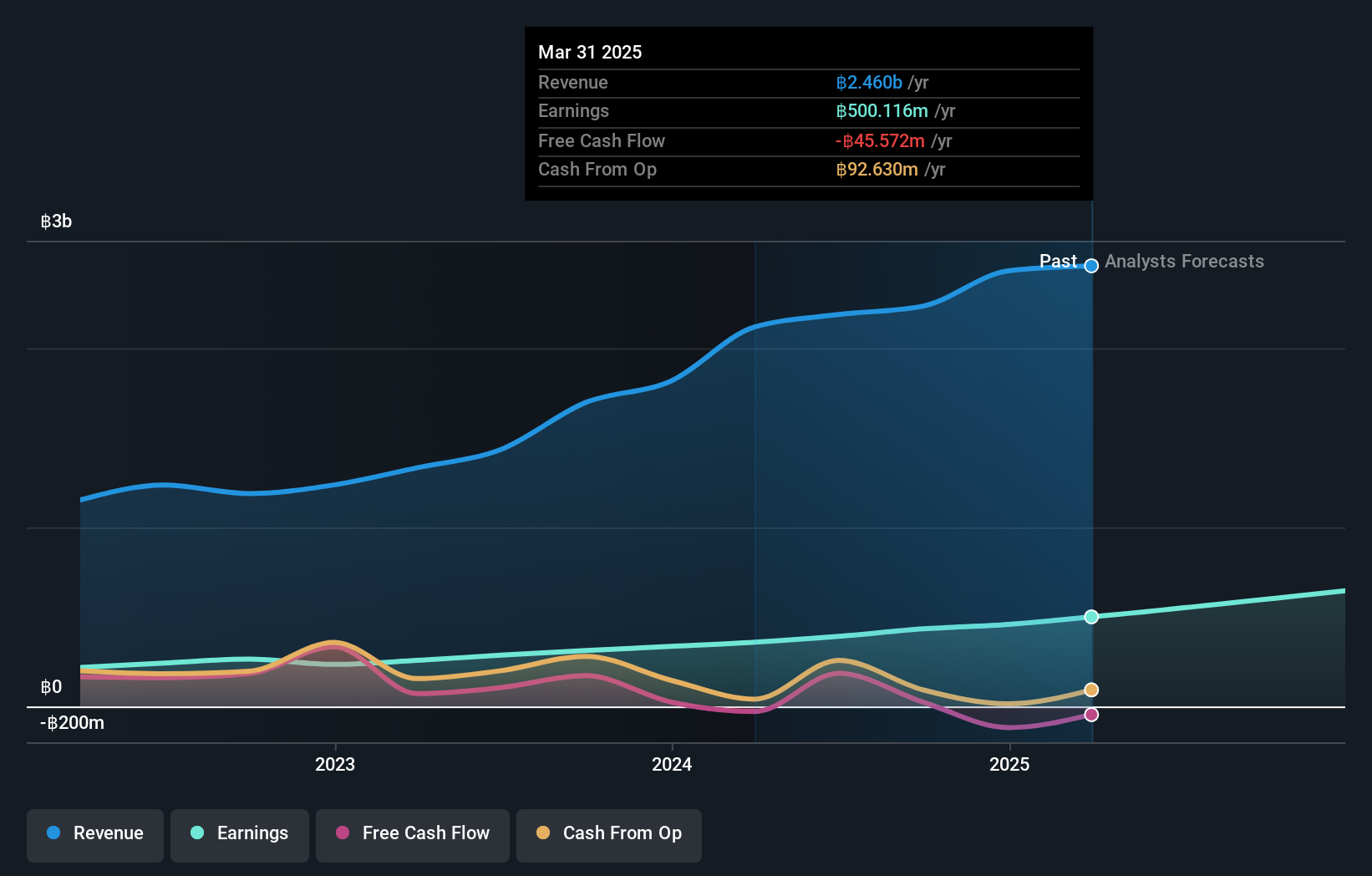

Overview: Ditto (Thailand) Public Company Limited is involved in distributing data and document management solutions in Thailand, with a market capitalization of THB9.99 billion.

Operations: Ditto (Thailand) generates revenue through three main segments: Technology Engineering Services, Data and Document Management Solutions, and Photocopiers, Printer and Technology Products. The largest revenue stream is from Technology Engineering Services at THB1.07 billion.

Ditto (Thailand) has demonstrated robust growth, with a notable increase in sales to THB 1.83 billion and net income reaching THB 368.14 million over nine months, marking year-over-year gains of 29.7% and 36.4%, respectively. This performance is underscored by a solid annual revenue growth rate of 27.8% and earnings expansion at 26.8%. The company's strategic presentations at industry events hint at ongoing initiatives to harness technological advancements, positioning it well within the competitive tech landscape despite its volatile share price in recent months.

