- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3530

Silicon Optronics (TWSE:3530) surges 13% this week, taking one-year gains to 58%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Silicon Optronics, Inc. (TWSE:3530) share price is up 58% in the last 1 year, clearly besting the market return of around 20% (not including dividends). So that should have shareholders smiling. Having said that, the longer term returns aren't so impressive, with stock gaining just 22% in three years.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Silicon Optronics

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months Silicon Optronics went from profitable to unprofitable. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. It may be that the company has done well on other metrics.

Silicon Optronics' revenue actually dropped 34% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

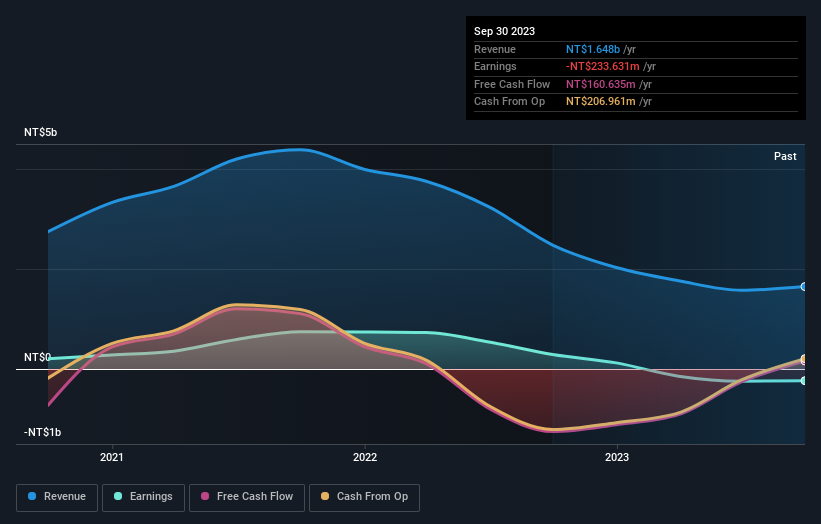

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Silicon Optronics' financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Silicon Optronics shareholders have received a total shareholder return of 58% over one year. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Silicon Optronics you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3530

Silicon Optronics

Designs, develops, and sells CMOS image sensors in Taiwan, Hong Kong, China, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives