- Taiwan

- /

- Tech Hardware

- /

- TWSE:3013

January 2025's Top Picks for Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are keenly assessing opportunities for value amid fluctuating indices and economic indicators. With the S&P 500 Index marking significant gains over the past two years despite recent contractions, identifying stocks trading below their intrinsic value becomes particularly appealing in this environment. In such a context, a good stock is one that demonstrates strong fundamentals and potential for growth, even when broader market conditions appear uncertain or challenging.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | US$30.89 | US$61.61 | 49.9% |

| Wasion Holdings (SEHK:3393) | HK$7.05 | HK$14.02 | 49.7% |

| Tourmaline Oil (TSX:TOU) | CA$66.79 | CA$133.01 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.08 | US$83.90 | 49.8% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Zhende Medical (SHSE:603301) | CN¥21.00 | CN¥41.99 | 50% |

| Ally Financial (NYSE:ALLY) | US$35.85 | US$71.62 | 49.9% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥23.89 | CN¥47.76 | 50% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.44 | NZ$2.88 | 50% |

| LG Energy Solution (KOSE:A373220) | ₩356000.00 | ₩709677.60 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

Aurora Cannabis (TSX:ACB)

Overview: Aurora Cannabis Inc. operates in the production, distribution, and sale of cannabis and cannabis-derivative products both in Canada and internationally, with a market cap of CA$372.93 million.

Operations: The company's revenue is primarily derived from its cannabis segment, which accounts for CA$247.57 million, and plant propagation, contributing CA$49.42 million.

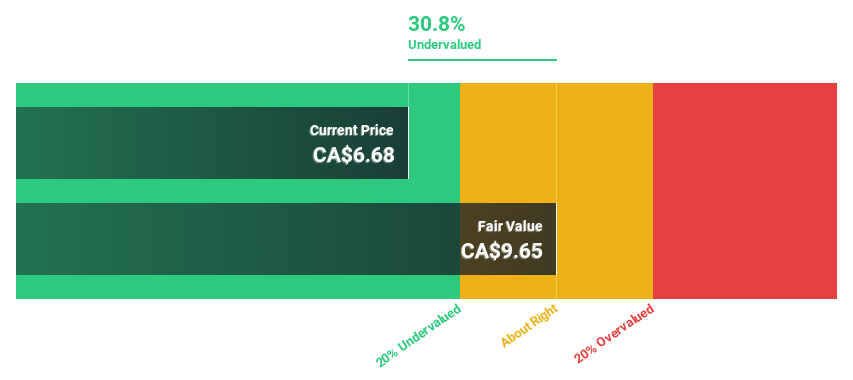

Estimated Discount To Fair Value: 29.5%

Aurora Cannabis is trading at CA$6.8, below its fair value estimate of CA$9.65, highlighting potential undervaluation based on discounted cash flow analysis. Despite recent shareholder dilution and legal challenges with a proposed $8.05 million settlement, Aurora's revenue growth outpaces the Canadian market at 10.7% annually. The company is forecast to become profitable within three years, supported by expanding product lines and innovative offerings from brands like Greybeard and Tasty's.

- Upon reviewing our latest growth report, Aurora Cannabis' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Aurora Cannabis stock in this financial health report.

Chenming Electronic Tech (TWSE:3013)

Overview: Chenming Electronic Tech Corp., with a market cap of NT$29.75 billion, is an OEM/ODM manufacturer involved in the research, development, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally.

Operations: The company's revenue primarily comes from the production and sales of computer and mobile device components, amounting to NT$8.53 billion.

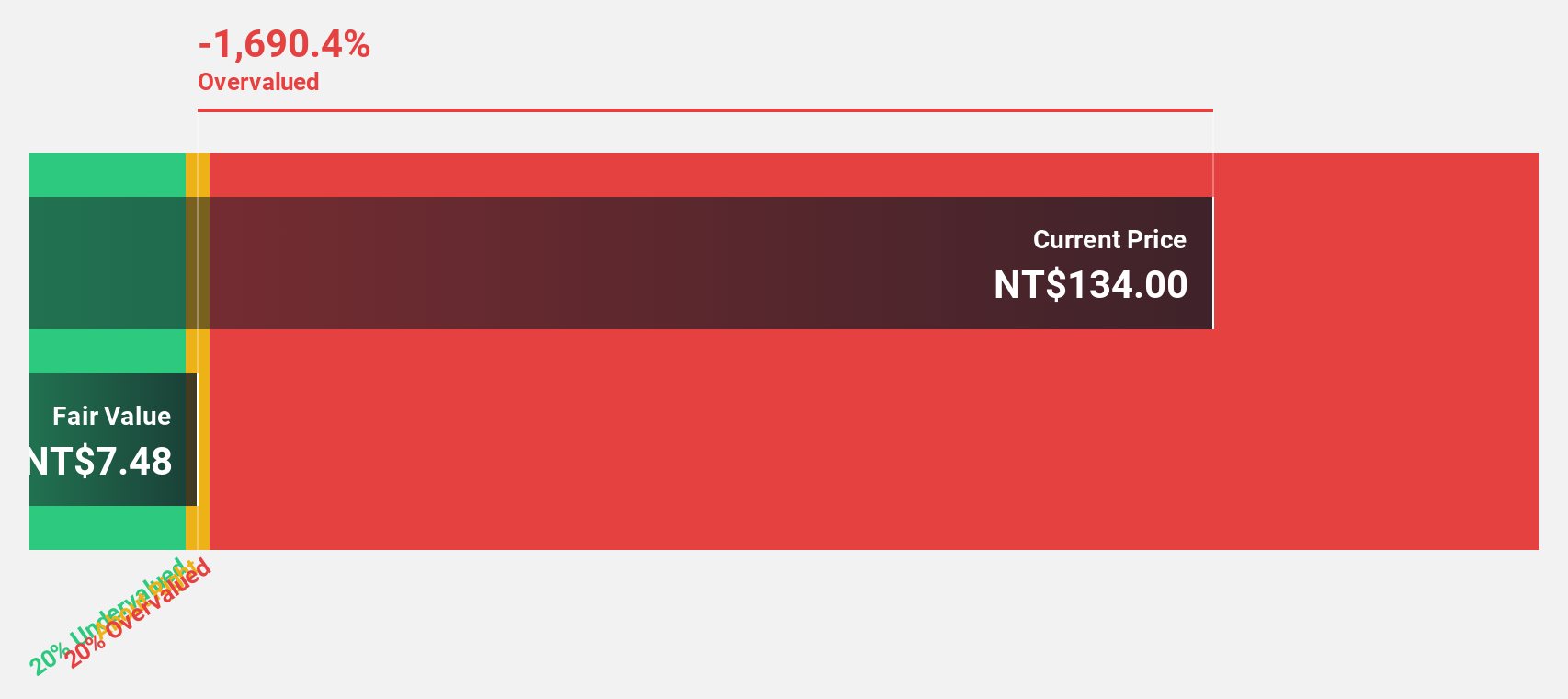

Estimated Discount To Fair Value: 31.5%

Chenming Electronic Tech. is trading at NT$145, significantly below its fair value estimate of NT$211.58, suggesting undervaluation based on cash flows. Recent earnings show robust growth, with Q3 sales rising to TWD 2.66 billion from TWD 1.77 billion year-over-year and net income nearly doubling to TWD 164.48 million. However, past shareholder dilution and high share price volatility present concerns despite strong revenue and earnings growth forecasts outpacing the Taiwan market significantly.

- Our growth report here indicates Chenming Electronic Tech may be poised for an improving outlook.

- Get an in-depth perspective on Chenming Electronic Tech's balance sheet by reading our health report here.

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG operates in commercial real estate and public investment finance across Europe and the USA, with a market cap of €665.65 million.

Operations: The company's revenue is primarily derived from Real Estate Finance (€255 million) and Non-Core activities (€108 million).

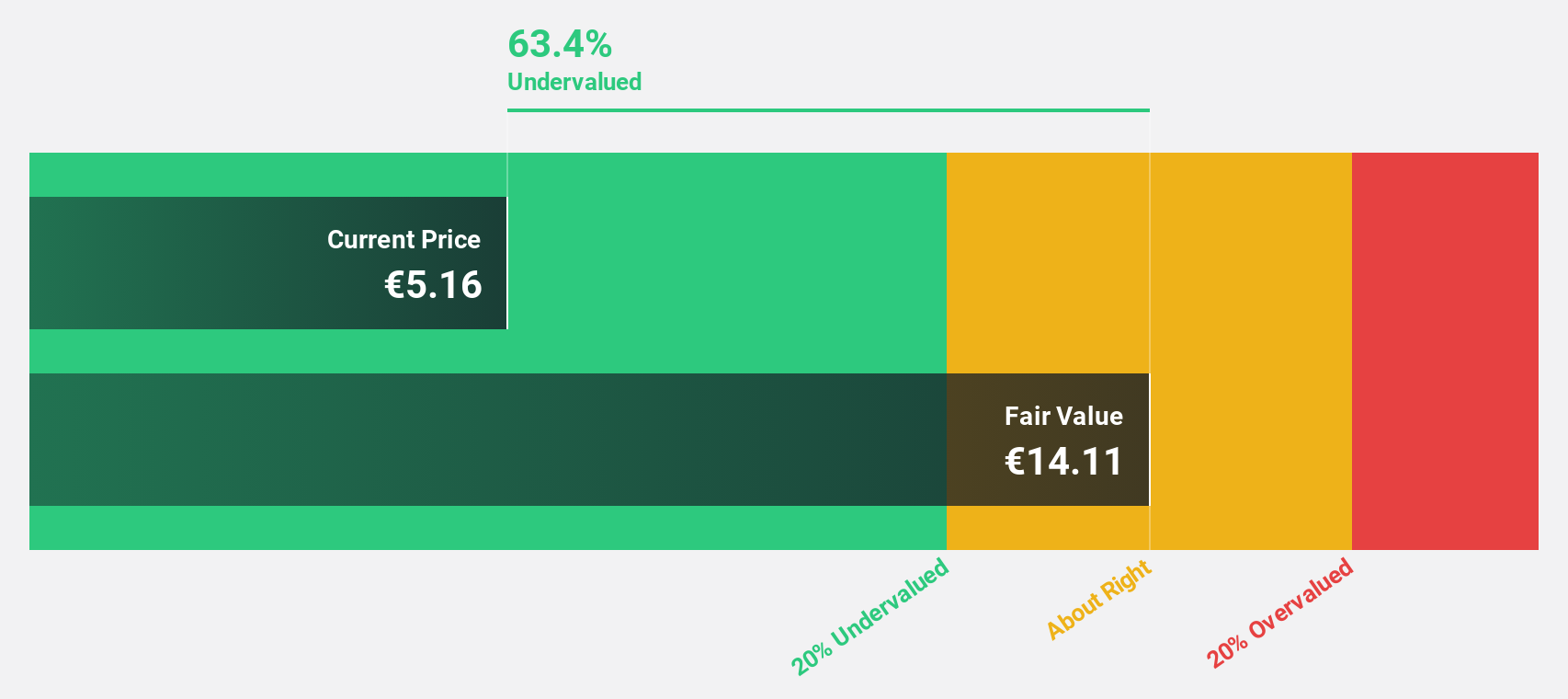

Estimated Discount To Fair Value: 36.7%

Deutsche Pfandbriefbank is trading at €4.95, below its fair value estimate of €7.82, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 35.1% annually, outpacing the German market's growth rate, though net income for the first nine months of 2024 slightly decreased to €74 million from €77 million year-over-year. Despite a high level of bad loans (4.1%), PBB remains competitively valued against peers and industry standards.

- Our comprehensive growth report raises the possibility that Deutsche Pfandbriefbank is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Deutsche Pfandbriefbank's balance sheet health report.

Seize The Opportunity

- Navigate through the entire inventory of 899 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3013

Chenming Electronic Tech

An OEM/ODM manufacturer, engages in the research and development, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds in Taiwan, China, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives