- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3037

High Growth Tech Stocks in Asia to Watch October 2025

Reviewed by Simply Wall St

As the Asian markets navigate a landscape marked by renewed U.S.-China trade tensions and fluctuating global economic indicators, investors are keenly observing the performance of high-growth tech stocks in the region. In such an environment, companies that demonstrate robust innovation capabilities and adaptability to geopolitical shifts stand out as potential opportunities for those looking to capitalize on technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.55% | 27.95% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

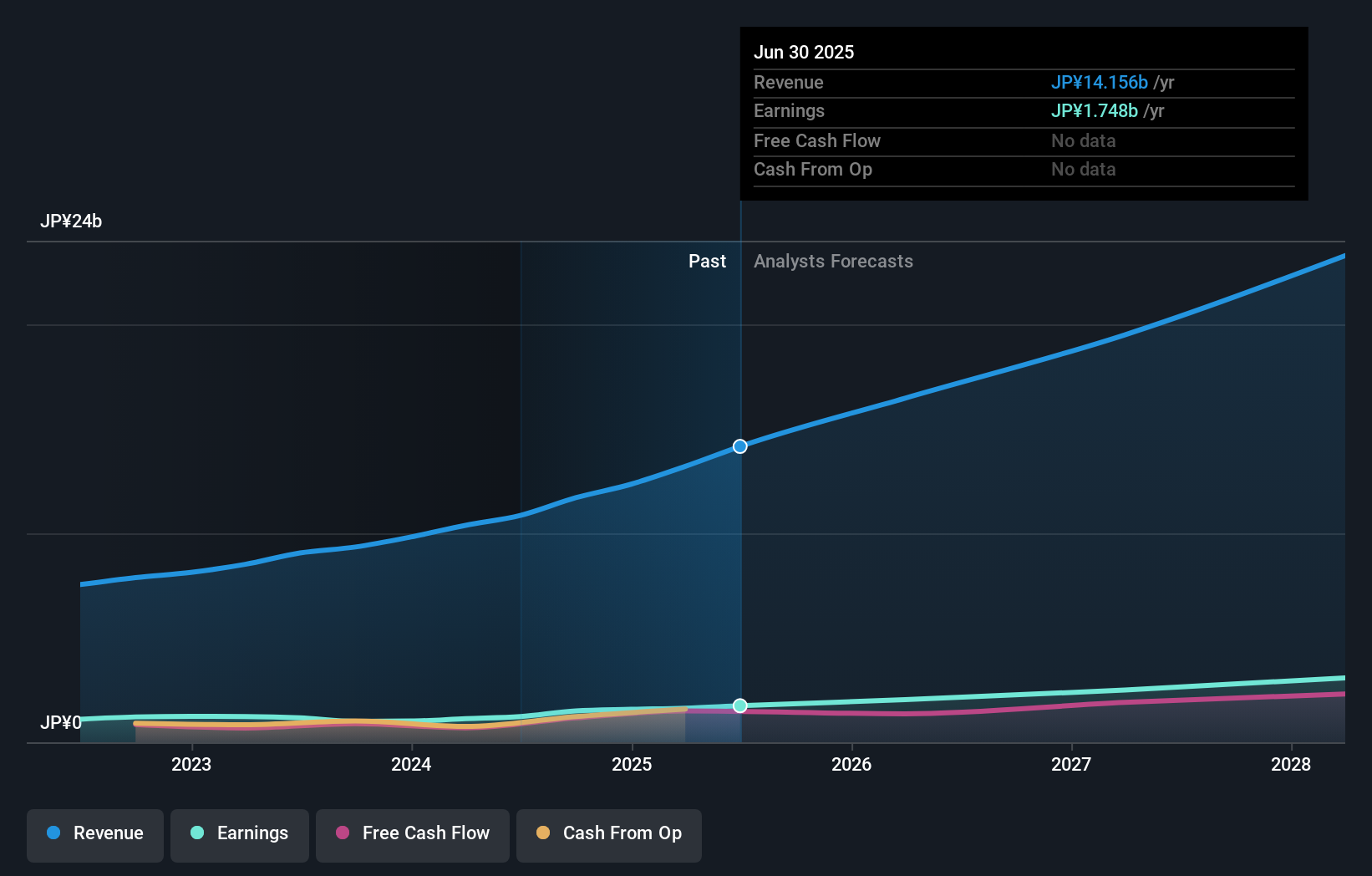

ULS Group (TSE:3798)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ULS Group, Inc. is a Japanese company specializing in IT consulting and solutions, with a market capitalization of ¥44.94 billion.

Operations: The company generates revenue primarily from its Consulting Business, which accounts for ¥14.16 billion.

ULS Group's recent inclusion in the S&P Global BMI Index underscores its growing influence in the tech sector, particularly after a robust 41.8% earnings growth over the past year. The company's commitment to innovation is evident from its R&D spending, which consistently aligns with industry demands for cutting-edge technology solutions. With revenue and earnings forecasted to grow at 18% and 20.7% annually, ULS is outpacing both the Japanese market and broader IT industry averages of 4.4% and 8.1%, respectively. Moreover, a strategic stock split indicates management's confidence in sustained future growth, positioning ULS well within Asia’s competitive high-tech landscape.

- Delve into the full analysis health report here for a deeper understanding of ULS Group.

Gain insights into ULS Group's past trends and performance with our Past report.

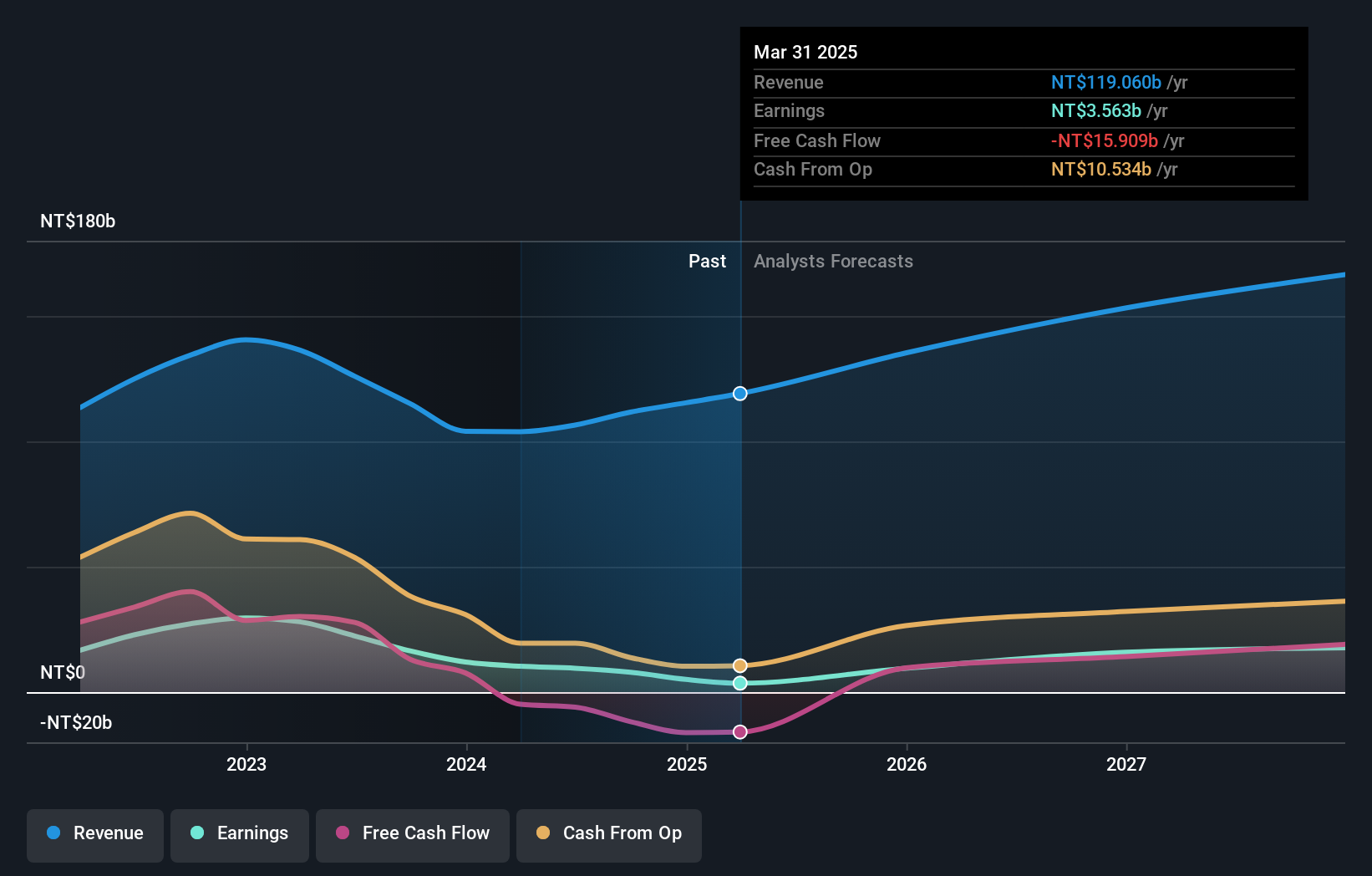

Unimicron Technology (TWSE:3037)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Unimicron Technology Corp. specializes in the development, manufacturing, processing, and sale of printed circuit boards and electronic products globally, with a market capitalization of NT$253 billion.

Operations: The company generates revenue primarily from Taiwan and Mainland China, with figures of NT$87.78 billion and NT$50.33 billion, respectively.

Despite recent setbacks, Unimicron Technology's strategic focus on innovation is evident in its robust R&D expenditure, aligning with the broader industry's push towards advanced tech solutions. With sales reaching TWD 62.56 billion and a notable revenue increase of 12.7% year-over-year, the company is poised for recovery. However, a sharp decline in net income highlights challenges ahead. As it navigates these waters, its commitment to research could play a pivotal role in maintaining competitiveness within Asia’s high-growth tech landscape.

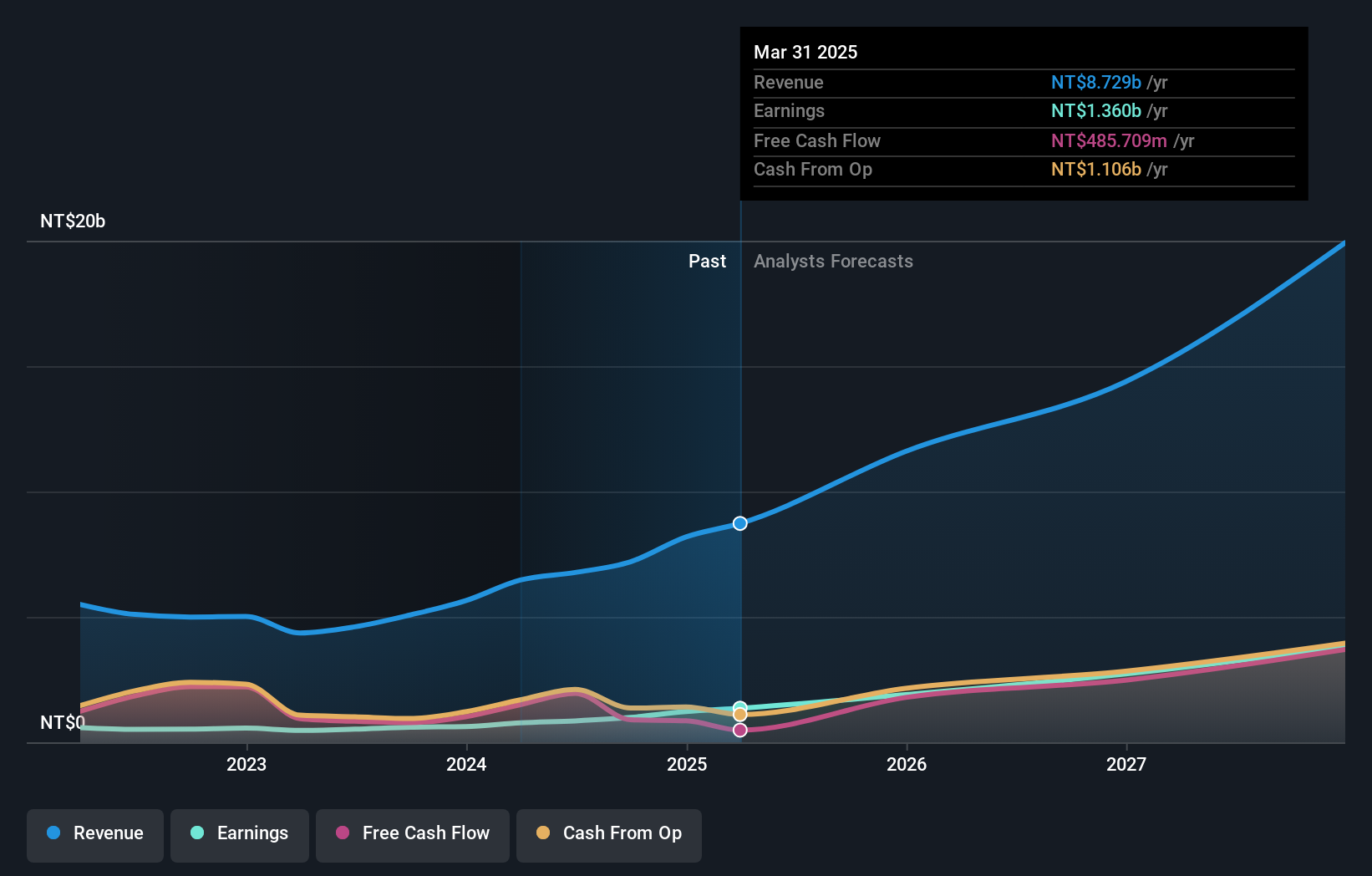

Fositek (TWSE:6805)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fositek Corp. specializes in designing and manufacturing metal stamping products across Asia, the United States, and Europe, with a market cap of NT$81.58 billion.

Operations: The company generates revenue primarily from electronic components and parts, amounting to NT$9.63 billion.

Fositek's recent earnings surge, with sales climbing to TWD 4.87 billion and net income reaching TWD 686.84 million in the first half of 2025, underscores its robust position in Asia's tech sector. This performance is highlighted by a significant annual revenue growth rate of 34.3% and an earnings increase of 44.8%, outpacing the broader Taiwanese market's growth rates significantly. The company not only demonstrates strong financial health but also a promising trajectory in innovation, as reflected by its substantial investment in R&D, ensuring it remains at the forefront of technological advancements despite market volatility.

- Unlock comprehensive insights into our analysis of Fositek stock in this health report.

Examine Fositek's past performance report to understand how it has performed in the past.

Taking Advantage

- Get an in-depth perspective on all 187 Asian High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3037

Unimicron Technology

Engages in the development, manufacturing, processing, and sale of printed circuit boards, electrical equipment, electronic products, and testing and burn-in systems for integrated circuit products worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives