- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2383

Global Market: 3 Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and inflation dynamics, recent developments have led to fluctuations in major indices, with U.S. stocks experiencing a notable rebound before facing late-week pressures. Amidst this backdrop, investors often seek undervalued stocks that may offer potential value due to market mispricing or overlooked fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PixArt Imaging (TPEX:3227) | NT$219.00 | NT$436.77 | 49.9% |

| Sahara International Petrochemical (SASE:2310) | SAR18.74 | SAR37.30 | 49.8% |

| cottaLTD (TSE:3359) | ¥433.00 | ¥860.83 | 49.7% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.36 | CN¥26.52 | 49.6% |

| Séché Environnement (ENXTPA:SCHP) | €99.00 | €197.26 | 49.8% |

| Dive (TSE:151A) | ¥916.00 | ¥1819.25 | 49.6% |

| Trøndelag Sparebank (OB:TRSB) | NOK114.50 | NOK226.55 | 49.5% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥21.44 | CN¥42.38 | 49.4% |

| ikeGPS Group (NZSE:IKE) | NZ$0.97 | NZ$1.92 | 49.6% |

| VIGO Photonics (WSE:VGO) | PLN522.00 | PLN1042.74 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

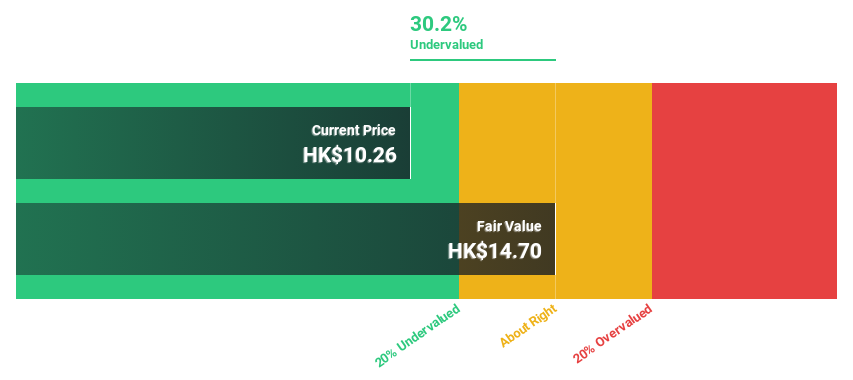

Chow Tai Fook Jewellery Group (SEHK:1929)

Overview: Chow Tai Fook Jewellery Group Limited is an investment holding company that manufactures and sells jewelry products across Mainland China, Hong Kong, Macau, and internationally, with a market cap of HK$115.25 billion.

Operations: Chow Tai Fook Jewellery Group's revenue is primarily derived from Mainland China, contributing HK$82.05 billion, and Hong Kong, Macau of China, and other markets, which together account for HK$17.80 billion.

Estimated Discount To Fair Value: 30.8%

Chow Tai Fook Jewellery Group is trading at HK$11.54, significantly below its estimated fair value of HK$16.69, indicating it may be undervalued based on cash flows. Despite high debt levels and slower revenue growth compared to the Hong Kong market, its earnings are expected to grow significantly at 23.55% annually, outpacing the market's 10.3%. Recent executive changes aim to enhance financial management and operational efficiency, potentially strengthening future performance amidst improved strategic oversight.

- In light of our recent growth report, it seems possible that Chow Tai Fook Jewellery Group's financial performance will exceed current levels.

- Take a closer look at Chow Tai Fook Jewellery Group's balance sheet health here in our report.

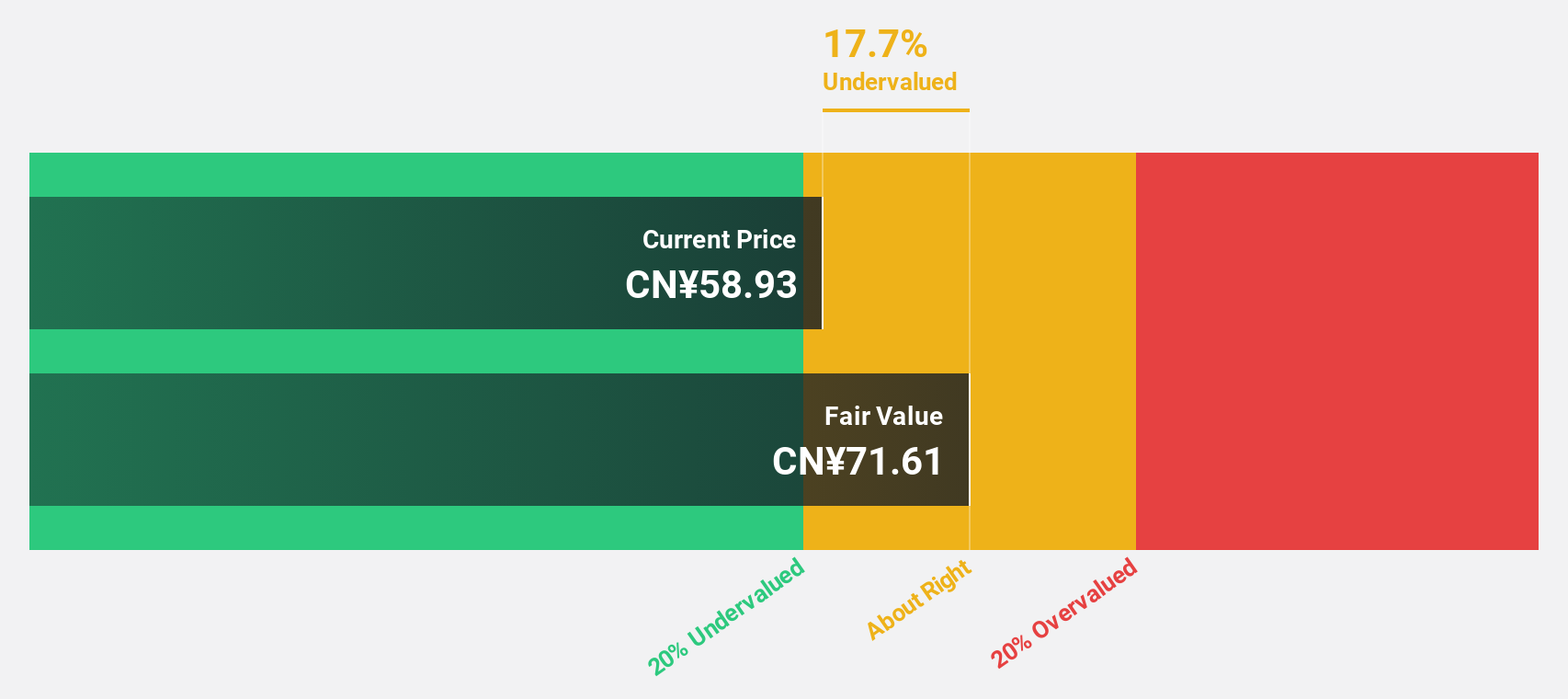

CSPC Innovation Pharmaceutical (SZSE:300765)

Overview: CSPC Innovation Pharmaceutical Co., Ltd. is involved in the research, development, production, and sales of biopharmaceuticals, APIs, and functional foods both in China and internationally with a market cap of CN¥72.29 billion.

Operations: The company's revenue is derived from its activities in biopharmaceuticals, APIs, and functional foods across domestic and international markets.

Estimated Discount To Fair Value: 27.3%

CSPC Innovation Pharmaceutical is trading at CN¥52.03, below its estimated fair value of CN¥71.61, suggesting undervaluation based on cash flows. Despite recent financial challenges including a net loss in Q1 2025 and reduced revenue compared to the previous year, the company is expected to achieve profitability within three years with significant annual earnings growth of 71.51%. Strategic collaborations may enhance product competitiveness and market expansion, although share price volatility remains high.

- Our earnings growth report unveils the potential for significant increases in CSPC Innovation Pharmaceutical's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of CSPC Innovation Pharmaceutical.

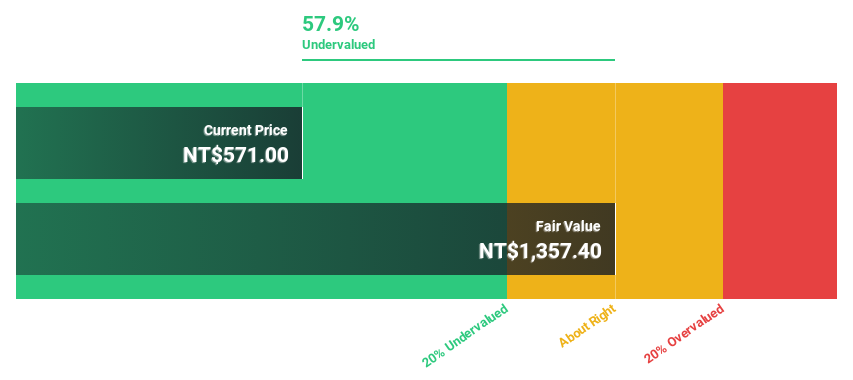

Elite Material (TWSE:2383)

Overview: Elite Material Co., Ltd. produces and sells copper clad laminates, electronic-industrial specialty chemicals, raw materials, and electronic components in Taiwan, China, and internationally with a market cap of NT$262.75 billion.

Operations: The company's revenue is derived from NT$16.17 billion in domestic sales and NT$69.60 billion from foreign operations.

Estimated Discount To Fair Value: 35.2%

Elite Material is trading at NT$783, significantly below its estimated fair value of NT$1209.24, indicating potential undervaluation based on cash flows. The company reported robust Q1 2025 earnings with sales of TWD 21.68 billion and net income of TWD 3.47 billion, reflecting strong year-over-year growth. Despite high share price volatility and reliance on non-cash earnings, Elite Material's projected revenue growth surpasses the market average, supported by ongoing business expansions such as the Tayuan factory construction project valued at TWD 3.31 billion.

- Upon reviewing our latest growth report, Elite Material's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Elite Material with our comprehensive financial health report here.

Turning Ideas Into Actions

- Dive into all 517 of the Undervalued Global Stocks Based On Cash Flows we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2383

Elite Material

Engages in the production and sale of copper clad laminates, electronic-industrial specialty chemical and raw materials, and electronic components in Taiwan, China, and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success