- Saudi Arabia

- /

- IT

- /

- SASE:9543

Discover 3 Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

In a week marked by volatile earnings reports and mixed economic signals, global markets have shown a cautious stance, with major indices like the Nasdaq Composite and S&P 500 experiencing fluctuations. As investors navigate this complex landscape, dividend stocks emerge as an attractive option for those seeking stability and income amidst uncertainty. A good dividend stock typically offers a reliable payout history and strong fundamentals, making it a potential cornerstone for any portfolio in today's unpredictable market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.72% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.87% | ★★★★★★ |

| Innotech (TSE:9880) | 4.76% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 2002 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

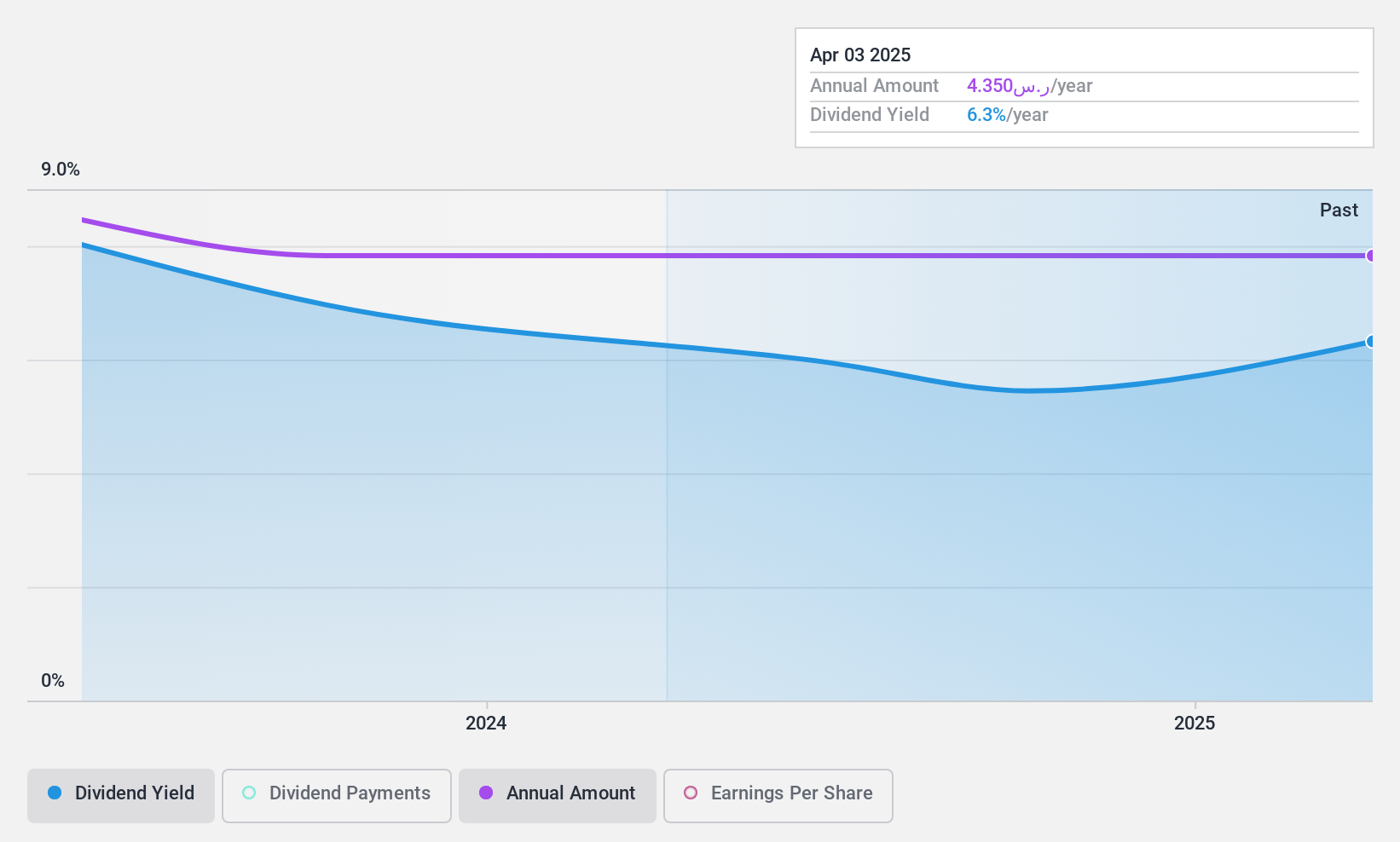

Saudi Networkers Services (SASE:9543)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saudi Networkers Services Company operates in the Kingdom of Saudi Arabia, focusing on implementing, establishing, maintaining, operating, installing, and managing telecommunication networks with a market cap of SAR437.40 million.

Operations: Saudi Networkers Services Company's revenue segment includes Computer Services, generating SAR560.41 million.

Dividend Yield: 5.7%

Saudi Networkers Services offers a compelling dividend yield of 5.72%, placing it in the top quartile of Saudi Arabian dividend payers. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 64.5% and 65.9%, respectively, though its dividend history is less than a decade old. Recent earnings growth of SAR 19.74 million underscores robust financial health, supporting continued dividend payments despite limited historical stability.

- Get an in-depth perspective on Saudi Networkers Services' performance by reading our dividend report here.

- Our valuation report unveils the possibility Saudi Networkers Services' shares may be trading at a discount.

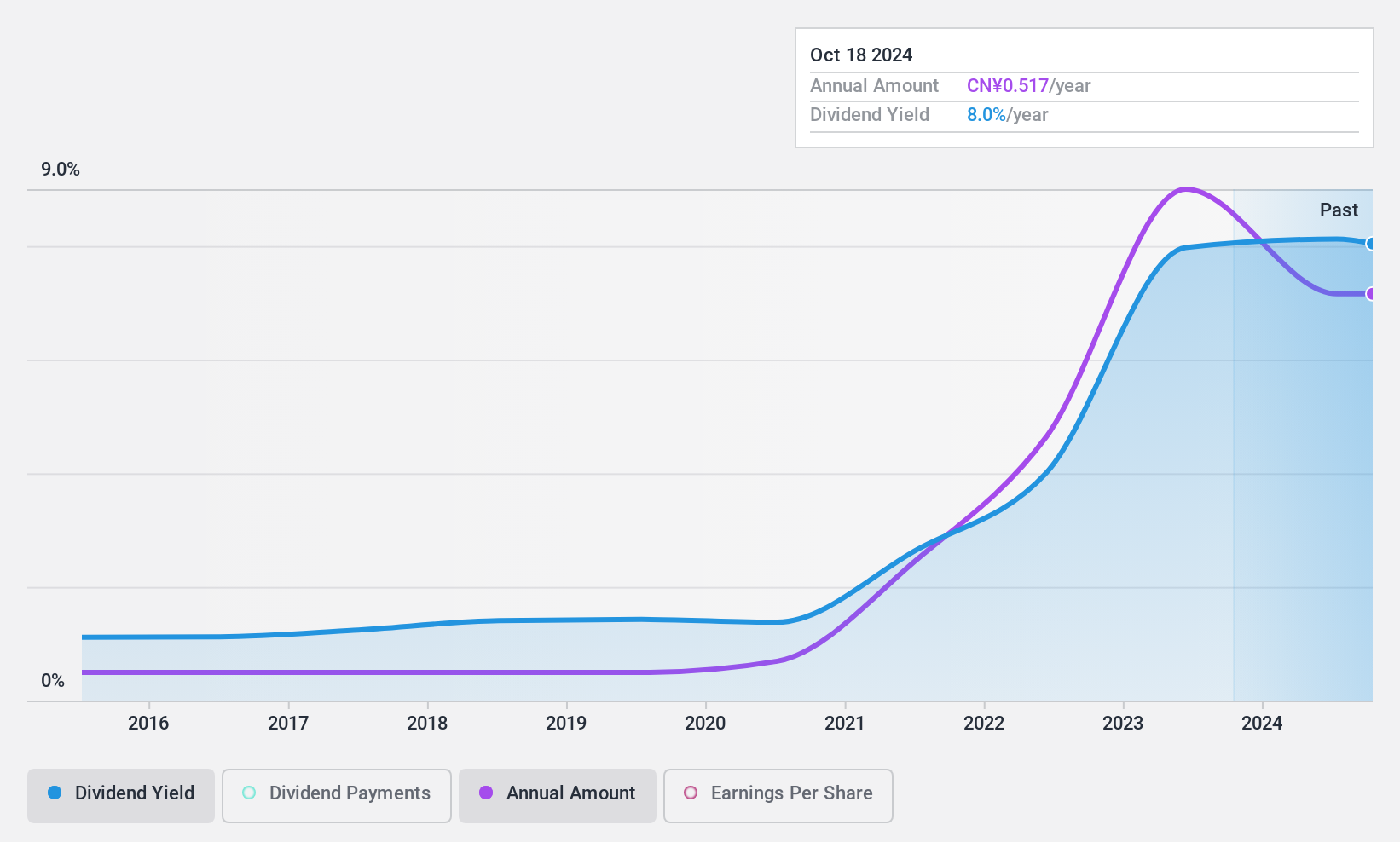

Sichuan Road & Bridge GroupLtd (SHSE:600039)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sichuan Road & Bridge Group Co., Ltd operates in the investment, development, construction, and operation of engineering construction, mining, clean energy, and new materials both in China and internationally with a market cap of CN¥66.65 billion.

Operations: Sichuan Road & Bridge Group Co., Ltd generates revenue from its core activities in engineering construction, mining, clean energy, and new materials across domestic and international markets.

Dividend Yield: 6.7%

Sichuan Road & Bridge Group Ltd. offers a dividend yield of 6.67%, ranking it in the top 25% of Chinese dividend payers, though its dividends are not covered by free cash flows. The company maintains stable and growing dividends over the past decade, yet faces challenges with high payout ratios and declining earnings, as net income fell to CNY 4.77 billion for the recent nine months from CNY 7.75 billion last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Sichuan Road & Bridge GroupLtd.

- The analysis detailed in our Sichuan Road & Bridge GroupLtd valuation report hints at an deflated share price compared to its estimated value.

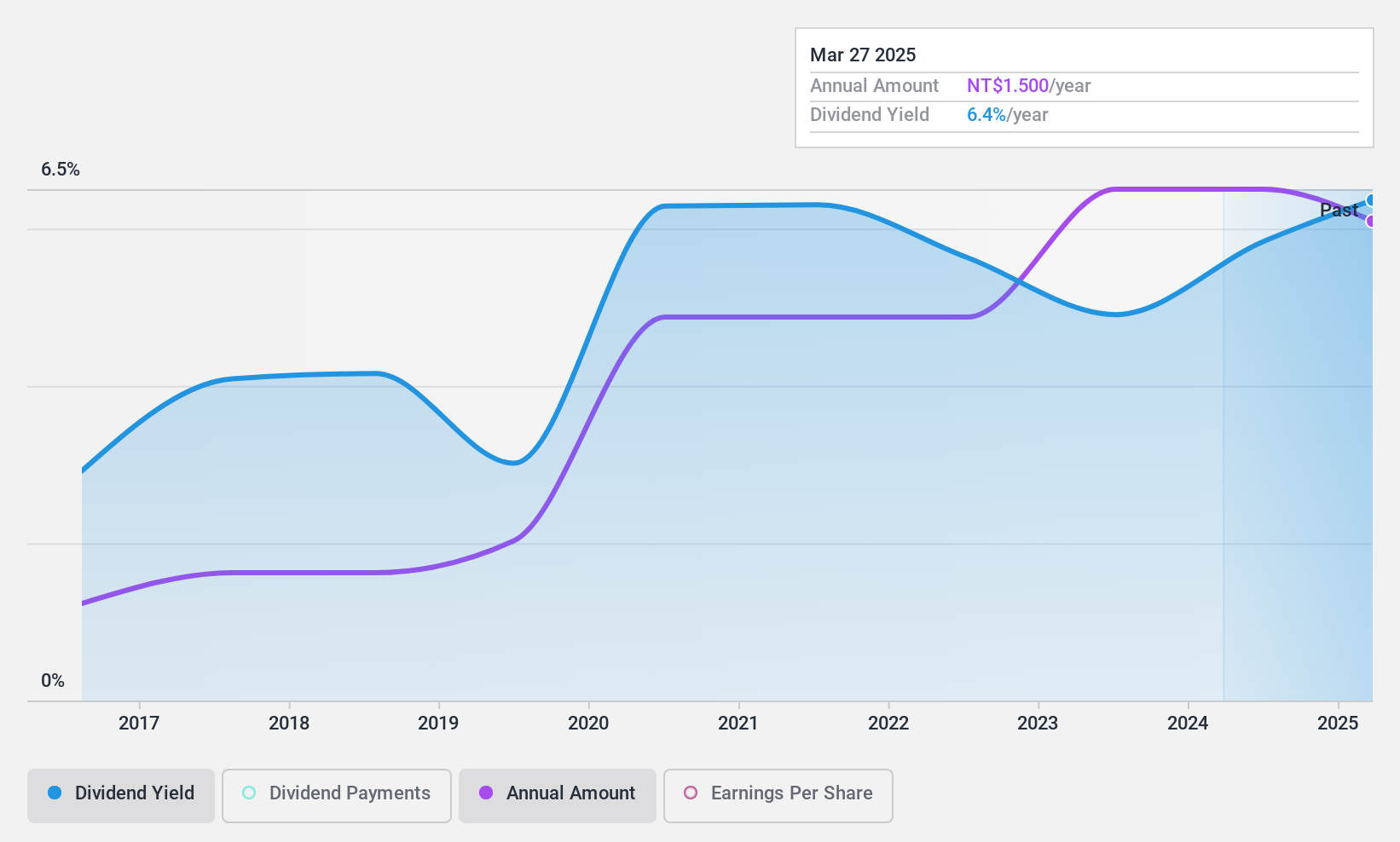

Emerging Display Technologies (TWSE:3038)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Emerging Display Technologies Corp. is a company that produces and sells capacitive touch panels and liquid crystal displays (LCD) across Taiwan, Europe, the United States, and internationally with a market cap of NT$3.86 billion.

Operations: Emerging Display Technologies Corp.'s revenue is derived from the Americas Business Unit (NT$1.39 billion), Taiwan Regional Division (NT$3.95 billion), and Mainland District Business Unit (NT$422.49 million).

Dividend Yield: 5.9%

Emerging Display Technologies Corp. offers a dividend yield of 5.94%, placing it among the top 25% in Taiwan, with dividends reliably covered by earnings and cash flows (payout ratio: 58.9%, cash payout ratio: 63.5%). Despite stable and growing dividends over the past decade, the company faces declining earnings forecasts, as evidenced by reduced sales (TWD 938.9 million) and net income (TWD 85.41 million) in Q2 compared to last year’s figures.

- Unlock comprehensive insights into our analysis of Emerging Display Technologies stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Emerging Display Technologies is priced higher than what may be justified by its financials.

Where To Now?

- Access the full spectrum of 2002 Top Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9543

Saudi Networkers Services

Engages in the implementing, establishing, maintaining, operating, installing, and managing of telecommunication networks in the Kingdom of Saudi Arabia.

Outstanding track record with excellent balance sheet and pays a dividend.