- Taiwan

- /

- Tech Hardware

- /

- TWSE:2425

Chaintech Technology's (TWSE:2425) Shareholders Will Receive A Smaller Dividend Than Last Year

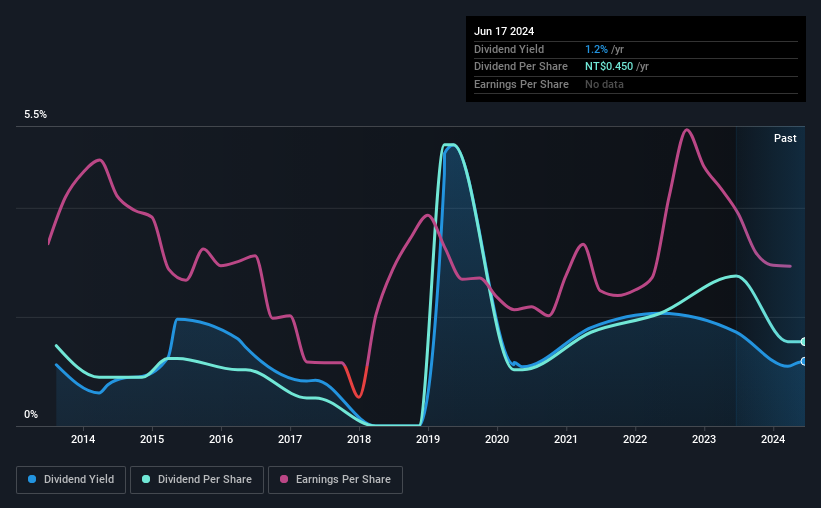

Chaintech Technology Corporation (TWSE:2425) has announced that on 31st of July, it will be paying a dividend ofNT$0.45, which a reduction from last year's comparable dividend. Based on this payment, the dividend yield will be 1.2%, which is lower than the average for the industry.

Check out our latest analysis for Chaintech Technology

Chaintech Technology's Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. Before making this announcement, Chaintech Technology was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, EPS could fall by 3.3% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 30%, which is definitely feasible to continue.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of NT$0.428 in 2014 to the most recent total annual payment of NT$0.45. Its dividends have grown at less than 1% per annum over this time frame. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Chaintech Technology's EPS has declined at around 3.3% a year. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Chaintech Technology is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 1 warning sign for Chaintech Technology that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2425

Chaintech Technology

Manufactures and sells products related to motherboards and computer peripherals in Mainland China and Taiwan.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion