- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

Subdued Growth No Barrier To Chroma ATE Inc. (TWSE:2360) With Shares Advancing 30%

Chroma ATE Inc. (TWSE:2360) shares have had a really impressive month, gaining 30% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 47%.

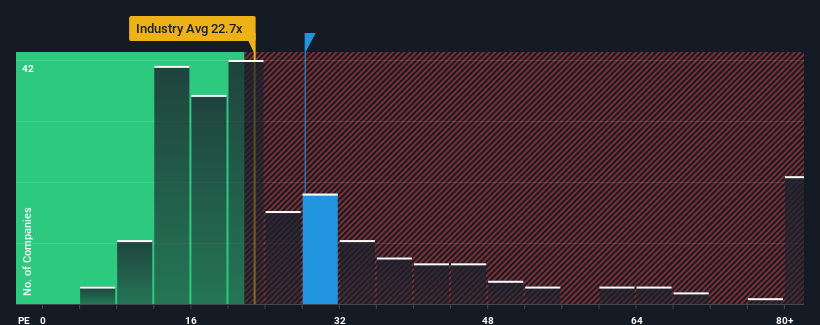

Since its price has surged higher, Chroma ATE may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 28.2x, since almost half of all companies in Taiwan have P/E ratios under 22x and even P/E's lower than 15x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Chroma ATE has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Chroma ATE

How Is Chroma ATE's Growth Trending?

Chroma ATE's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 69% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 15% per year during the coming three years according to the eight analysts following the company. With the market predicted to deliver 13% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Chroma ATE is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Chroma ATE's P/E

Chroma ATE shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Chroma ATE currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Chroma ATE that you should be aware of.

If you're unsure about the strength of Chroma ATE's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives