- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3030

Uncovering Three Promising Asian Small Caps for Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, Asian small-cap stocks have been gaining attention for their potential to outperform larger counterparts, particularly as investor sentiment shifts towards growth opportunities in emerging sectors. With the Russell 2000 Index showing notable gains, investors are increasingly looking at these smaller companies for their agility and capacity to adapt swiftly to changing market dynamics. When considering such investments, it is crucial to focus on companies with robust fundamentals and innovative business models that can thrive amid evolving economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| HG Metal Manufacturing | 3.31% | 8.63% | 5.71% | ★★★★★★ |

| Korea Ratings | NA | 1.15% | 4.26% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Tibet Development | 13.94% | -0.13% | 42.61% | ★★★★★★ |

| Quality Reliability Technology | 18.75% | 0.46% | -43.08% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 9.74% | 13.35% | ★★★★★★ |

| Creative & Innovative System | 0.72% | 37.76% | 64.55% | ★★★★★★ |

| Shenzhen China Micro Semicon | 6.54% | 5.94% | -43.71% | ★★★★★☆ |

| Xinya Electronic | 51.57% | 28.63% | 3.77% | ★★★★★☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shandong Weida Machinery (SZSE:002026)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shandong Weida Machinery Co., Ltd. specializes in the manufacture and sale of drill chucks both in China and internationally, with a market cap of CN¥7.11 billion.

Operations: The primary revenue stream for Shandong Weida Machinery comes from the manufacture and sale of drill chucks. The company's financial performance is highlighted by a notable net profit margin trend, which reflects its efficiency in managing costs relative to its revenue.

Shandong Weida Machinery, a smaller player in the machinery sector, has shown robust growth with earnings increasing by 26% over the past year, outpacing the industry average of 6%. The company's net income rose to CNY 229.78 million from CNY 199.44 million a year prior, reflecting strong operational performance. Despite a slight increase in its debt-to-equity ratio to 3% over five years, it maintains more cash than total debt and remains profitable with positive free cash flow. With a price-to-earnings ratio of 21.5x below the CN market average of 43.5x, it appears attractively valued for investors seeking opportunities in Asia's machinery sector.

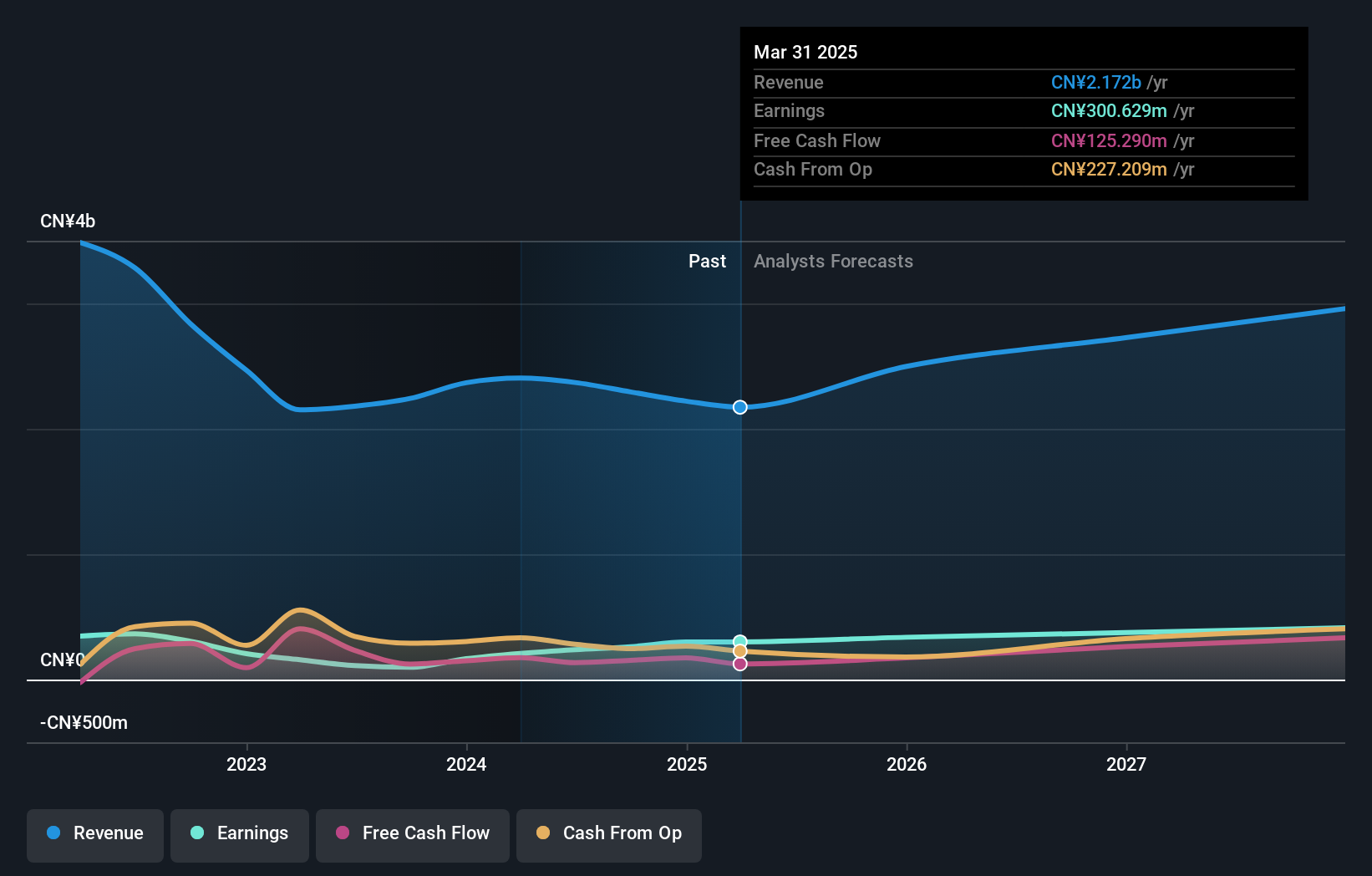

Shenzhen LiantronicsLtd (SZSE:300269)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Liantronics Co., Ltd offers display solutions in China and has a market cap of CN¥4.38 billion.

Operations: The company generates revenue primarily through its display solutions segment. It reported a gross profit margin of 34.5% in the most recent financial period, reflecting its pricing strategy and cost management within this segment.

Shenzhen Liantronics has recently turned profitable, reporting a net income of CNY 18.23 million for the first nine months of 2025, a significant improvement from a net loss of CNY 6.89 million during the same period last year. Despite this positive turnaround, sales have decreased to CNY 381.63 million from CNY 469.6 million previously, indicating potential challenges in revenue generation. The company has also seen its debt to equity ratio drop significantly over five years from 306% to 218%, reflecting efforts in managing financial leverage effectively while maintaining high-quality earnings with interest payments well covered by EBIT at a multiple of 12x.

- Get an in-depth perspective on Shenzhen LiantronicsLtd's performance by reading our health report here.

Assess Shenzhen LiantronicsLtd's past performance with our detailed historical performance reports.

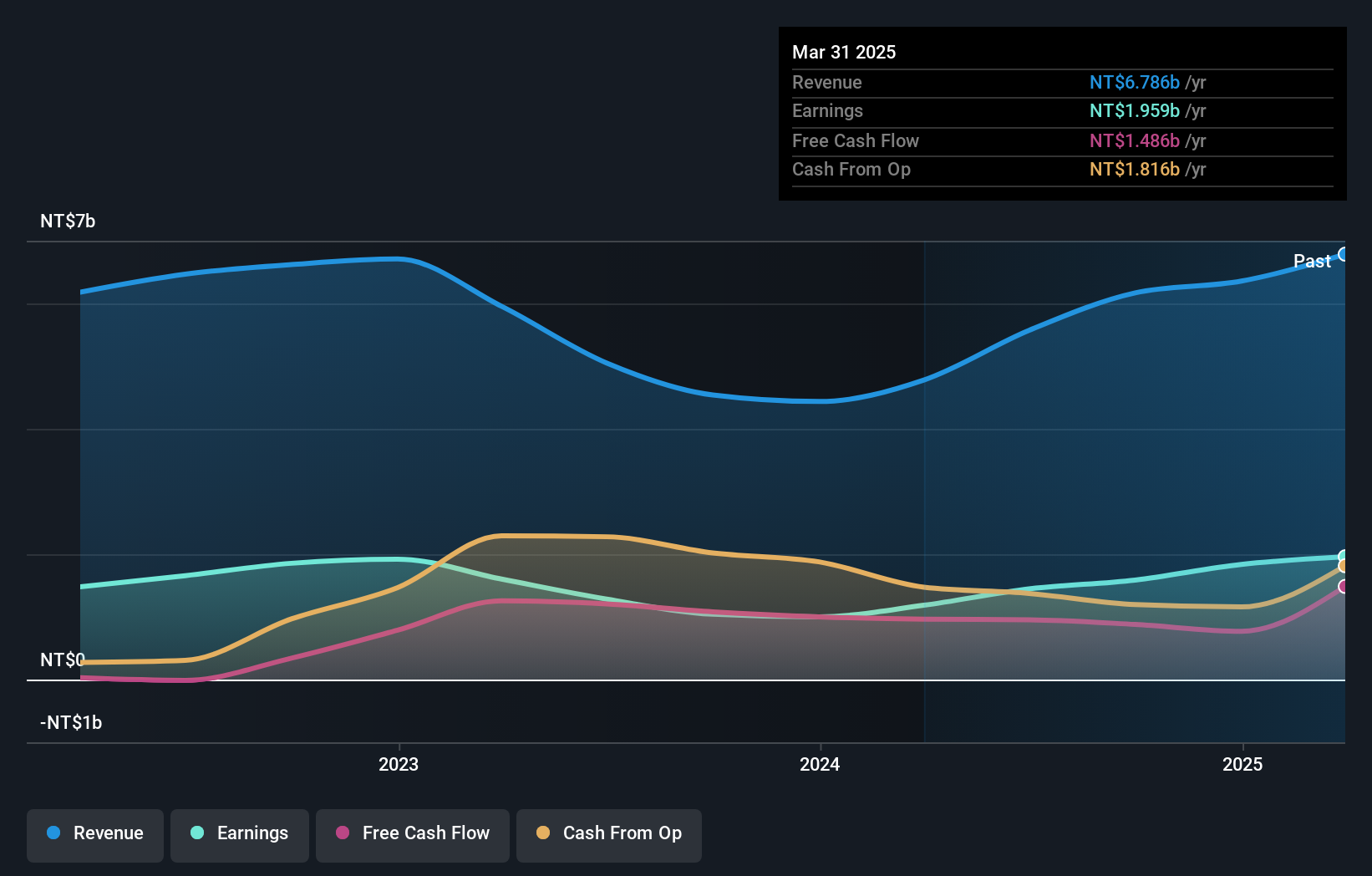

Test Research (TWSE:3030)

Simply Wall St Value Rating: ★★★★★★

Overview: Test Research, Inc. is a company that specializes in the design, assembly, manufacturing, sale, repair, and maintenance of automated inspection and testing equipment globally with a market capitalization of NT$40.51 billion.

Operations: The primary revenue stream for Test Research comes from the design, assembly, manufacturing, sale, and repair of automated testing equipment, generating NT$7.88 billion.

Test Research, a nimble player in the electronics sector, has shown impressive growth with earnings soaring by 46.1% over the past year, outpacing industry norms of 6.6%. The company is debt-free, enhancing its financial stability and flexibility. Recent results reflect strong performance; third-quarter sales reached TWD 2.07 billion from TWD 1.63 billion last year, while net income climbed to TWD 693 million from TWD 388 million previously. With a price-to-earnings ratio of 17.5x below the TW market's average of 20.4x and high-quality earnings reported consistently, Test Research seems well-positioned for future opportunities in its field.

- Navigate through the intricacies of Test Research with our comprehensive health report here.

Evaluate Test Research's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Gain an insight into the universe of 2506 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Test Research might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3030

Test Research

Designs, assembles, manufactures, sells, repairs, and maintains automated inspection and testing equipment in Asia, America, Europe, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026