- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2383

3 Stocks Estimated To Be Up To 41.8% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and climbing stock indexes, investors are increasingly focused on identifying opportunities within this shifting economic environment. With U.S. indices nearing record highs and inflation data influencing rate expectations, the search for stocks trading below their intrinsic value becomes particularly relevant, offering potential upside in an otherwise uncertain market climate.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Meorient Commerce Exhibition (SZSE:300795) | CN¥23.89 | CN¥47.35 | 49.5% |

| Provident Financial Services (NYSE:PFS) | US$18.66 | US$36.99 | 49.6% |

| Samwha ElectricLtd (KOSE:A009470) | ₩43300.00 | ₩86056.86 | 49.7% |

| Power Wind Health Industry (TWSE:8462) | NT$111.00 | NT$221.07 | 49.8% |

| Smurfit Westrock (NYSE:SW) | US$55.30 | US$109.74 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.07 | CN¥30.01 | 49.8% |

| Com2uS (KOSDAQ:A078340) | ₩48300.00 | ₩96048.27 | 49.7% |

| BIKE O (TSE:3377) | ¥410.00 | ¥812.21 | 49.5% |

| Saipem (BIT:SPM) | €2.341 | €4.67 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

Here's a peek at a few of the choices from the screener.

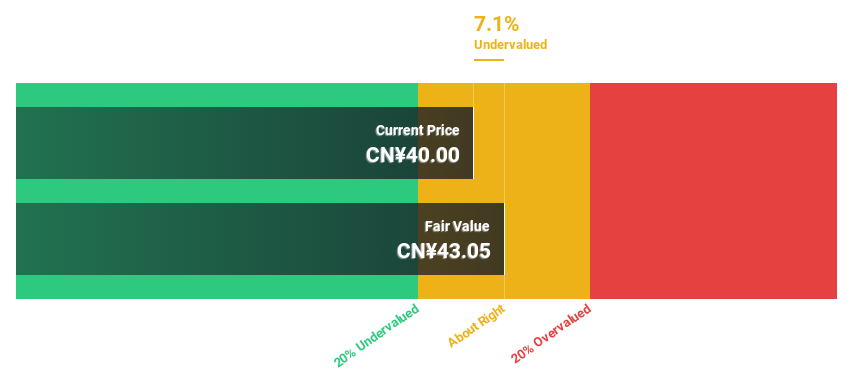

Shenzhen Sinexcel ElectricLtd (SZSE:300693)

Overview: Shenzhen Sinexcel Electric Co., Ltd. operates as a provider of energy interconnection ecosystems across multiple continents, including Asia, Oceania, Europe, North America, South America, and Africa, with a market cap of CN¥9.84 billion.

Operations: Shenzhen Sinexcel Electric Co., Ltd. generates its revenue from providing energy interconnection solutions across various regions, including China, the rest of Asia, Oceania, Europe, North America, South America, and Africa.

Estimated Discount To Fair Value: 18%

Shenzhen Sinexcel Electric Ltd. is trading at CN¥35.02, below its estimated fair value of CN¥42.69, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 29.4% annually over the next three years, outpacing the Chinese market's growth rate of 25%. Recent strategic partnerships and robust revenue growth further enhance its potential for future expansion in the energy sector despite a modest dividend yield of 0.94%.

- In light of our recent growth report, it seems possible that Shenzhen Sinexcel ElectricLtd's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Shenzhen Sinexcel ElectricLtd.

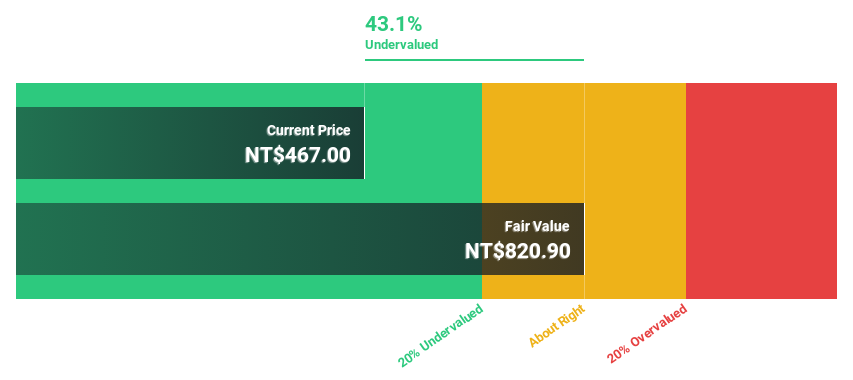

Elite Material (TWSE:2383)

Overview: Elite Material Co., Ltd. produces and sells copper clad laminates, electronic-industrial specialty chemicals, raw materials, and electronic components across Taiwan, China, and globally with a market cap of NT$211.28 billion.

Operations: The company's revenue is comprised of NT$14.61 billion from domestic operations and NT$54.56 billion from international activities.

Estimated Discount To Fair Value: 27%

Elite Material is trading at NT$612, notably below its estimated fair value of NT$838.63, suggesting undervaluation based on cash flows. Despite recent high share price volatility, its earnings grew by 83.4% last year and are forecast to rise 18.69% annually, outpacing the Taiwan market's growth rate of 17.9%. The company's revenue is expected to grow at 15.4% per year, offering good relative value compared to peers and industry standards.

- Our growth report here indicates Elite Material may be poised for an improving outlook.

- Dive into the specifics of Elite Material here with our thorough financial health report.

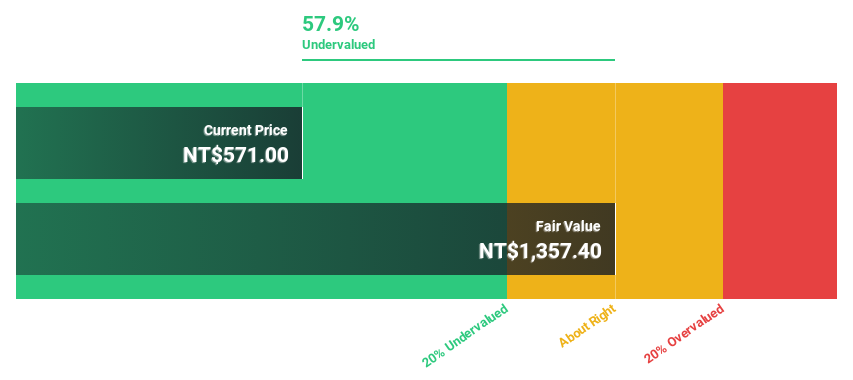

Lai Yih Footwear (TWSE:6890)

Overview: Lai Yih Footwear Co., Ltd. specializes in the production and sale of vulcanized shoes, athletic footwear, cold-pressed shoes, and specialized functional footwear, with a market cap of NT$110.73 billion.

Operations: The company generates revenue of NT$35.04 billion from the production and sales of sports and leisure footwear.

Estimated Discount To Fair Value: 41.8%

Lai Yih Footwear is trading at NT$474.5, well below its estimated fair value of NT$815.51, highlighting significant undervaluation based on cash flows. Despite recent share price volatility, the company's earnings grew by 279.1% last year and are expected to increase by 29.93% annually, surpassing the Taiwan market's growth rate of 17.9%. Recent participation in major conferences underscores management's proactive engagement with investors and stakeholders amid robust financial performance forecasts.

- According our earnings growth report, there's an indication that Lai Yih Footwear might be ready to expand.

- Click here to discover the nuances of Lai Yih Footwear with our detailed financial health report.

Seize The Opportunity

- Get an in-depth perspective on all 923 Undervalued Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2383

Elite Material

Engages in the production and sale of copper clad laminates, electronic-industrial specialty chemical and raw materials, and electronic components in Taiwan, China, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives