Asian Value Stocks Estimated Below Intrinsic Worth In July 2025

Reviewed by Simply Wall St

As of July 2025, Asian markets are experiencing a notable upswing, buoyed by optimism around trade deals and improving economic indicators in key regions like Japan and China. Amid this positive environment, investors are increasingly interested in identifying stocks that may be undervalued relative to their intrinsic worth, offering potential opportunities for those seeking value investments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1174.00 | ¥2321.82 | 49.4% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥23.34 | CN¥46.18 | 49.5% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥51.15 | CN¥101.32 | 49.5% |

| Polaris Holdings (TSE:3010) | ¥220.00 | ¥433.40 | 49.2% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$177.00 | NT$350.10 | 49.4% |

| LigaChem Biosciences (KOSDAQ:A141080) | ₩139000.00 | ₩277490.02 | 49.9% |

| Hibino (TSE:2469) | ¥2345.00 | ¥4664.61 | 49.7% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.82 | NZ$1.62 | 49.4% |

| Forum Engineering (TSE:7088) | ¥1206.00 | ¥2405.10 | 49.9% |

| Andes Technology (TWSE:6533) | NT$274.50 | NT$542.92 | 49.4% |

Here we highlight a subset of our preferred stocks from the screener.

Lucky Harvest (SZSE:002965)

Overview: Lucky Harvest Co., Ltd. operates in China focusing on the research, development, production, and sale of precision stamping dies and structural metal parts with a market cap of CN¥10.59 billion.

Operations: Lucky Harvest Co., Ltd.'s revenue is derived from its activities in research, development, production, and sale of precision stamping dies and structural metal parts within China.

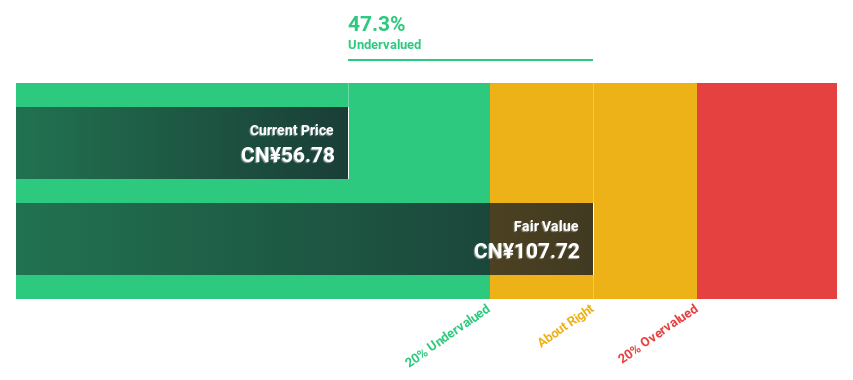

Estimated Discount To Fair Value: 42.3%

Lucky Harvest is trading at CN¥39.89, significantly below its estimated fair value of CN¥69.16, indicating potential undervaluation based on cash flows. Despite improved profit margins last year, they remain lower than the previous year's figures. The company's earnings are expected to grow significantly by 27% annually over the next three years, outpacing the Chinese market's growth rate. However, its dividend track record remains unstable and share price volatility has been high recently.

- Our earnings growth report unveils the potential for significant increases in Lucky Harvest's future results.

- Take a closer look at Lucky Harvest's balance sheet health here in our report.

Visional (TSE:4194)

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market capitalization of ¥461.33 billion.

Operations: The company's revenue is derived from its HR Tech segment, contributing ¥73.55 billion, and its Incubation segment, which adds ¥2.52 billion.

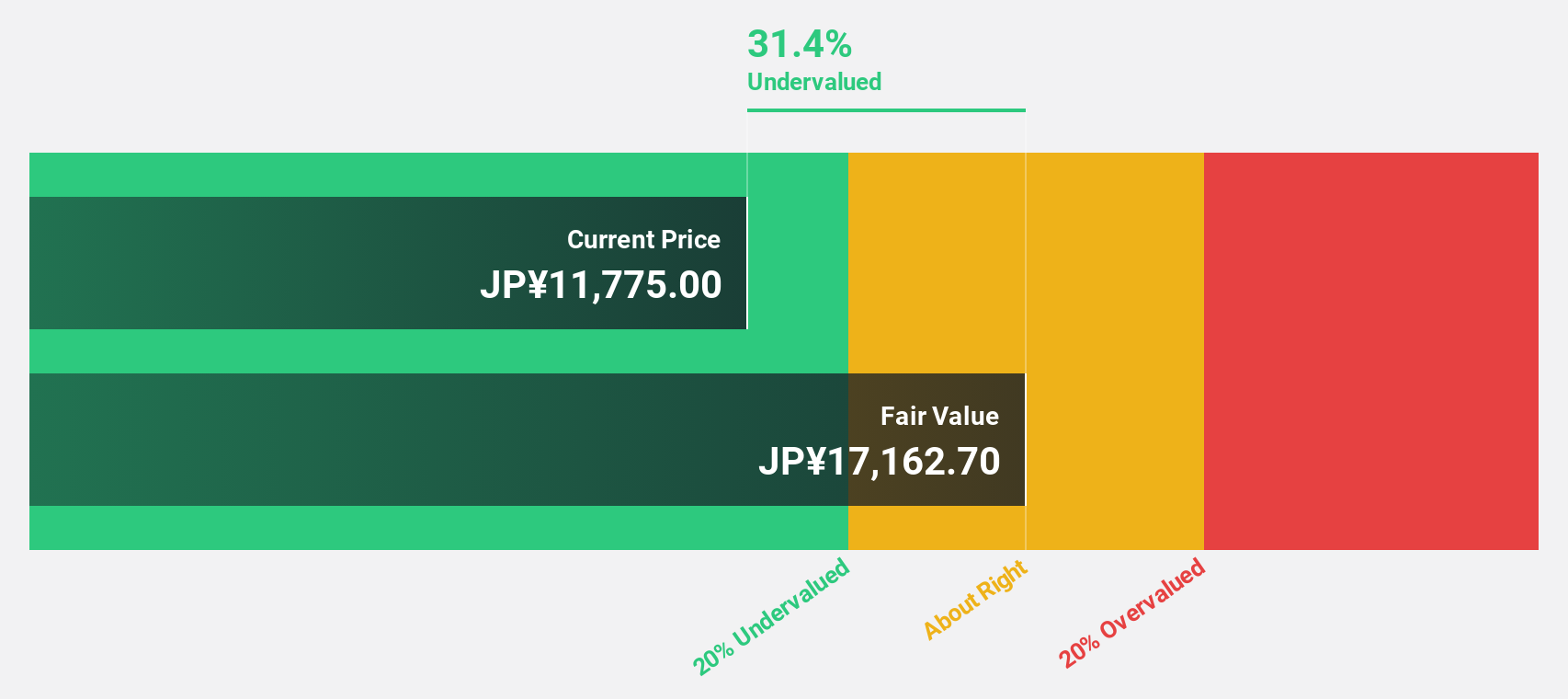

Estimated Discount To Fair Value: 32.6%

Visional is trading at ¥11,600, notably below its estimated fair value of ¥17,222.56, suggesting potential undervaluation based on cash flows. The company has raised its earnings forecast for fiscal 2025 due to BizReach's robust performance. Earnings are projected to grow 15.34% annually, surpassing the Japanese market average of 7.8%. Despite high share price volatility recently, Visional's return on equity is expected to reach a strong 23.7% in three years.

- Insights from our recent growth report point to a promising forecast for Visional's business outlook.

- Click here to discover the nuances of Visional with our detailed financial health report.

Unimicron Technology (TWSE:3037)

Overview: Unimicron Technology Corp. develops, manufactures, processes, and sells printed circuit boards and electronic products globally with a market cap of NT$214.02 billion.

Operations: The company's revenue is derived from Taiwan, contributing NT$83.34 billion, and Mainland China, contributing NT$49.14 billion.

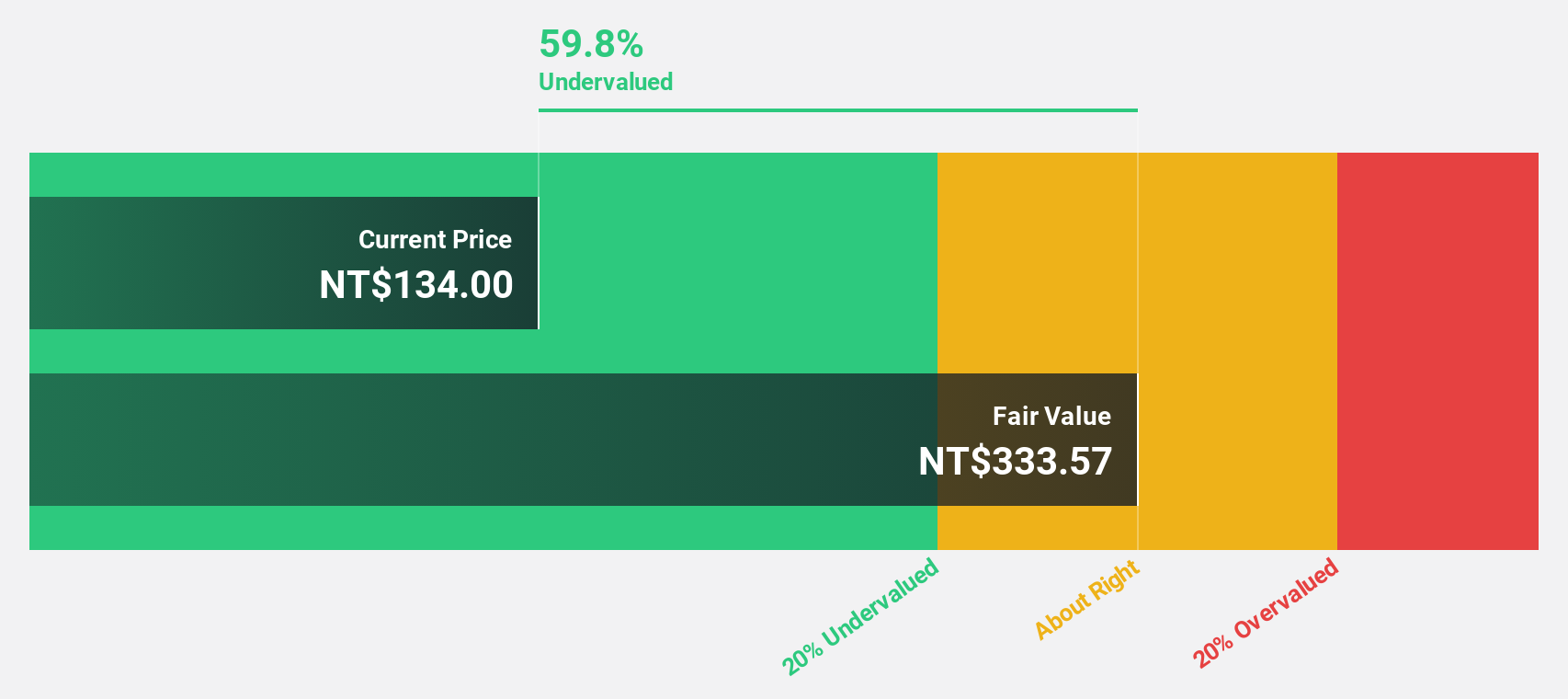

Estimated Discount To Fair Value: 47.6%

Unimicron Technology's stock, trading at NT$140, is significantly undervalued compared to its estimated fair value of NT$266.95. Despite recent earnings challenges with net income dropping to NT$29.61 million from NT$1,595.29 million a year ago, the company's earnings are expected to grow substantially by 51.97% annually over the next three years, outpacing Taiwan's market growth rate of 13.2%. However, profit margins have decreased from last year’s 9.9% to 3%.

- Our expertly prepared growth report on Unimicron Technology implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Unimicron Technology stock in this financial health report.

Where To Now?

- Embark on your investment journey to our 265 Undervalued Asian Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002965

Lucky Harvest

Engages in the research, development, production, and sale of precision stamping dies and structural metal parts in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives