- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

High Growth Tech Stocks in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets experience a boost from favorable trade deals, with indices like the S&P 500 and Nasdaq reaching record highs, Asian tech stocks are drawing attention amid hopes for continued stabilization in U.S.-China relations. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate innovation and resilience in adapting to evolving market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.23% | 29.66% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| PharmaResearch | 27.32% | 30.59% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 27.79% | 111.80% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. is a company based in the People’s Republic of China that focuses on developing, manufacturing, and commercializing vaccines, with a market cap of approximately HK$16.29 billion.

Operations: The company generates revenue primarily from the research and development of vaccine products for human use, amounting to CN¥869.22 million.

CanSino Biologics, amidst a robust Asian biotech landscape, is harnessing innovative technologies to propel its growth. The company's recent approval to initiate clinical trials for its non-infectious polio vaccine underscores its commitment to pioneering safer immunization methods. This development complements their existing portfolio, which includes the newly approved 13-valent Pneumococcal Conjugate Vaccine, illustrating CanSino's strategic expansion in preventive healthcare. Financially, while currently unprofitable with a net loss of CNY 11.55 million in Q1 2025 significantly lower than the previous year's CNY 170.1 million loss, the forecasted annual revenue growth of 26.1% and earnings spike of 107.46% signal potential turnaround within three years. These advancements are critical as they navigate through stringent regulatory environments and escalating market demands in high-growth sectors like vaccines and biologics.

- Click to explore a detailed breakdown of our findings in CanSino Biologics' health report.

Understand CanSino Biologics' track record by examining our Past report.

Taiyo Yuden (TSE:6976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiyo Yuden Co., Ltd. is engaged in the development, manufacturing, and sale of electronic components across Japan, China, Hong Kong, and other international markets with a market cap of ¥351.75 billion.

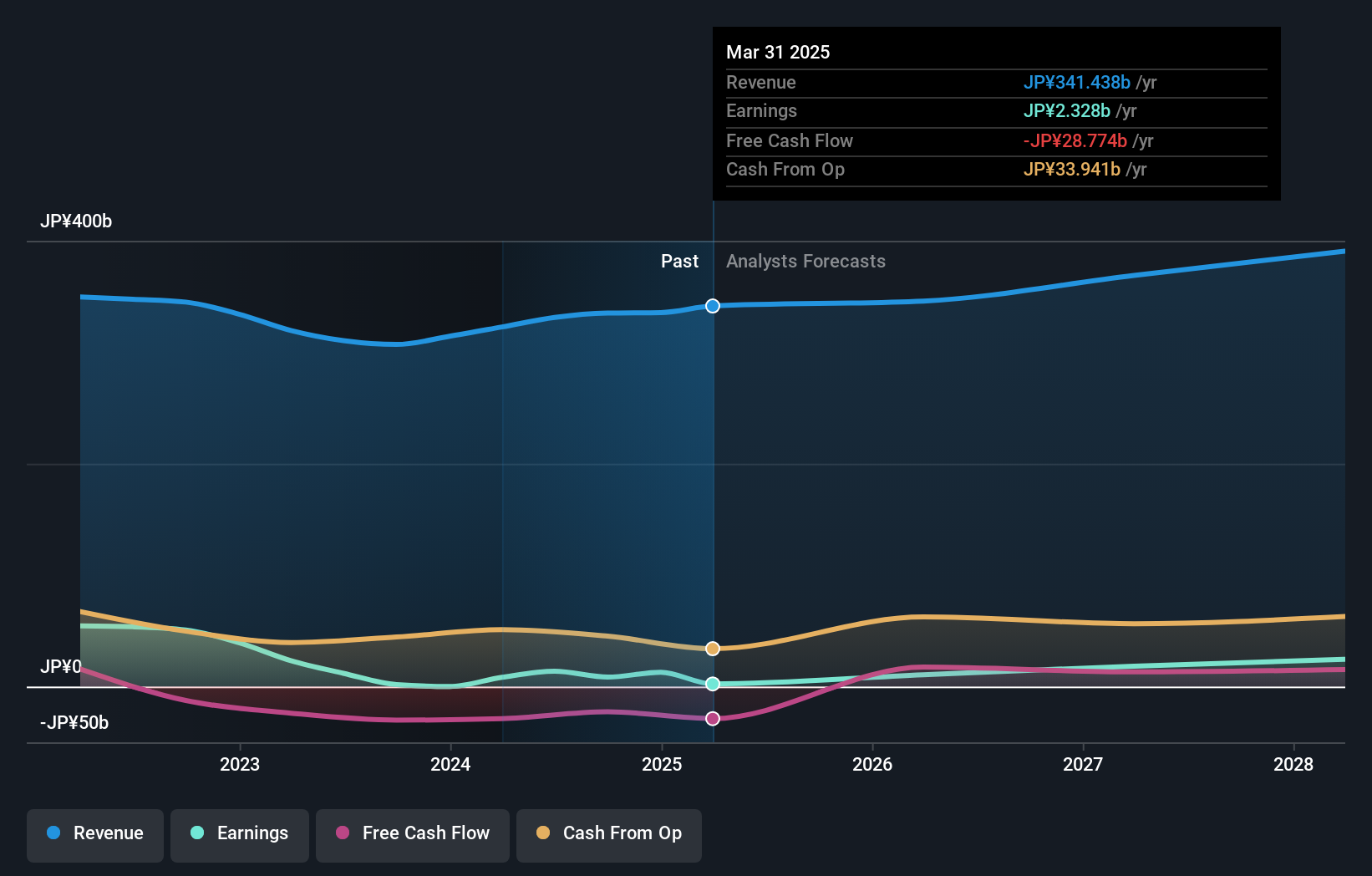

Operations: The company generates revenue primarily from its Electronic Components Business, amounting to ¥341.44 billion. Its operations span various international markets, focusing on the development and sale of electronic components.

Taiyo Yuden, a pivotal figure in the Asian tech scene, is capitalizing on the robust demand for automotive electronics with its innovative LCQPB series power inductors, crucial for miniaturizing power supply circuits. Despite a challenging fiscal year with revised earnings guidance projecting net sales at JPY 341.44 billion and operating profit at JPY 10.46 billion, their strategic focus on high-quality automotive components positions them well within this niche market. With an expected annual profit growth of 35% and revenue growth pacing at 4.6%, Taiyo Yuden's recent product launches and operational adjustments suggest a resilient adaptation to market needs, underscored by their active participation in key tech expos like COMPUTEX Taipei.

- Click here to discover the nuances of Taiyo Yuden with our detailed analytical health report.

Evaluate Taiyo Yuden's historical performance by accessing our past performance report.

Wistron (TWSE:3231)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wistron Corporation, along with its subsidiaries, is involved in the design, manufacture, and sale of information technology products across the United States, Europe, China, and other international markets with a market capitalization of NT$347.31 billion.

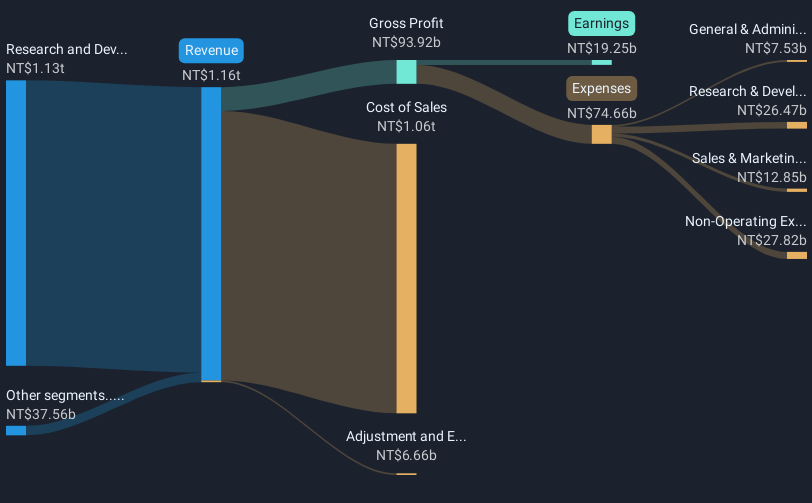

Operations: The company primarily generates revenue from its Research and Development and Manufacturing Services Operations, amounting to NT$1.13 trillion. This segment plays a significant role in its business model, reflecting the company's focus on providing comprehensive IT solutions across various international markets.

Wistron's strategic maneuvers in expanding operations, like the recent $48.85 million acquisition of a factory and land, underscore its commitment to growth amidst a dynamic tech landscape. This move complements their robust financial performance with first-quarter sales surging to TWD 346.49 billion, up from TWD 239.33 billion year-over-year, and net income increasing to TWD 5.33 billion. The establishment of Wistron Ventures Corporation with an investment of TWD 3.5 billion further highlights their proactive approach in scaling innovation and securing competitive advantages in high-growth sectors.

Make It Happen

- Investigate our full lineup of 478 Asian High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiyo Yuden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives