- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2486

Here's Why I-Chiun Precision Industry (TWSE:2486) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that I-Chiun Precision Industry Co., Ltd. (TWSE:2486) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for I-Chiun Precision Industry

How Much Debt Does I-Chiun Precision Industry Carry?

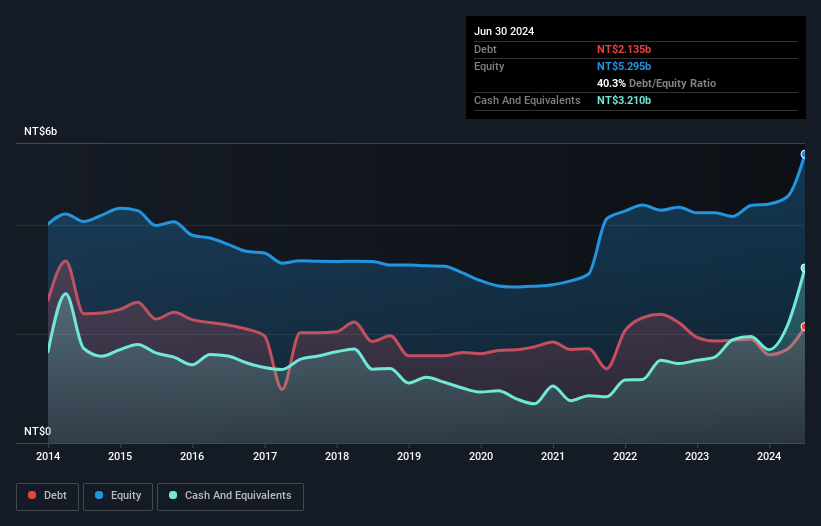

You can click the graphic below for the historical numbers, but it shows that as of June 2024 I-Chiun Precision Industry had NT$2.13b of debt, an increase on NT$1.89b, over one year. However, it does have NT$3.21b in cash offsetting this, leading to net cash of NT$1.07b.

A Look At I-Chiun Precision Industry's Liabilities

The latest balance sheet data shows that I-Chiun Precision Industry had liabilities of NT$2.63b due within a year, and liabilities of NT$1.38b falling due after that. Offsetting these obligations, it had cash of NT$3.21b as well as receivables valued at NT$2.24b due within 12 months. So it can boast NT$1.44b more liquid assets than total liabilities.

This surplus suggests that I-Chiun Precision Industry has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, I-Chiun Precision Industry boasts net cash, so it's fair to say it does not have a heavy debt load!

Importantly, I-Chiun Precision Industry's EBIT fell a jaw-dropping 29% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But it is I-Chiun Precision Industry's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While I-Chiun Precision Industry has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, I-Chiun Precision Industry actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that I-Chiun Precision Industry has net cash of NT$1.07b, as well as more liquid assets than liabilities. The cherry on top was that in converted 179% of that EBIT to free cash flow, bringing in NT$473m. So we are not troubled with I-Chiun Precision Industry's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example I-Chiun Precision Industry has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2486

I-Chiun Precision Industry

Manufactures, processes, and trades machinery and parts, electronic components, electrical components, semiconductor LED lead frames, precision molds, and ceramic circuit boards in Taiwan, China, and internationally.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives