- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2431

Lien Chang Electronic Enterprise's (TWSE:2431) growing losses don't faze investors as the stock swells 14% this past week

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. Of course, in an ideal world, all your stocks would beat the market. Lien Chang Electronic Enterprise Co., Ltd (TWSE:2431) has done well over the last year, with the stock price up 47% beating the market return of 41% (not including dividends). Looking back further, the stock price is 42% higher than it was three years ago.

Since it's been a strong week for Lien Chang Electronic Enterprise shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Lien Chang Electronic Enterprise

Lien Chang Electronic Enterprise isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Lien Chang Electronic Enterprise actually shrunk its revenue over the last year, with a reduction of 37%. Despite the lack of revenue growth, the stock has returned a solid 47% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

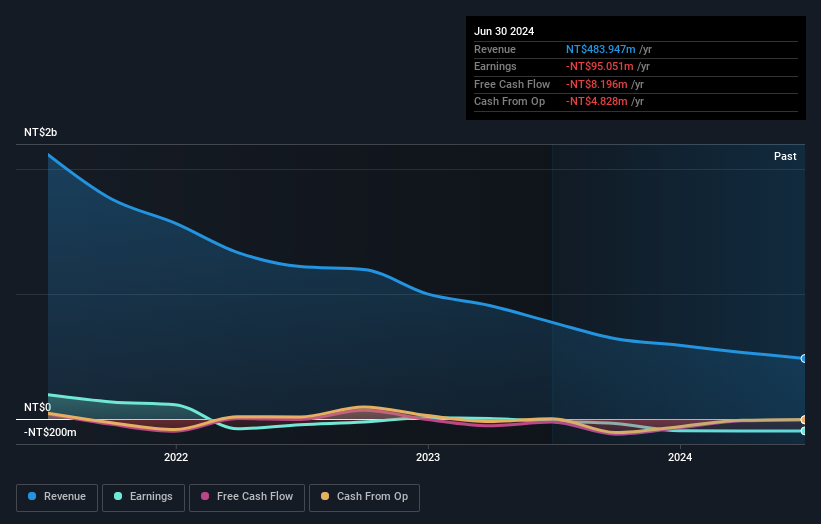

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Lien Chang Electronic Enterprise shareholders have received returns of 47% over twelve months, which isn't far from the general market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 8% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. It's always interesting to track share price performance over the longer term. But to understand Lien Chang Electronic Enterprise better, we need to consider many other factors. Take risks, for example - Lien Chang Electronic Enterprise has 2 warning signs (and 1 which is concerning) we think you should know about.

We will like Lien Chang Electronic Enterprise better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2431

Lien Chang Electronic Enterprise

Manufactures and sells power supply units in Taiwan.

Flawless balance sheet very low.

Market Insights

Community Narratives