- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

Exploring Three High Growth Tech Stocks with Global Potential

Reviewed by Simply Wall St

Amidst a backdrop of mixed performance in major stock indexes, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 have shown resilience, posting gains despite broader market challenges. As global trade uncertainties and economic headwinds continue to shape market sentiment, identifying high-growth tech stocks with robust fundamentals and global potential becomes crucial for investors seeking opportunities in this dynamic landscape.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Pharma Mar | 23.66% | 40.07% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 46.06% | 66.78% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

China Leadshine Technology (SZSE:002979)

Simply Wall St Growth Rating: ★★★★★☆

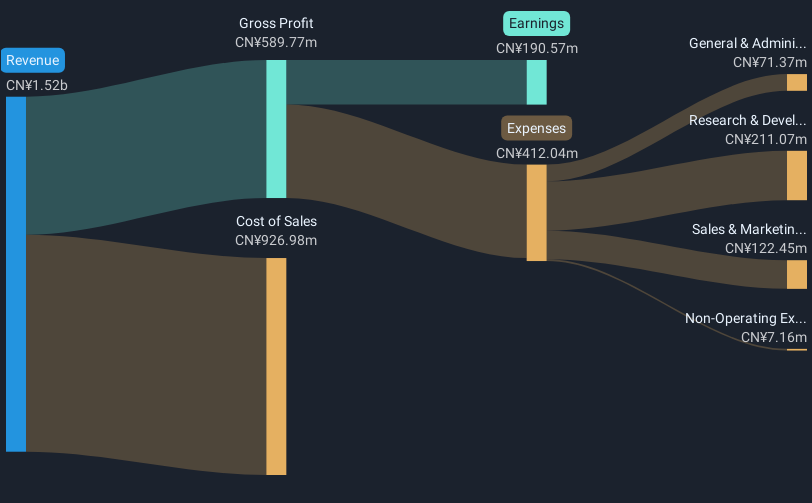

Overview: China Leadshine Technology Co., Ltd. specializes in designing, manufacturing, and selling motion control equipment and components in China, with a market cap of CN¥13.96 billion.

Operations: Leadshine focuses on the production and sale of motion control equipment and components within China. The company operates with a market capitalization of approximately CN¥13.96 billion, reflecting its significant presence in the industry.

China Leadshine Technology, amidst a volatile share price, showcases robust growth metrics that are hard to overlook. With earnings surging by 84.3% over the past year, significantly outpacing the Electronic industry's 7% growth, this momentum is underlined by a promising revenue forecast set to exceed the CN market's average with an annual increase of 21.1%. Notably, its commitment to innovation is reflected in substantial R&D investments linked directly to these performance figures. Moreover, recent strategic moves include a share buyback program completed in March 2025 for CNY 28.8 million, underscoring confidence in its operational strategy and future prospects despite current market volatility and a forecasted modest Return on Equity of 17.3% in three years' time.

Longshine Technology Group (SZSE:300682)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Longshine Technology Group Co., Ltd. is a technology company based in China with a market capitalization of approximately CN¥13.65 billion.

Operations: Longshine Technology Group generates revenue primarily through its Energy Digital Business and Energy Internet Business, with contributions of approximately CN¥2.20 billion and CN¥1.86 billion, respectively. Additionally, the Internet TV Business adds around CN¥528.23 million to the company's revenue streams.

Longshine Technology Group's recent financial performance shows a challenging landscape with a net loss of CNY 250.28 million for the year ending December 31, 2024, contrasting sharply with the previous year's net income of CNY 603.95 million. Despite this setback, the company continues to prioritize innovation as evidenced by its significant R&D expenditure which aligns closely with its revenue growth rate forecasted at an impressive 20.3% per annum. This strategic focus on research is crucial as it seeks to rebound and capitalize on emerging tech trends, potentially enhancing its market position in upcoming years. Furthermore, Longshine's commitment to returning value to shareholders is demonstrated through a recent dividend payout and ongoing adjustments to enhance financial health and operational efficiency.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

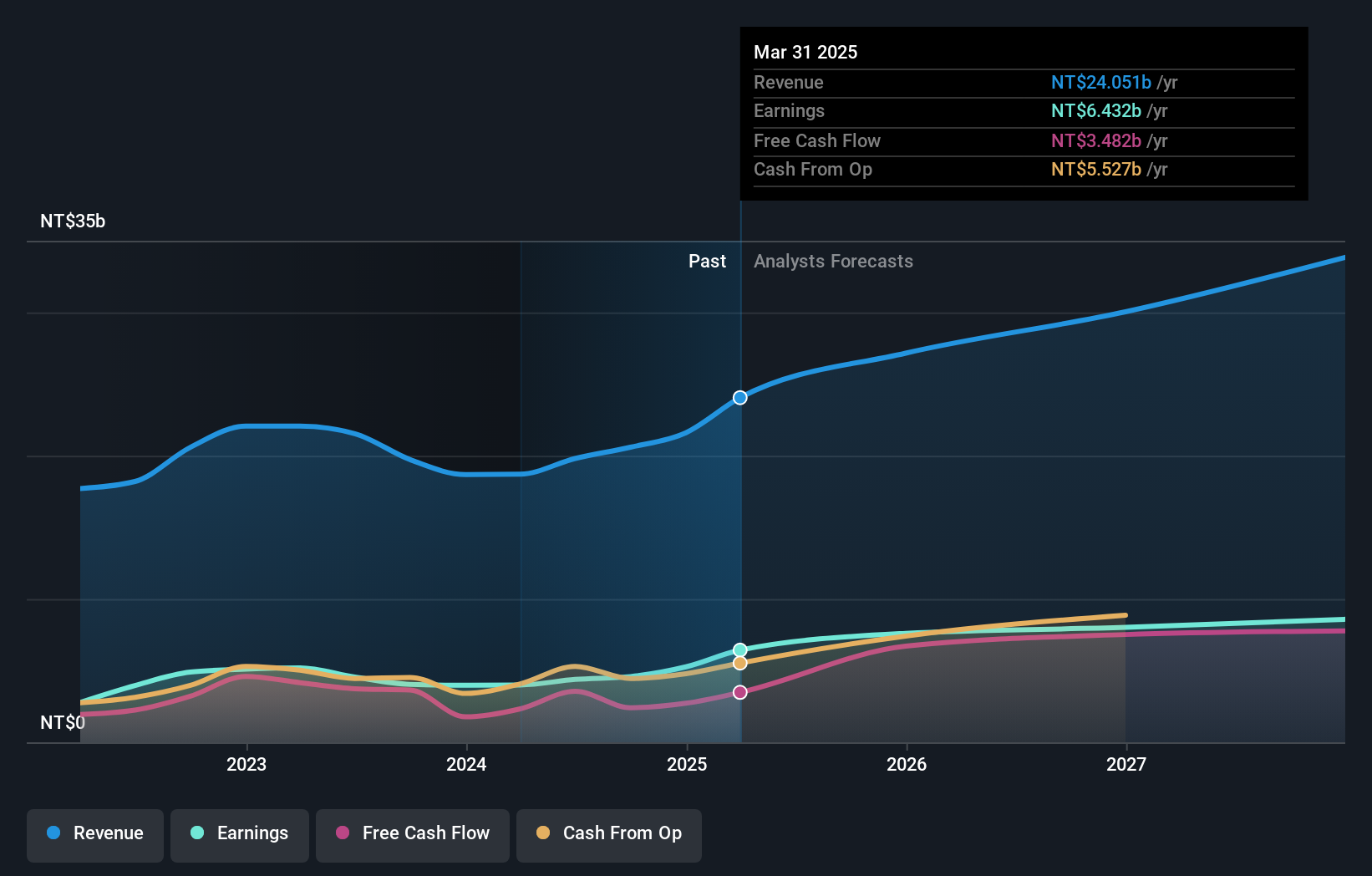

Overview: Chroma ATE Inc. is involved in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as various testing systems and power supplies across Taiwan, China, the United States, and other international markets with a market cap of NT$114.39 billion.

Operations: The Measuring Instruments Business is a significant revenue stream, generating NT$33.42 billion. Automated Transport Engineering contributes NT$1.45 billion to the company's revenue.

Chroma ATE has demonstrated robust financial health with a notable increase in annual revenue, up 16.1% to TWD 21.6 billion, and a surge in net income by 32.3% to TWD 5.26 billion for the year ended December 31, 2024. These gains reflect the company's strategic emphasis on innovation and R&D investment, which is evident from its recent inclusion in the FTSE All-World Index, signaling strong market recognition. This focus is further underscored by its aggressive R&D spending aligned with revenue growth, ensuring Chroma ATE remains at the forefront of technological advances within the electronics sector.

- Click here to discover the nuances of Chroma ATE with our detailed analytical health report.

Gain insights into Chroma ATE's past trends and performance with our Past report.

Next Steps

- Gain an insight into the universe of 758 Global High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion