- Hong Kong

- /

- Energy Services

- /

- SEHK:3337

Insider-Favored Growth Companies To Watch In February 2025

Reviewed by Simply Wall St

As global markets continue to edge toward record highs, driven by robust performances in U.S. stock indexes and a buoyant European market, investors are increasingly focused on growth stocks that have shown resilience amid economic uncertainties. In this context, companies with high insider ownership often attract attention as they can signal confidence from those closest to the business and potentially align management interests with shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's dive into some prime choices out of the screener.

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Anton Oilfield Services Group is an investment holding company offering oilfield engineering and technical services to oil companies in China, Iraq, and internationally, with a market cap of HK$2.42 billion.

Operations: The company's revenue segments include CN¥441.14 million from Inspection Services, CN¥292.99 million from Drilling Rig Services, CN¥2.22 billion from Oilfield Technical Services, and CN¥1.77 billion from Oilfield Management Services.

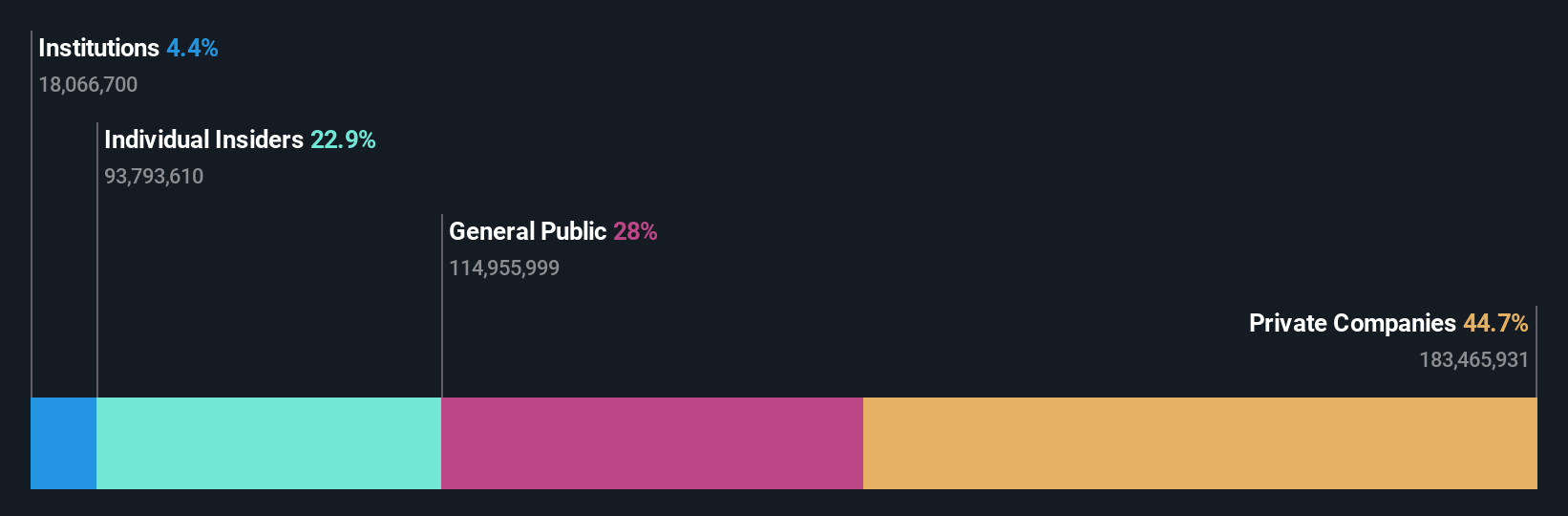

Insider Ownership: 25.9%

Revenue Growth Forecast: 13.1% p.a.

Anton Oilfield Services Group shows potential with its earnings forecast to grow significantly at 25.4% annually, outpacing the Hong Kong market. However, profit margins have decreased from last year. The company trades well below its estimated fair value and has recently managed a substantial debt repayment of US$63.19 million, indicating financial prudence. Recent board changes include appointing Ms. Chen Xin as an independent non-executive director and ESG Committee chairperson, potentially strengthening governance practices.

- Take a closer look at Anton Oilfield Services Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Anton Oilfield Services Group shares in the market.

Xianheng International Science&Technology (SHSE:605056)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xianheng International Science&Technology Co., Ltd. operates in the technology sector and has a market capitalization of approximately CN¥5.84 billion.

Operations: The company's revenue segments are not provided in the given text.

Insider Ownership: 23.2%

Revenue Growth Forecast: 20.5% p.a.

Xianheng International Science & Technology is poised for robust growth, with earnings forecast to increase significantly by 36.3% annually, surpassing the Chinese market average. Revenue is expected to grow at 20.5% per year, outpacing market trends. However, profit margins have declined from 6.1% to 4.1%, and the company has an unstable dividend history. A special shareholders meeting on Feb 10 may address strategic directions amid these dynamics and high insider ownership levels could influence decision-making processes.

- Click to explore a detailed breakdown of our findings in Xianheng International Science&Technology's earnings growth report.

- The analysis detailed in our Xianheng International Science&Technology valuation report hints at an inflated share price compared to its estimated value.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

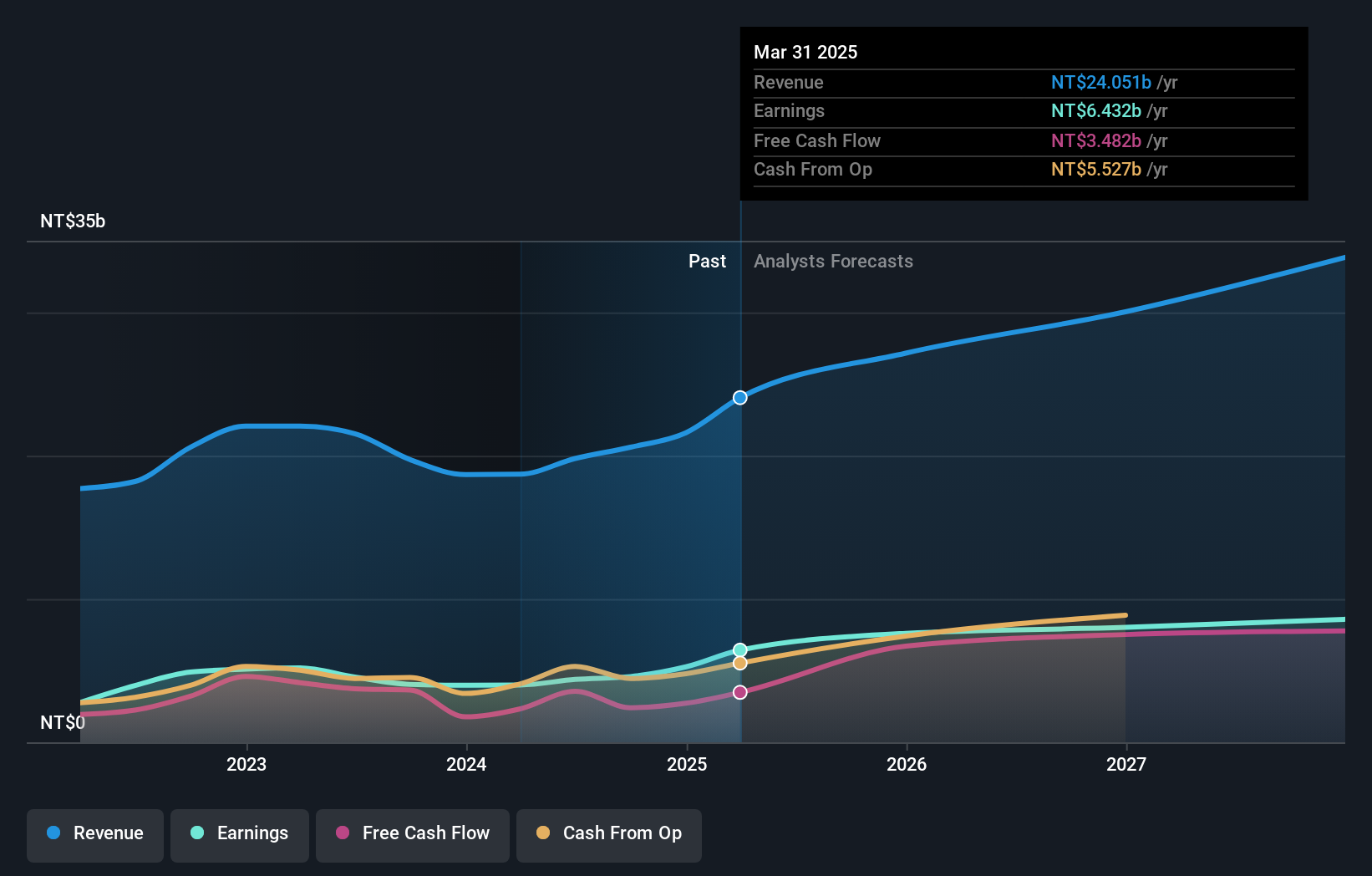

Overview: Chroma ATE Inc. is involved in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as various test systems and power supplies across Taiwan, China, the United States, and other international markets; its market cap stands at NT$147.86 billion.

Operations: The company's revenue is primarily derived from its Measuring Instruments Business, which accounts for NT$30.84 billion, followed by Automated Transport Engineering at NT$1.69 billion.

Insider Ownership: 14.5%

Revenue Growth Forecast: 17% p.a.

Chroma ATE's earnings are projected to grow significantly at 26.7% annually, outpacing Taiwan's market average. Despite high volatility in its share price recently, the stock is trading at 29.7% below estimated fair value, with analysts expecting a 30.8% price increase. Revenue growth is forecasted at 17% per year, faster than the market but not exceptionally high for a growth firm. The dividend yield of 1.87% lacks coverage by free cash flows, and no recent insider trading activity has been reported.

- Navigate through the intricacies of Chroma ATE with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Chroma ATE's shares may be trading at a discount.

Where To Now?

- Investigate our full lineup of 1458 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3337

Anton Oilfield Services Group

An investment holding company, provides oilfield engineering and technical services for oil companies in the People’s Republic of China, Iraq, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives