- Taiwan

- /

- Tech Hardware

- /

- TWSE:6669

High Growth Tech Stocks Leading The Future

Reviewed by Simply Wall St

In the wake of recent global market developments, U.S. stocks have rallied to record highs, driven by optimism around potential growth and tax reforms following a significant political shift. The small-cap Russell 2000 Index has notably surged, highlighting investor interest in high-growth opportunities within the tech sector. In such an environment, a strong stock is often characterized by robust earnings potential and innovative capabilities that can thrive amidst regulatory changes and economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1283 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

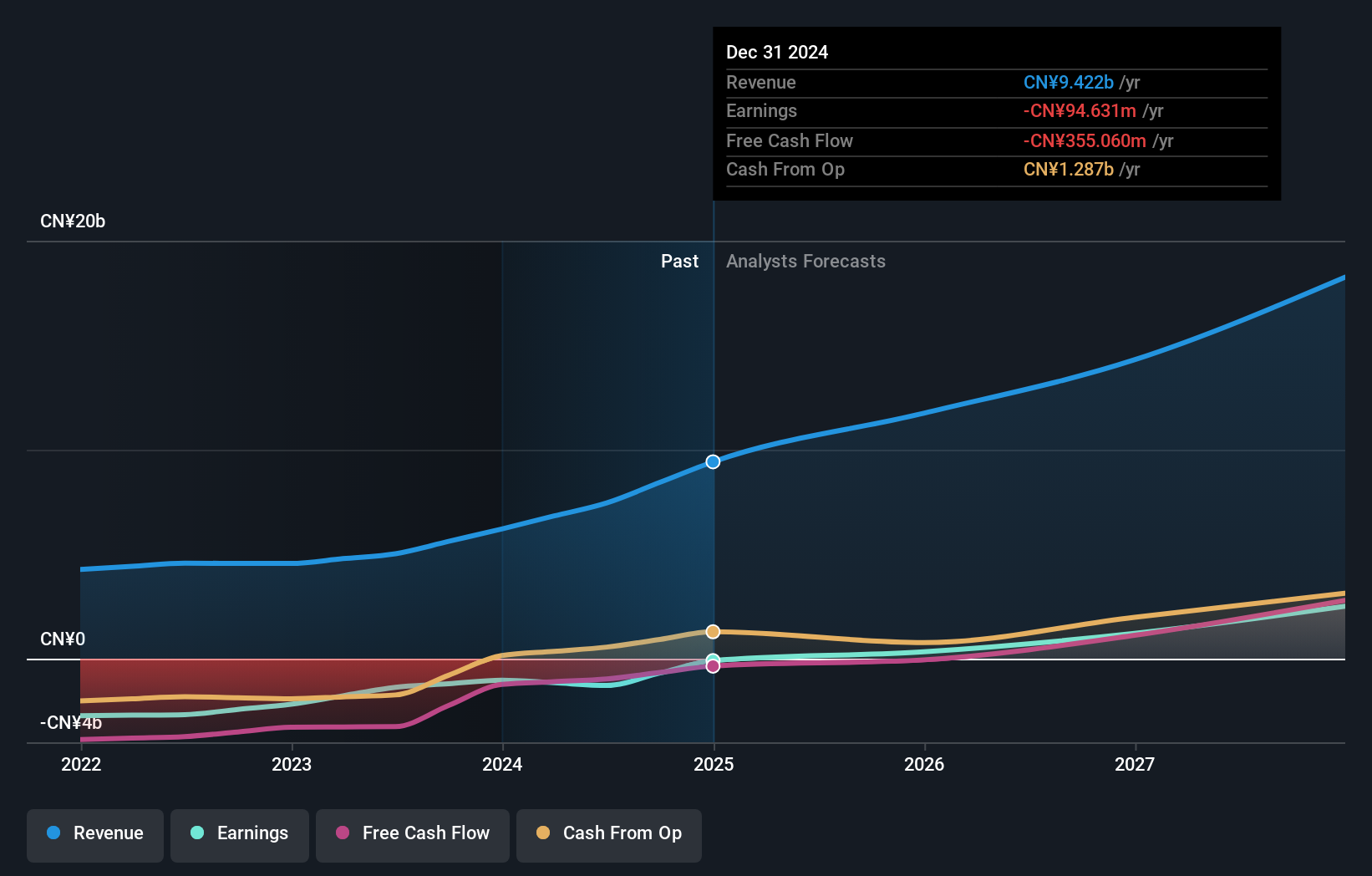

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that develops and commercializes monoclonal antibodies and other drug assets across various therapeutic areas including oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in China, with a market cap of approximately HK$63.54 billion.

Operations: Innovent Biologics focuses on developing and commercializing monoclonal antibodies in China, generating revenue primarily from its biotechnology segment, which totals CN¥7.46 billion.

Innovent Biologics is navigating a transformative phase with robust forecasts indicating a 58.74% annual growth in earnings and an above-market revenue increase of 22% per year. This growth trajectory is underpinned by significant R&D investments, which are crucial as the company ramps up its biotechnological innovations. Recent strategic moves include the acquisition of exclusive commercialization rights for limertinib in China, showing potential to capture substantial market share in lung cancer treatments. Moreover, their active participation in key industry conferences and recent NDA approvals underscore their proactive approach in expanding their biologics portfolio and enhancing global visibility.

Wistron (TWSE:3231)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wistron Corporation, along with its subsidiaries, is engaged in the design, manufacture, and sale of information technology products across Taiwan, Asia, and globally; it has a market capitalization of approximately NT$354.51 billion.

Operations: The company primarily generates revenue through its Research and Development and Manufacturing Services Operations, amounting to approximately NT$890.35 billion.

Wistron's recent leap in earnings, growing by 42.6% over the past year, aligns with its strategic advancements in AI and technology infrastructure. The company's commitment to innovation is evident from its R&D expenses, which have surged to 15% of revenue, supporting projects like Taiwan's first Hyperscale AI Data Center in partnership with Zettabyte. This initiative not only enhances Wistron's product offerings but also positions it as a pivotal player in Asia Pacific’s tech expansion, expected to significantly influence the region’s AI capabilities and economic landscape.

- Click here and access our complete health analysis report to understand the dynamics of Wistron.

Understand Wistron's track record by examining our Past report.

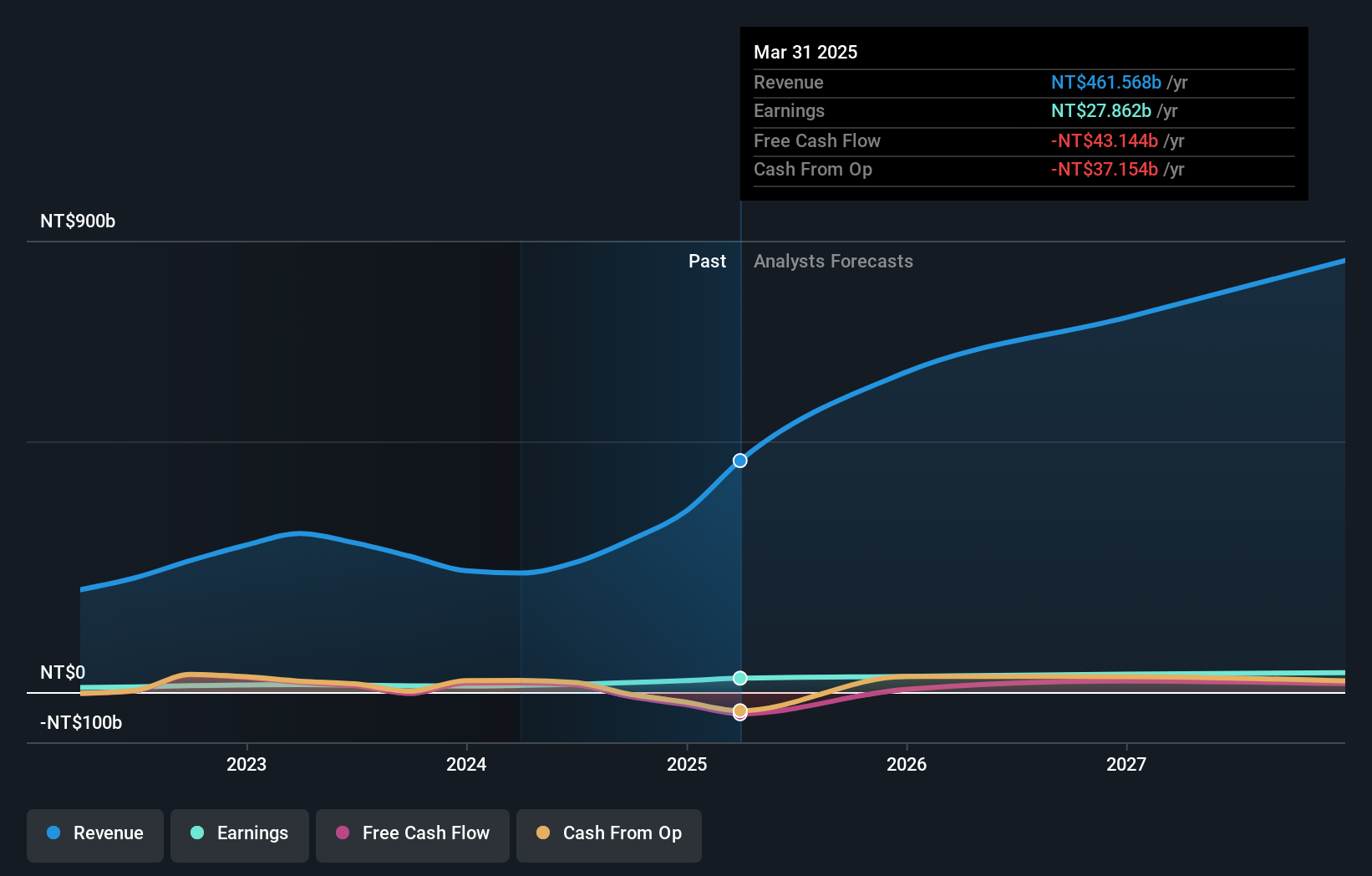

Wiwynn (TWSE:6669)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wiwynn Corporation specializes in manufacturing and selling servers and storage products for cloud infrastructure and hyperscale data centers globally, with a market cap of NT$382.83 billion.

Operations: The company generates revenue primarily from the computer hardware segment, amounting to NT$258.48 billion.

Wiwynn's trajectory in the tech sector is underscored by its robust revenue growth, projected at 30.4% annually, outpacing the broader TW market's 12.7%. This surge is anchored in strategic R&D investments which now represent a substantial 25% of its revenue, fueling developments that keep it competitive. Despite a highly volatile share price recently, Wiwynn's forward-looking initiatives were highlighted at the recent OCP Global Summit, signaling ongoing innovation and market adaptability. These efforts are anticipated to bolster its standing in global tech markets, leveraging advanced technologies to meet escalating demands.

- Click here to discover the nuances of Wiwynn with our detailed analytical health report.

Gain insights into Wiwynn's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 1283 High Growth Tech and AI Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wiwynn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6669

Wiwynn

Manufactures and sells servers and storage products in cloud infrastructure and hyperscale data center in the United States, Europe, Asia, and internationally.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives