- South Korea

- /

- Healthtech

- /

- KOSDAQ:A328130

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets have shown mixed signals with U.S. stocks closing out a strong year despite some recent declines, while economic indicators like the Chicago PMI and revised GDP forecasts highlight ongoing challenges. In this environment, high-growth tech stocks remain of interest due to their potential for innovation and resilience in adapting to changing market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Qt Group Oyj (HLSE:QTCOM)

Simply Wall St Growth Rating: ★★★★★☆

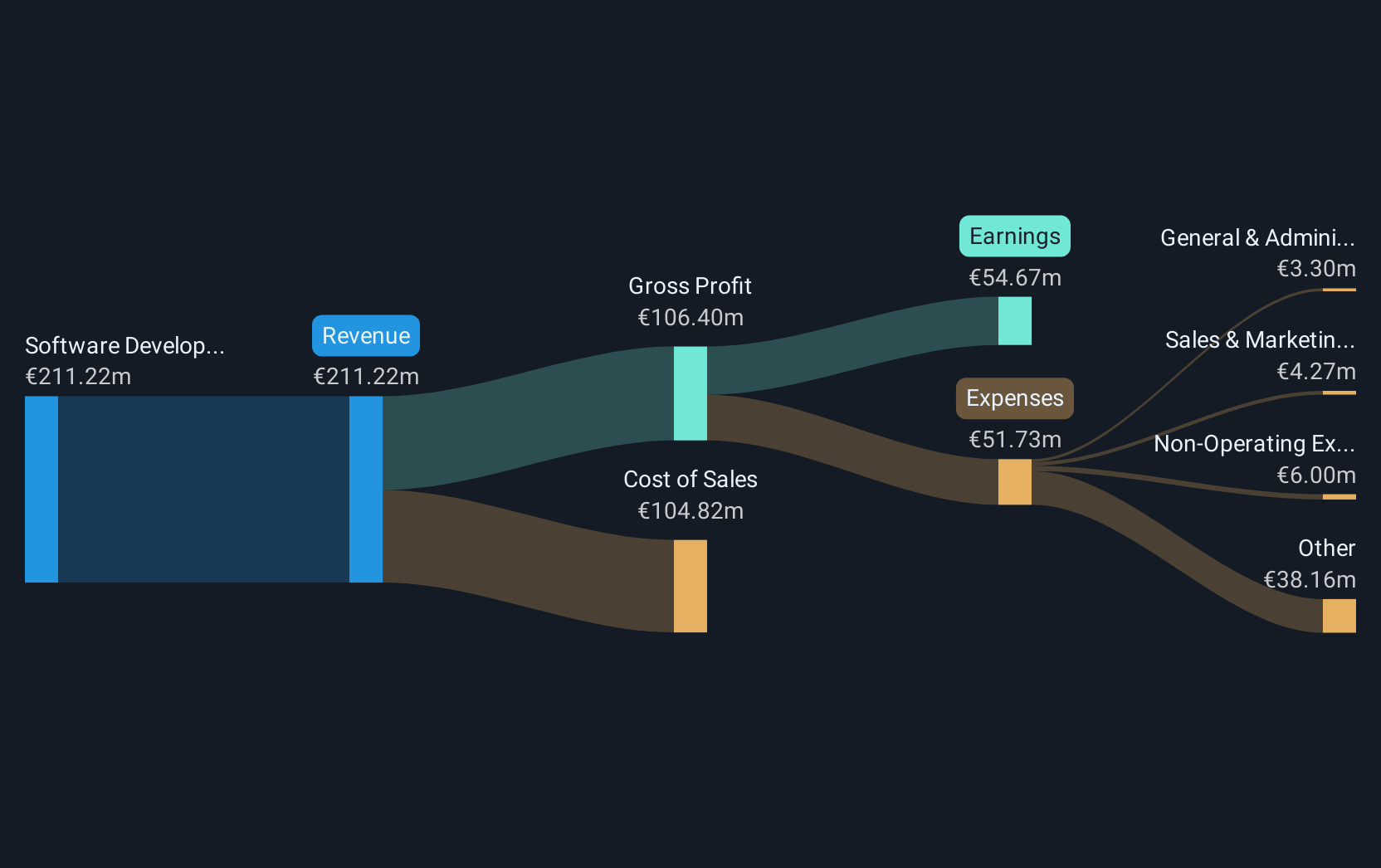

Overview: Qt Group Oyj provides cross-platform solutions for the software development lifecycle across several countries including Finland, Norway, Germany, and others, with a market cap of €1.89 billion.

Operations: Qt Group Oyj generates revenue primarily from its Software Development Tools segment, which accounts for €199.85 million. The company operates in diverse international markets, including the United States, Japan, and China.

Qt Group Oyj, amidst a challenging landscape, has demonstrated robust growth with earnings surging by 49% over the past year, significantly outpacing the software industry's average decline of 8.9%. This growth trajectory is supported by an aggressive R&D focus, as evidenced by their latest innovations presented at major tech conferences and updates to their flagship Qt platform. Despite a recent revision in revenue forecasts for 2024—projecting sales between EUR 208 million and EUR 210 million, down from earlier estimates—Qt's strategic deal negotiations poised for completion in 2025 suggest potential for rebound. Their commitment to enhancing software frameworks for diverse applications ensures Qt remains integral in evolving tech ecosystems.

- Take a closer look at Qt Group Oyj's potential here in our health report.

Examine Qt Group Oyj's past performance report to understand how it has performed in the past.

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

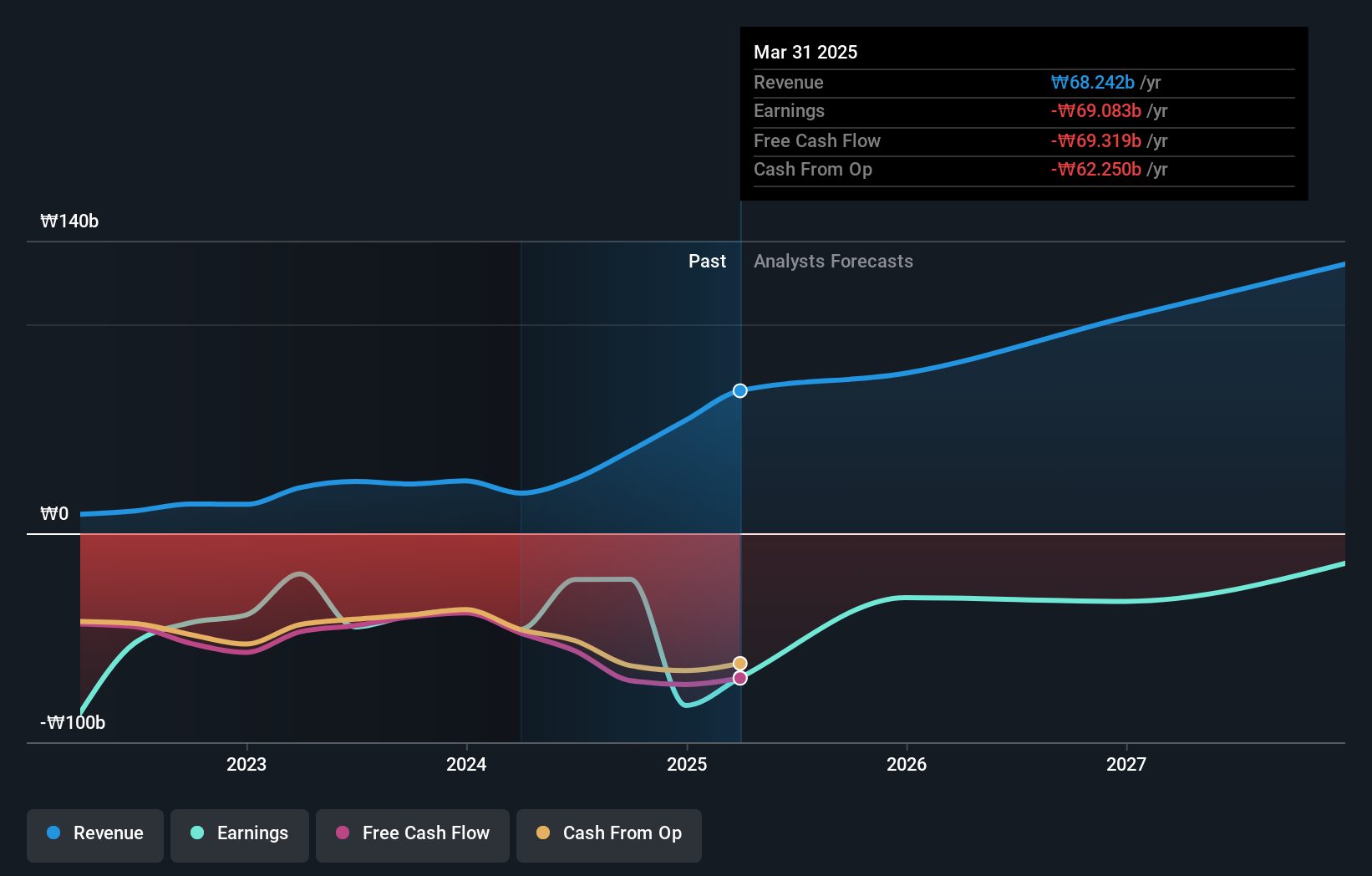

Overview: Lunit Inc. is a South Korean company specializing in AI-powered software and solutions for cancer diagnostics and therapeutics, with a market cap of ₩2 trillion.

Operations: The company generates revenue primarily from its healthcare software segment, amounting to ₩39.54 billion.

Lunit's dynamic approach to R&D is evident in its recent advancements, notably the Universal Immunohistochemistry (uIHC) AI model, which has shown remarkable performance across various cancer types and immunostains. This innovation not only enhances diagnostic accuracy but also addresses significant challenges in oncology by reducing reliance on large, stain-specific datasets. With an annual revenue growth of 49.9% and earnings expected to grow by 78.2% per year, Lunit's strategic focus on integrating AI into clinical workflows positions it as a transformative force in healthcare technology. Moreover, collaborations like those with Volpara Health highlight Lunit's commitment to expanding its technological footprint and improving patient outcomes through advanced AI solutions.

- Unlock comprehensive insights into our analysis of Lunit stock in this health report.

Understand Lunit's track record by examining our Past report.

WT Microelectronics (TWSE:3036)

Simply Wall St Growth Rating: ★★★★☆☆

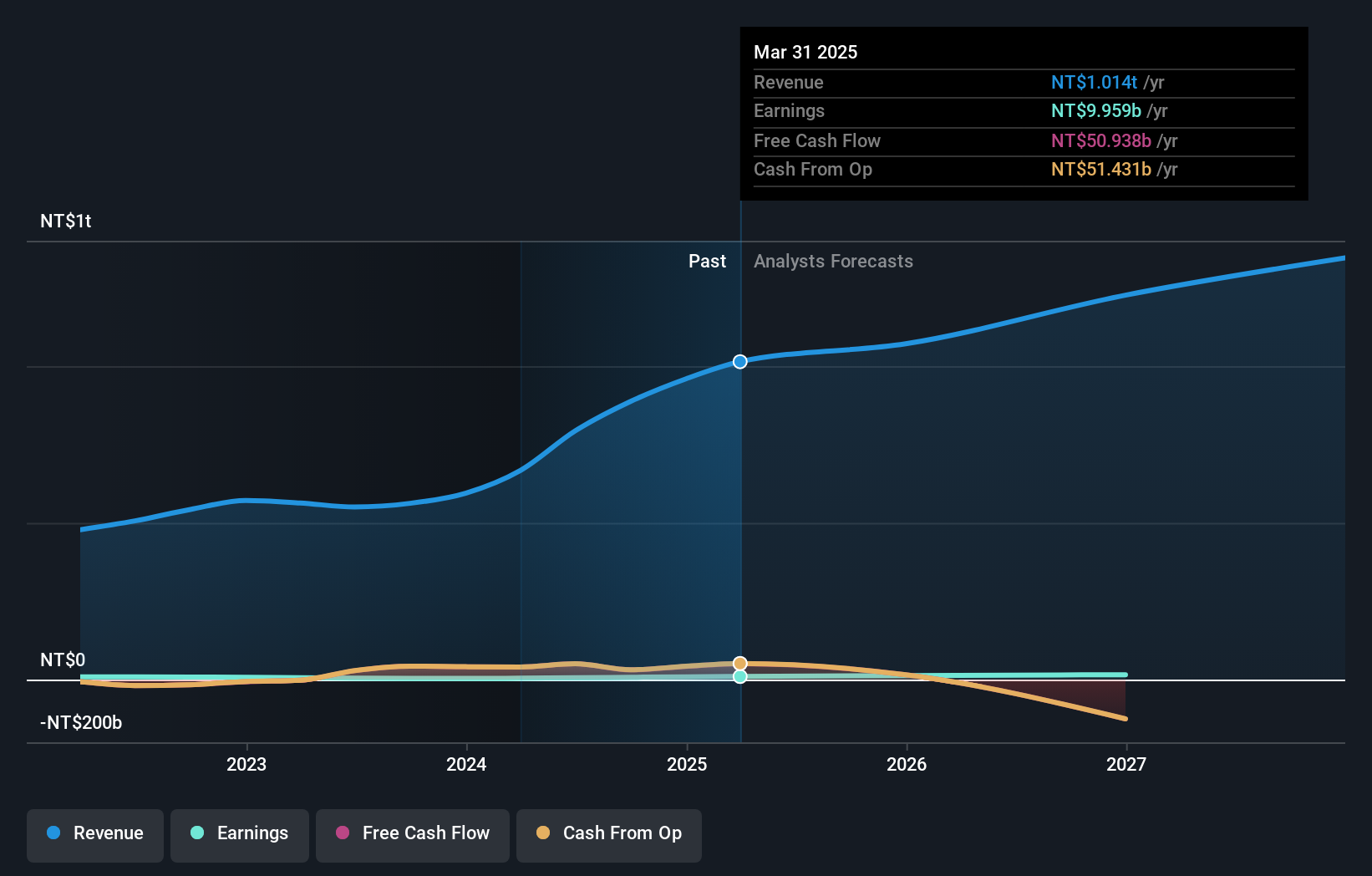

Overview: WT Microelectronics Co., Ltd. and its subsidiaries are engaged in the development and sale of electronic and communication components across Taiwan, China, and international markets, with a market capitalization of NT$126.71 billion.

Operations: The company focuses on the development and sale of electronic and communication components, serving markets in Taiwan, China, and internationally. It operates with a market capitalization of NT$126.71 billion.

WT Microelectronics has demonstrated robust financial performance, with a notable 61% increase in year-to-date sales reaching TWD 863.6 billion by November 2024, reflecting a consistent upward trajectory from earlier months. This growth is underpinned by significant earnings improvements, as evidenced by a surge in net income to TWD 6.576 billion over nine months, nearly doubling the previous year's figures. The company's strategic emphasis on expanding its technological capabilities is likely contributing to these gains, positioning it well within the competitive electronics sector where innovation drives market success. Additionally, WT Microelectronics' commitment to research and development is poised to sustain its growth momentum and enhance its market adaptability.

- Delve into the full analysis health report here for a deeper understanding of WT Microelectronics.

Assess WT Microelectronics' past performance with our detailed historical performance reports.

Taking Advantage

- Reveal the 1258 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A328130

Lunit

Provides AI-powered software and solutions for cancer diagnostics and therapeutics in South Korea.

Limited growth with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives