- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3029

High Growth Tech Stocks To Watch For Potential Expansion

Reviewed by Simply Wall St

In recent weeks, global markets have shown a mixed performance, with U.S. stock indexes climbing toward record highs while small-cap stocks have lagged behind larger indices like the S&P 500. Amidst this backdrop of rising inflation and volatile treasury yields, investors are closely watching high-growth tech stocks for potential expansion opportunities, as these companies often thrive in dynamic market environments by leveraging innovation and adaptability to drive growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1213 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

TXT e-solutions (BIT:TXT)

Simply Wall St Growth Rating: ★★★★★☆

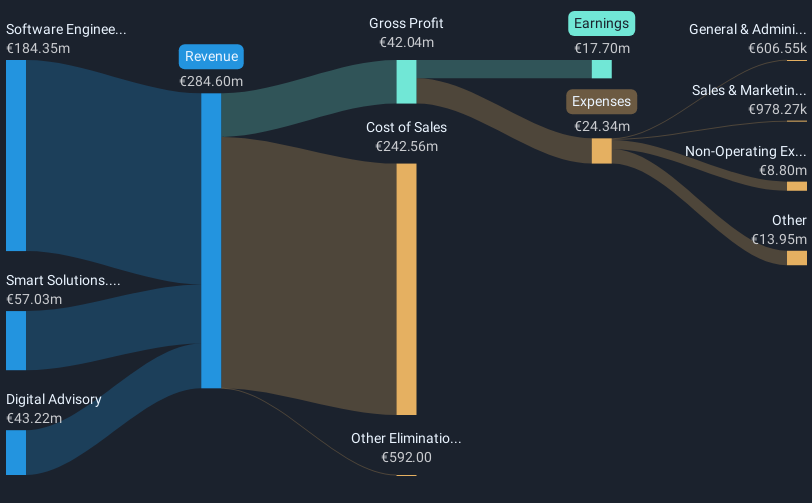

Overview: TXT e-solutions S.p.A. is an Italian company that offers software and service solutions both domestically and internationally, with a market capitalization of approximately €474.35 million.

Operations: TXT e-solutions S.p.A. generates revenue through three primary segments: Software Engineering (€184.35 million), Smart Solutions (€57.03 million), and Digital Advisory (€43.22 million).

TXT e-solutions, with a projected annual revenue growth of 12.7%, is outpacing the Italian market's average of 4.3%. This growth is bolstered by a recent strategic MoU with Zen Technologies, enhancing their capabilities in military aviation training solutions—a sector demanding continual innovation and technological advancement. Additionally, TXT's earnings are expected to surge by 22.9% annually, reflecting robust financial health despite its earnings growth over the past year (7.6%) lagging behind the broader software industry's 18%. The company’s focus on high-quality earnings and an anticipated Return on Equity of 20.3% positions it well for future endeavors in high-tech sectors, although challenges remain in covering debt through operating cash flow.

- Dive into the specifics of TXT e-solutions here with our thorough health report.

Evaluate TXT e-solutions' historical performance by accessing our past performance report.

Arent (TSE:5254)

Simply Wall St Growth Rating: ★★★★☆☆

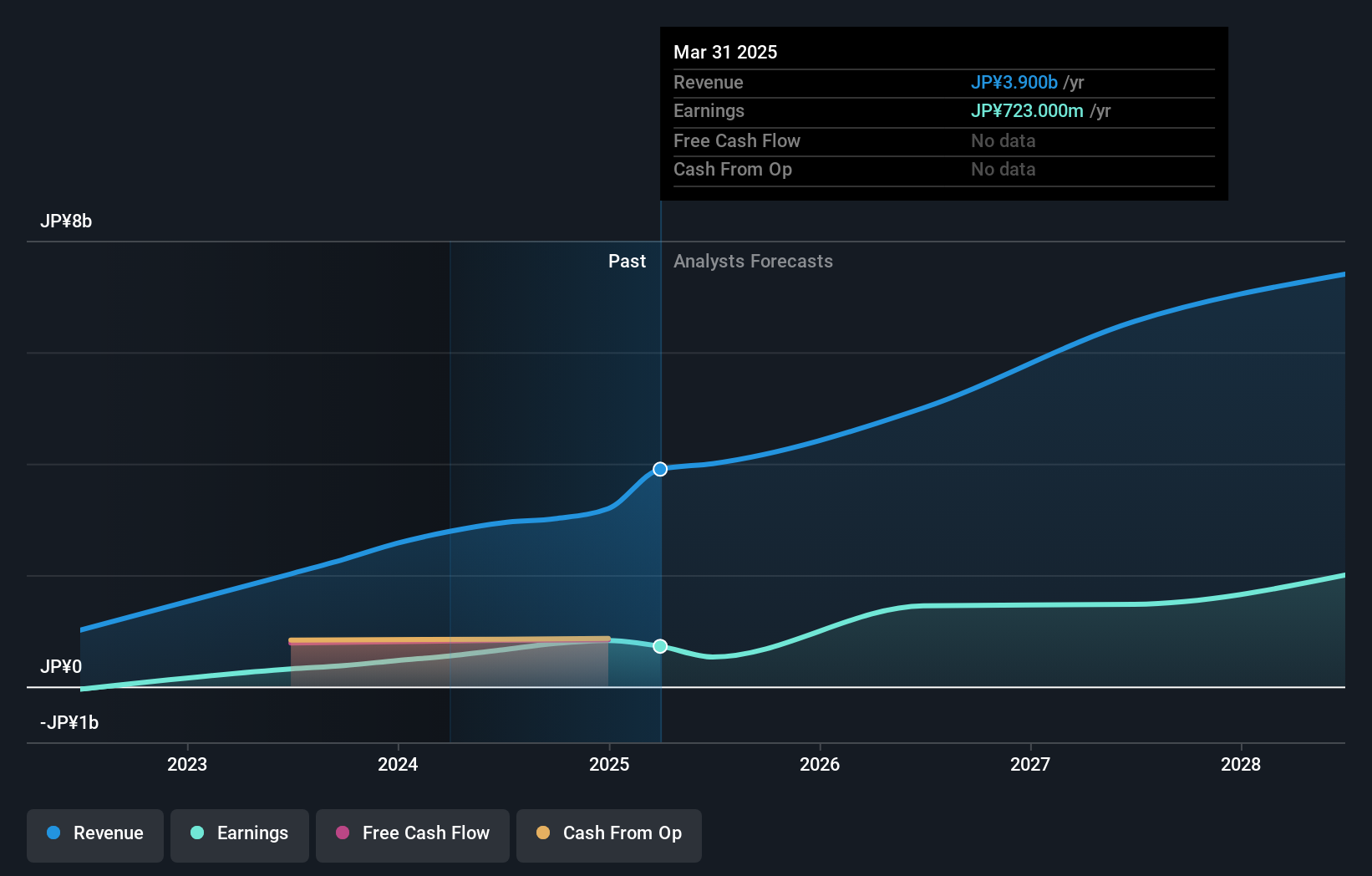

Overview: Arent Inc. specializes in creating SaaS-based solutions for the construction industry in Japan, with a market capitalization of ¥41.64 billion.

Operations: Arent Inc. focuses on developing SaaS solutions tailored for Japan's construction sector.

Arent Inc. has demonstrated a robust growth trajectory with an annual revenue increase of 19%, outperforming the Japanese market average of 4.2%. This growth is complemented by an impressive earnings surge, forecasted at 22.5% annually, which notably exceeds the broader IT industry's past year performance of 10.1%. A strategic focus on R&D has led to significant investments amounting to $1.3 billion last year, underscoring Arent’s commitment to innovation and securing its competitive edge in a rapidly evolving tech landscape. Despite market volatility, these figures highlight Arent's potential as a leader in technology advancement and financial health.

- Get an in-depth perspective on Arent's performance by reading our health report here.

Examine Arent's past performance report to understand how it has performed in the past.

Zero One Technology (TWSE:3029)

Simply Wall St Growth Rating: ★★★★★☆

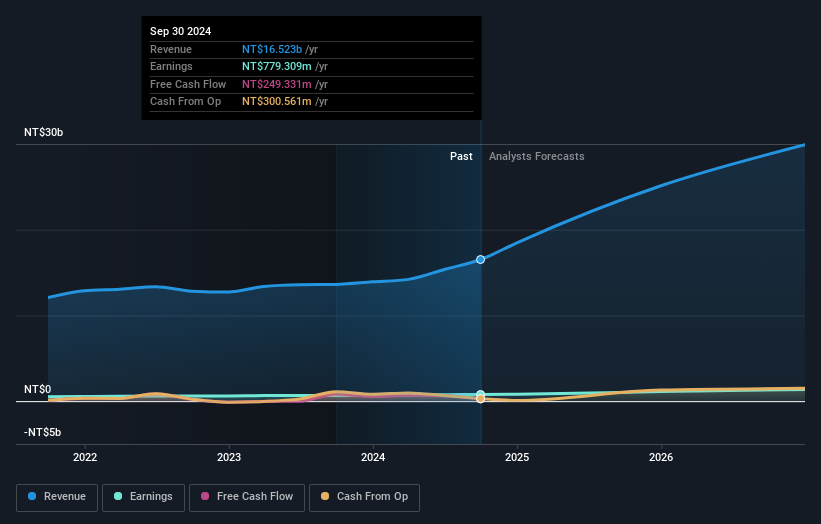

Overview: Zero One Technology Co., Ltd. offers enterprise information technology solutions in Taiwan and has a market cap of approximately NT$24.63 billion.

Operations: Zero One Technology Co., Ltd. generates revenue primarily through its Brand Agency Business Group, which contributes NT$14.44 billion. The company's market cap is approximately NT$24.63 billion, reflecting its position in the enterprise IT solutions sector in Taiwan.

Zero One Technology, amidst a dynamic tech landscape, has shown promising growth with an annual revenue increase of 26.5%, outstripping the broader market's expansion. This growth is bolstered by an earnings surge of 26.3% per year, reflecting robust operational efficiency and market demand. Investing $1.2 billion in R&D last year, Zero One not only prioritizes innovation but also aligns its strategy with evolving technological trends, ensuring its offerings remain competitive and relevant. Such financial health and strategic foresight suggest a solid footing in the tech sector's future developments.

- Click here and access our complete health analysis report to understand the dynamics of Zero One Technology.

Assess Zero One Technology's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click here to access our complete index of 1213 High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zero One Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3029

Zero One Technology

Provides enterprise information technology solutions in Taiwan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives