- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2402

Ichia Technologies (TWSE:2402) Could Easily Take On More Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Ichia Technologies, Inc. (TWSE:2402) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Ichia Technologies

What Is Ichia Technologies's Net Debt?

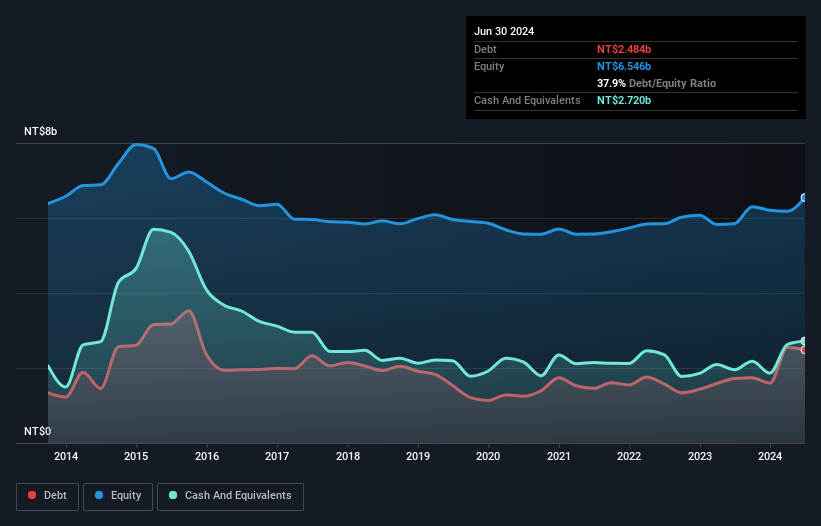

The image below, which you can click on for greater detail, shows that at June 2024 Ichia Technologies had debt of NT$2.48b, up from NT$1.72b in one year. But on the other hand it also has NT$2.72b in cash, leading to a NT$236.7m net cash position.

How Strong Is Ichia Technologies' Balance Sheet?

According to the last reported balance sheet, Ichia Technologies had liabilities of NT$5.02b due within 12 months, and liabilities of NT$392.5m due beyond 12 months. On the other hand, it had cash of NT$2.72b and NT$3.58b worth of receivables due within a year. So it actually has NT$889.9m more liquid assets than total liabilities.

This short term liquidity is a sign that Ichia Technologies could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Ichia Technologies boasts net cash, so it's fair to say it does not have a heavy debt load!

In addition to that, we're happy to report that Ichia Technologies has boosted its EBIT by 43%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Ichia Technologies will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Ichia Technologies has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Ichia Technologies's free cash flow amounted to 47% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Ichia Technologies has net cash of NT$236.7m, as well as more liquid assets than liabilities. And it impressed us with its EBIT growth of 43% over the last year. So we don't think Ichia Technologies's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Ichia Technologies that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2402

Ichia Technologies

Manufactures, processes, and trades in components and materials for electronics, home appliances, electronical engineering, electrical equipment, communications, and computers in the United States, Europe, and Asia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026