Scientech (TWSE:3583)

Simply Wall St Growth Rating: ★★★★★★

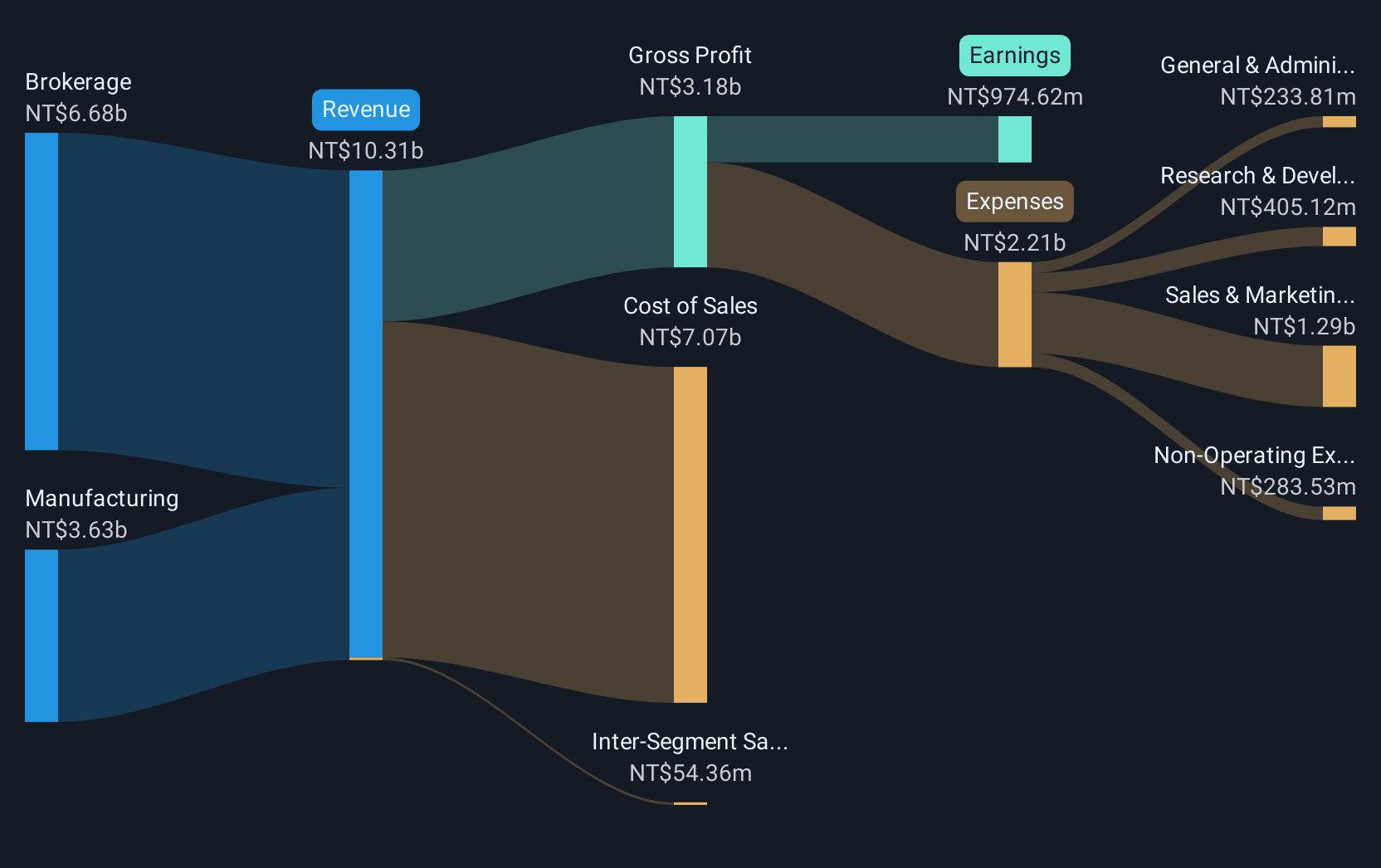

Overview: Scientech Corporation focuses on the R&D, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power generation industries with a market cap of NT$30.28 billion.

Operations: Scientech Corporation generates revenue primarily from its brokerage and manufacturing segments, with NT$6.01 billion and NT$3.10 billion respectively. The company operates in the semiconductor, LCD, LED, and solar power generation sectors.

Scientech has showcased a robust performance with third-quarter sales and revenue soaring by 42.8% and 43.4% respectively, year-over-year, reflecting a strategic uptick in market demand. This growth trajectory is underpinned by an aggressive R&D investment strategy, where the firm consistently allocates substantial resources—evidenced by its latest R&D to revenue ratio of 15%. These investments not only fuel innovation but also strategically position Scientech at the forefront of technological advancements in electronics. With earnings per share escalating from TWD 2.09 to TWD 3 over the past year, coupled with a remarkable annual earnings growth forecast of 50.4%, Scientech is poised for sustained financial health, further cemented by its high-quality earnings profile and positive free cash flow status.

- Dive into the specifics of Scientech here with our thorough health report.

Gain insights into Scientech's historical performance by reviewing our past performance report.

Taking Advantage

- Delve into our full catalog of 1230 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanza might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HANZA

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives