- South Korea

- /

- Consumer Durables

- /

- KOSE:A192400

3 Reliable Dividend Stocks Yielding Up To 5.9%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks experiencing fluctuations and economic indicators like the Chicago PMI signaling contraction, investors are increasingly seeking stability amid uncertainty. In such an environment, dividend stocks can offer a reliable source of income and potential for steady returns, making them an attractive option for those looking to balance their portfolios against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

Click here to see the full list of 2015 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

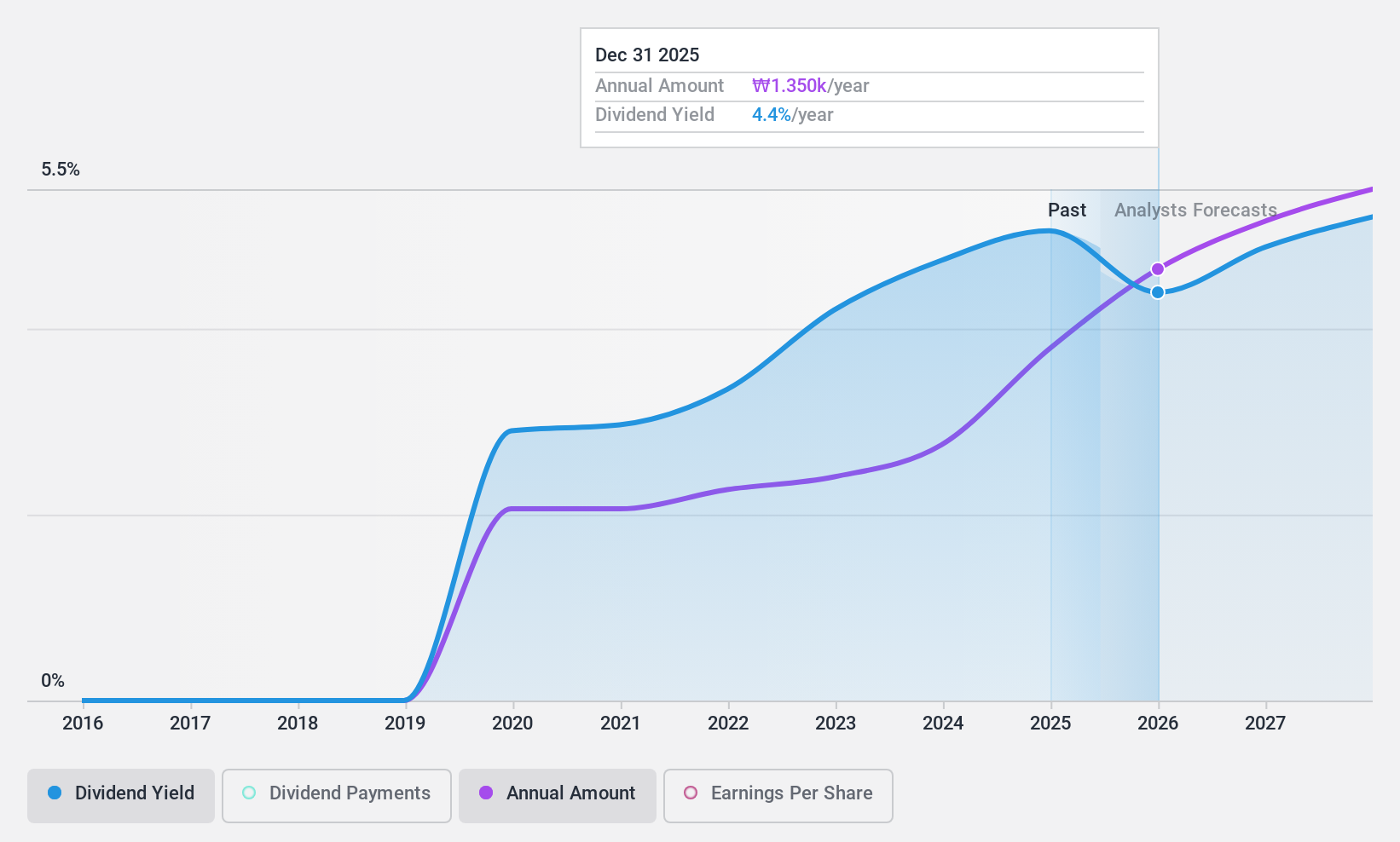

Cuckoo Holdings (KOSE:A192400)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cuckoo Holdings Co., Ltd. and its subsidiaries manufacture and sell electric heaters and daily necessities in South Korea and internationally, with a market cap of approximately ₩696.16 billion.

Operations: Cuckoo Holdings Co., Ltd. generates revenue primarily from its Electric Heating Appliances segment, which accounts for approximately ₩810.25 million.

Dividend Yield: 4.9%

Cuckoo Holdings offers a compelling dividend profile with its 4.89% yield, ranking in the top 25% of Korean market payers. The dividends are well-supported by a low payout ratio of 27% and a cash payout ratio of 50.2%. Although dividends have been stable and growing for five years, their reliability is limited by the company's shorter history of payments. With earnings growth at 21.1% last year, financial fundamentals appear strong for sustaining payouts.

- Click here to discover the nuances of Cuckoo Holdings with our detailed analytical dividend report.

- Our expertly prepared valuation report Cuckoo Holdings implies its share price may be too high.

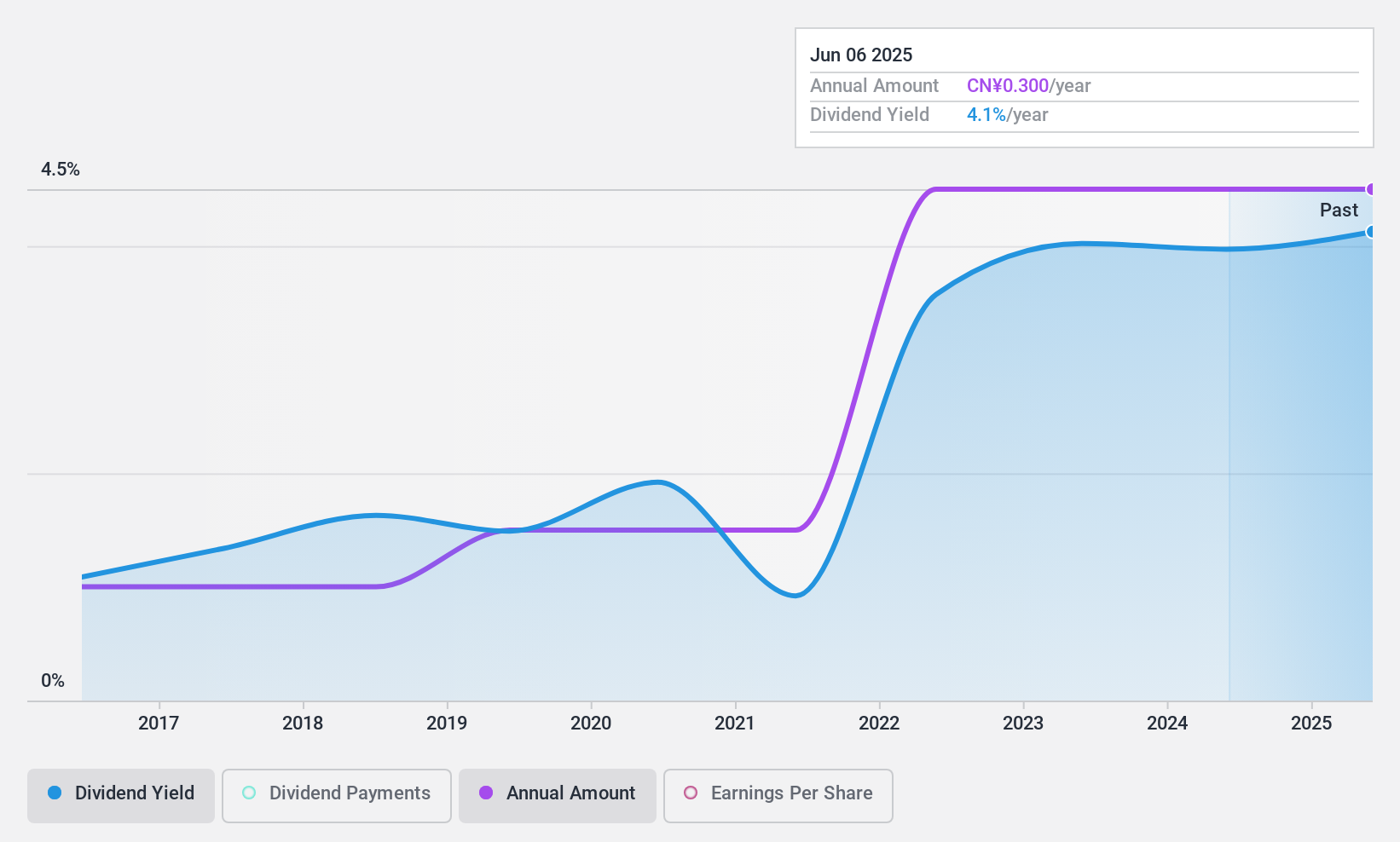

Jiangsu Huachang Chemical (SZSE:002274)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Huachang Chemical Co., Ltd operates in China, producing and selling agrochemicals, basic chemicals, fine chemicals, and biochemical products with a market capitalization of CN¥7.28 billion.

Operations: Jiangsu Huachang Chemical Co., Ltd generates revenue through its production and sale of agrochemicals, basic chemicals, fine chemicals, and biochemical products in China.

Dividend Yield: 3.9%

Jiangsu Huachang Chemical's dividend yield of 3.92% places it among the top quarter of Chinese market payers, supported by a low payout ratio of 36.2% and a cash payout ratio of 71.3%. While dividends have been stable and growing, they have only been paid for nine years. Recent earnings growth, with net income rising to CNY 529.99 million for the first nine months of 2024, reinforces its capacity to sustain payouts.

- Take a closer look at Jiangsu Huachang Chemical's potential here in our dividend report.

- The valuation report we've compiled suggests that Jiangsu Huachang Chemical's current price could be inflated.

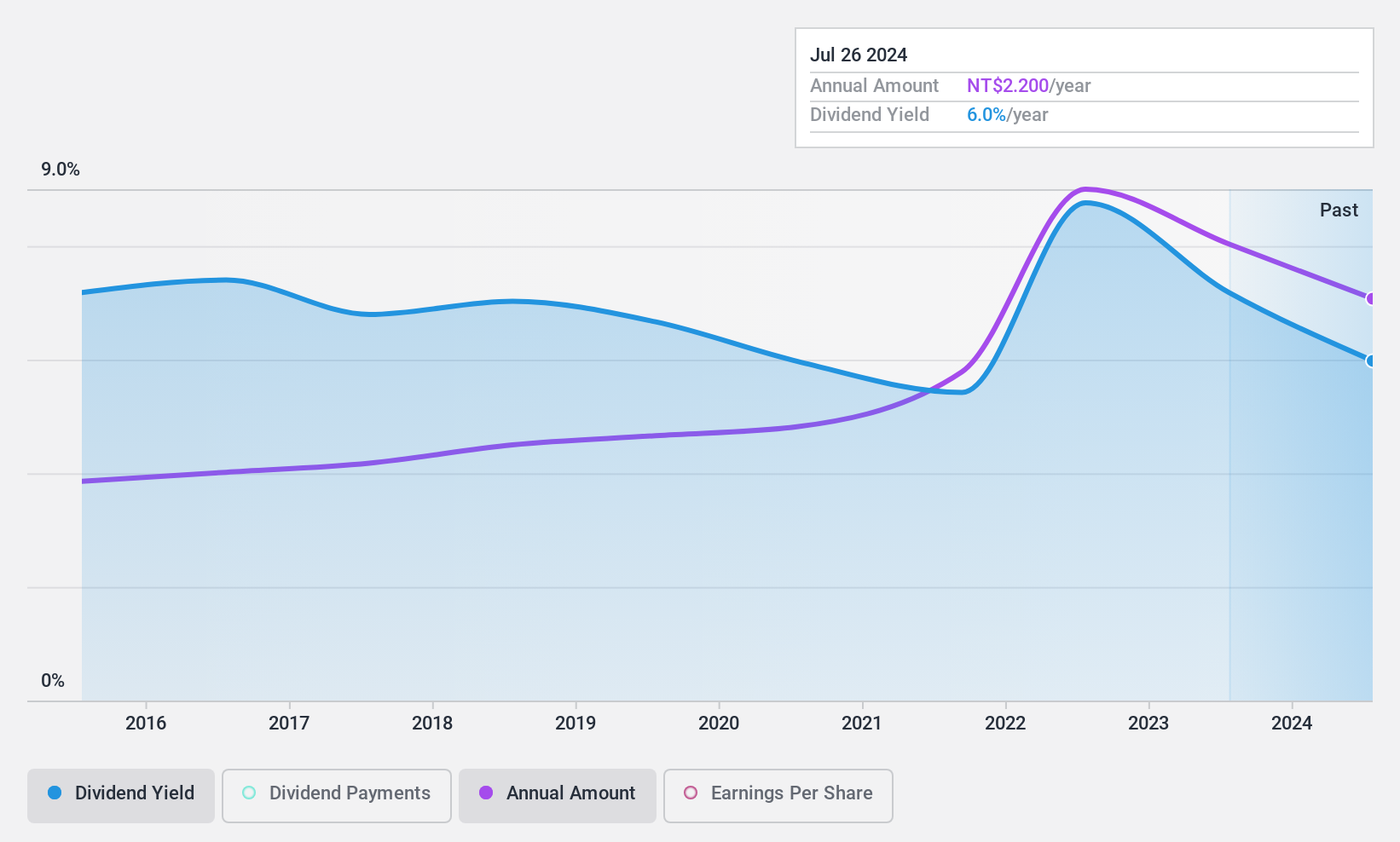

Unitech Computer (TWSE:2414)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Unitech Computer Co., Ltd. operates in the information technology product channel business across Asia, America, Europe, and Oceania with a market cap of NT$5.90 billion.

Operations: Unitech Computer Co., Ltd. generates its revenue primarily from the Information Access Business Segment, contributing NT$20.54 billion, and the Automatic Identification of Data Collection Product Sector, which adds NT$2.37 billion.

Dividend Yield: 6%

Unitech Computer's dividend yield of 5.99% ranks it in the top 25% of Taiwan's market, but sustainability is a concern due to a high cash payout ratio of 6786.6%. Although dividends have been stable and growing over the past decade, they are not well covered by free cash flows. Recent earnings growth, with Q3 net income rising to TWD 128.07 million from TWD 102.01 million last year, provides some support for continued payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Unitech Computer.

- Upon reviewing our latest valuation report, Unitech Computer's share price might be too pessimistic.

Taking Advantage

- Get an in-depth perspective on all 2015 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A192400

Cuckoo Holdings

Manufactures and sells electric heaters and daily necessities in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives