- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A020150

High Growth Tech Stocks In Asia With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious investor sentiment and mixed economic signals, the Asian tech sector stands out as a dynamic area with potential for significant growth. In this environment, identifying promising stocks requires an understanding of key factors such as innovation, market adaptability, and resilience in the face of economic uncertainties.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.74% | 33.49% | ★★★★★★ |

| Zhongji Innolight | 28.47% | 28.81% | ★★★★★★ |

| Fositek | 31.39% | 36.95% | ★★★★★★ |

| Xi'an NovaStar Tech | 29.59% | 34.21% | ★★★★★★ |

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

We'll examine a selection from our screener results.

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

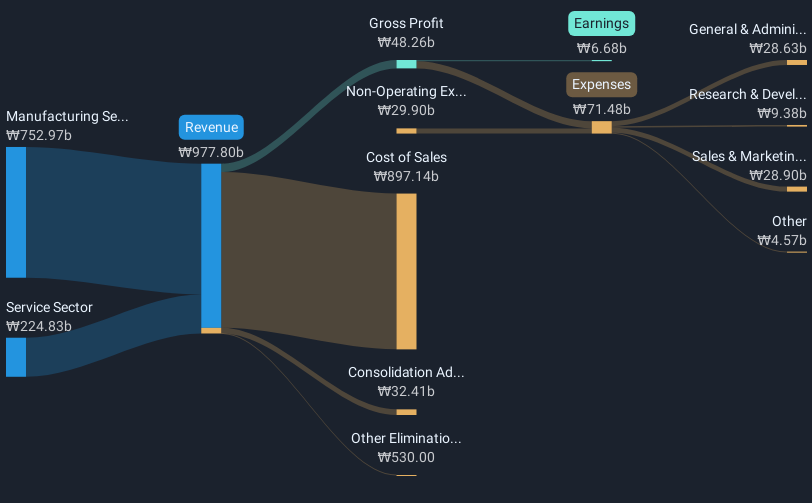

Overview: Lotte Energy Materials Corporation is engaged in the production and sale of elecfoils both domestically in Korea and internationally, with a market capitalization of ₩1.36 trillion.

Operations: Lotte Energy Materials Corporation focuses on the production and sale of elecfoils, catering to both domestic and international markets. The company operates with a market capitalization of approximately ₩1.36 trillion.

Lotte Energy Materials has shown a robust trajectory, with its revenue expected to grow by 16.1% annually, outpacing the Korean market's average of 8.2%. This growth is complemented by an impressive forecast in earnings increase at 62.2% per year, significantly higher than the market's 23.3%. Despite challenges like a one-off loss of ₩7.7 billion last year affecting financial results, the firm has transitioned into profitability recently, which marks a pivotal turn in its operational efficiency and market positioning. These factors collectively underscore Lotte Energy Materials' potential within Asia's high-growth tech sector despite some financial inconsistencies and a low projected return on equity of just 2.5% over three years.

- Delve into the full analysis health report here for a deeper understanding of Lotte Energy Materials.

Understand Lotte Energy Materials' track record by examining our Past report.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

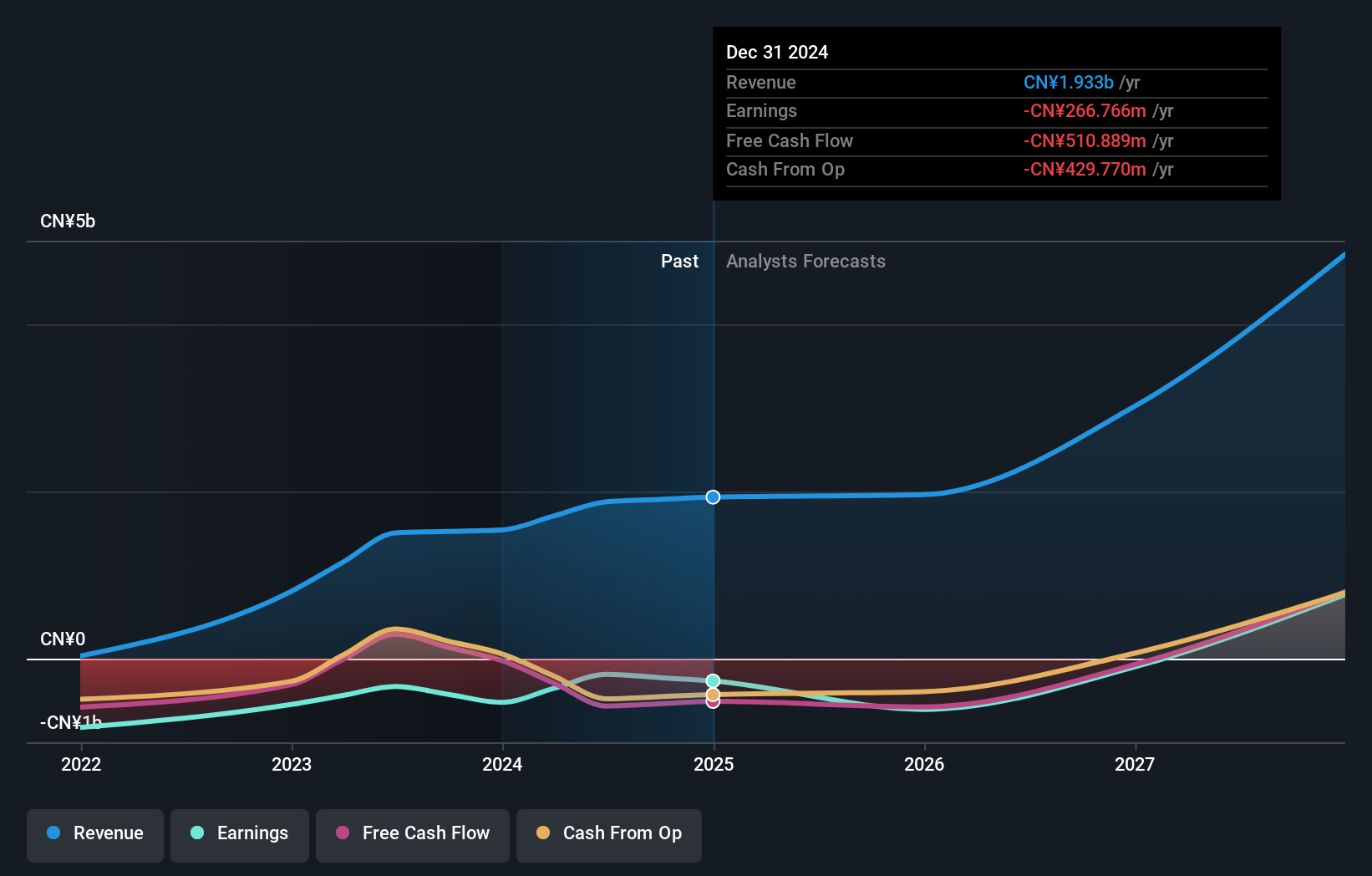

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to meet unmet medical needs in China and globally, with a market cap of approximately HK$59.09 billion.

Operations: Kelun-Biotech focuses on the development and commercialization of innovative pharmaceuticals, generating revenue primarily from its pharmaceutical segment, which reported CN¥1.88 billion.

Sichuan Kelun-Biotech Biopharmaceutical has recently made significant strides in the biotech sector, notably with its TROP2-directed ADC, sac-TMT, now approved for treating advanced lung cancer—a first globally. This innovation not only extends survival benefits significantly compared to standard care but also marks a pivotal development in targeted cancer therapy. Financially, the company's R&D investment has robustly supported these advancements; last year alone, R&D expenses constituted 15% of their total revenue. With ongoing Phase III trials and new drug applications underway, Sichuan Kelun-Biotech is poised to impact both market dynamics and patient care profoundly.

Unimicron Technology (TWSE:3037)

Simply Wall St Growth Rating: ★★★★☆☆

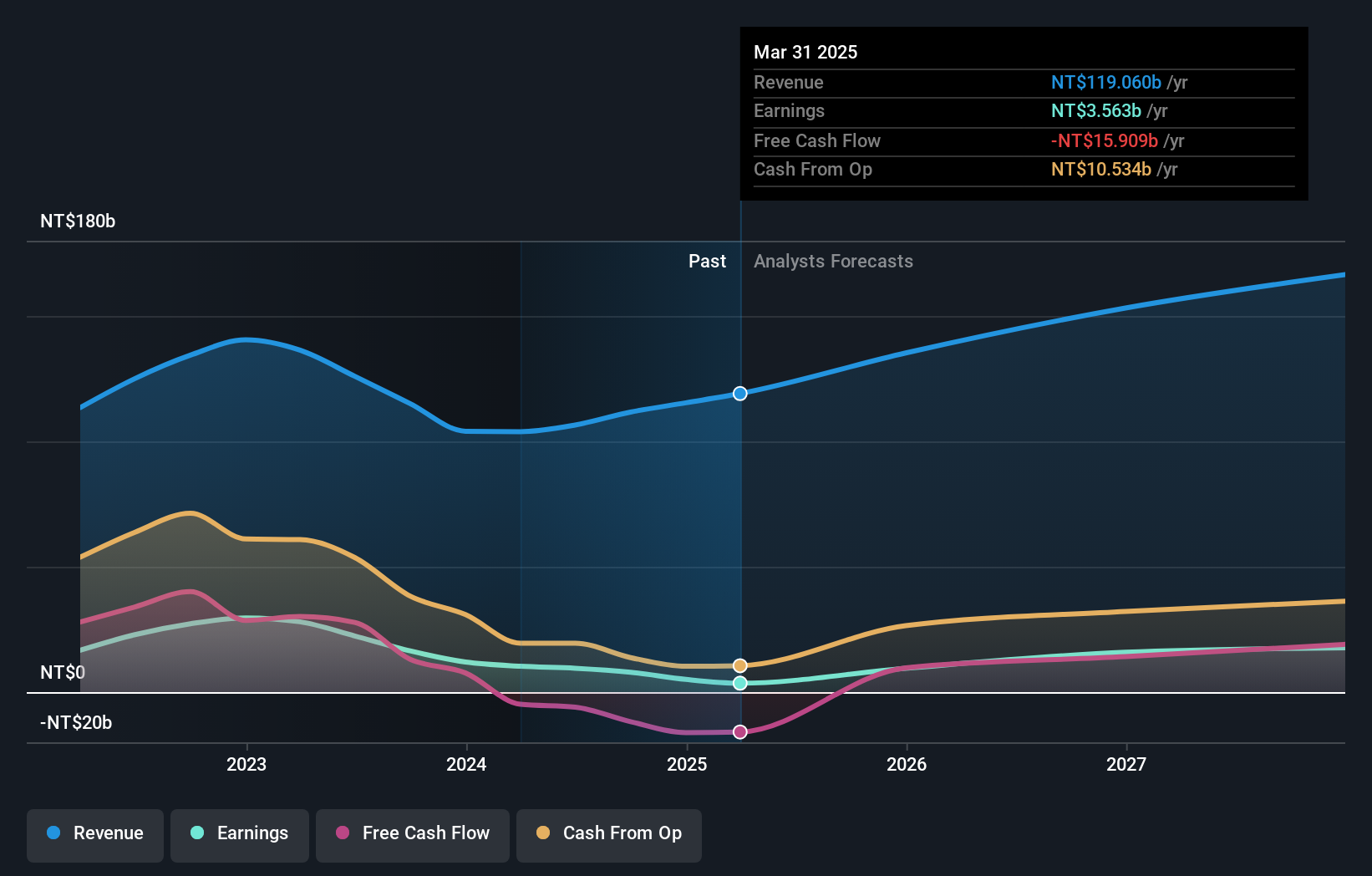

Overview: Unimicron Technology Corp. is involved in the development, manufacturing, processing, and sale of printed circuit boards and electronic products globally, with a market capitalization of NT$168.16 billion.

Operations: The company focuses on the production and sale of printed circuit boards, electrical equipment, electronic products, and testing systems for integrated circuits globally. Its revenue is primarily derived from Taiwan (NT$80.07 billion) and Mainland China (NT$47.36 billion).

Unimicron Technology, amidst a challenging year with a significant 57.6% drop in earnings, still demonstrates resilience with anticipated robust growth. The company's R&D commitment is evident as expenses are strategically allocated to foster innovation—critical for staying competitive in the fast-evolving tech landscape of Asia. Despite recent executive changes and a dip in net income to TWD 5.08 billion from TWD 11.98 billion, the firm's revenue growth projection at 13.7% annually outpaces Taiwan's market average of 10.1%. This positions Unimicron well for future recovery and growth, leveraging its strategic initiatives and market responsiveness.

- Take a closer look at Unimicron Technology's potential here in our health report.

Explore historical data to track Unimicron Technology's performance over time in our Past section.

Turning Ideas Into Actions

- Dive into all 510 of the Asian High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A020150

Lotte Energy Materials

Produces and sells elecfoils in Korea and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)