Cellnex Telecom And 2 Other Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

With global markets experiencing heightened volatility and economic slowdown concerns, many investors are on the lookout for opportunities that may be undervalued amidst the turbulence. In such an environment, identifying stocks that are priced below their estimated value can offer a strategic advantage, as these investments have the potential to provide significant returns when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3395.00 | ¥6777.77 | 49.9% |

| Owens Corning (NYSE:OC) | US$157.76 | US$315.19 | 49.9% |

| I-PEX (TSE:6640) | ¥1460.00 | ¥2910.46 | 49.8% |

| Pilot (TSE:7846) | ¥4451.00 | ¥8898.73 | 50% |

| NSE (ENXTPA:ALNSE) | €29.20 | €58.31 | 49.9% |

| Trisul (BOVESPA:TRIS3) | R$4.63 | R$9.24 | 49.9% |

| Arteche Lantegi Elkartea (BME:ART) | €6.25 | €12.46 | 49.9% |

| EVERTEC (NYSE:EVTC) | US$32.94 | US$65.79 | 49.9% |

| Exosens (ENXTPA:EXENS) | €20.995 | €41.89 | 49.9% |

| Grifols (BME:GRF) | €9.228 | €18.41 | 49.9% |

We'll examine a selection from our screener results.

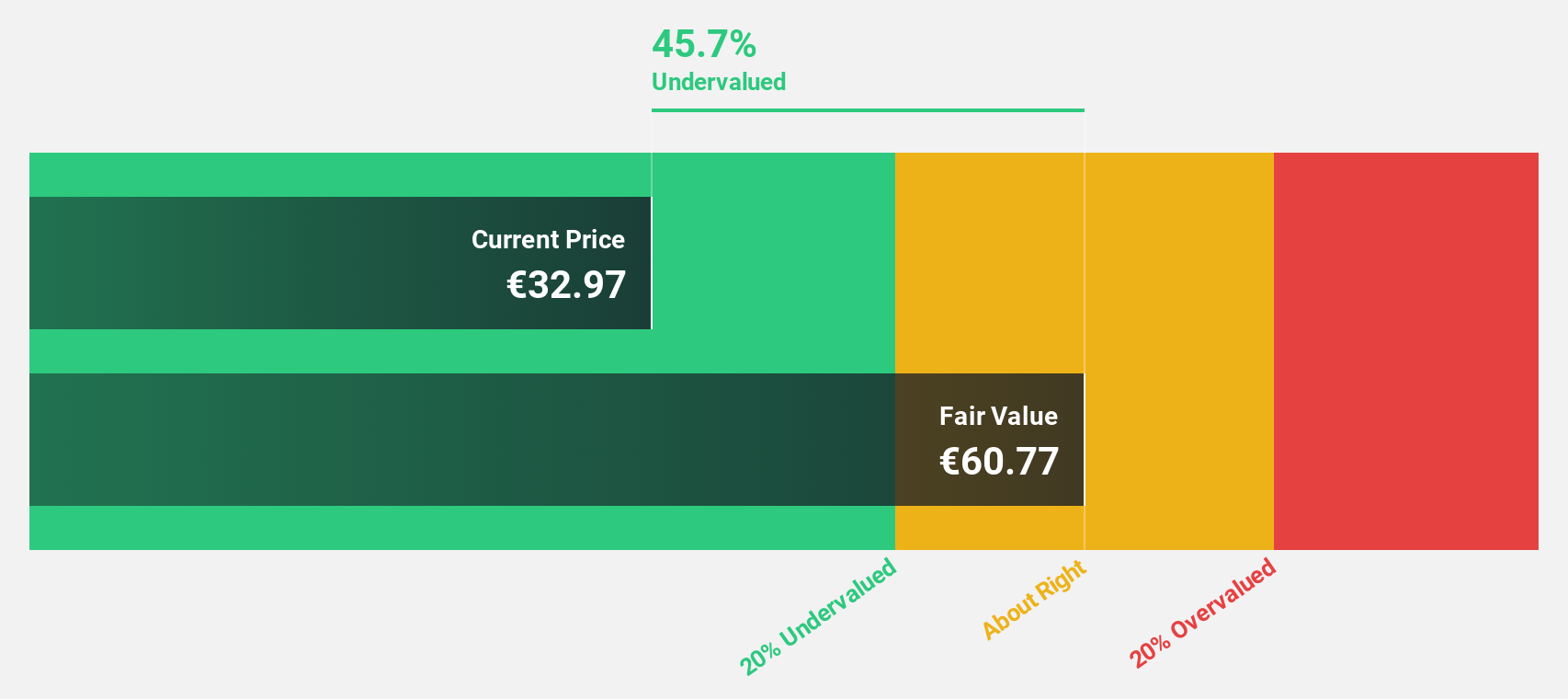

Cellnex Telecom (BME:CLNX)

Overview: Cellnex Telecom, S.A. operates infrastructure for wireless telecommunication across various European countries and has a market cap of €25.36 billion.

Operations: Cellnex Telecom generates revenue from operating wireless telecommunication infrastructure across Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden and Switzerland.

Estimated Discount To Fair Value: 48.3%

Cellnex Telecom, trading at €35.94, is significantly undervalued based on its discounted cash flow valuation of €69.52. Despite a net loss of €418.09 million for the first half of 2024, revenue increased to €2.12 billion from €1.99 billion year-over-year. The company halted a potential €4 billion stake sale in its Polish unit due to stalled negotiations but remains focused on cost management and shareholder returns through strategic divestments like the ongoing Austrian process.

- The analysis detailed in our Cellnex Telecom growth report hints at robust future financial performance.

- Dive into the specifics of Cellnex Telecom here with our thorough financial health report.

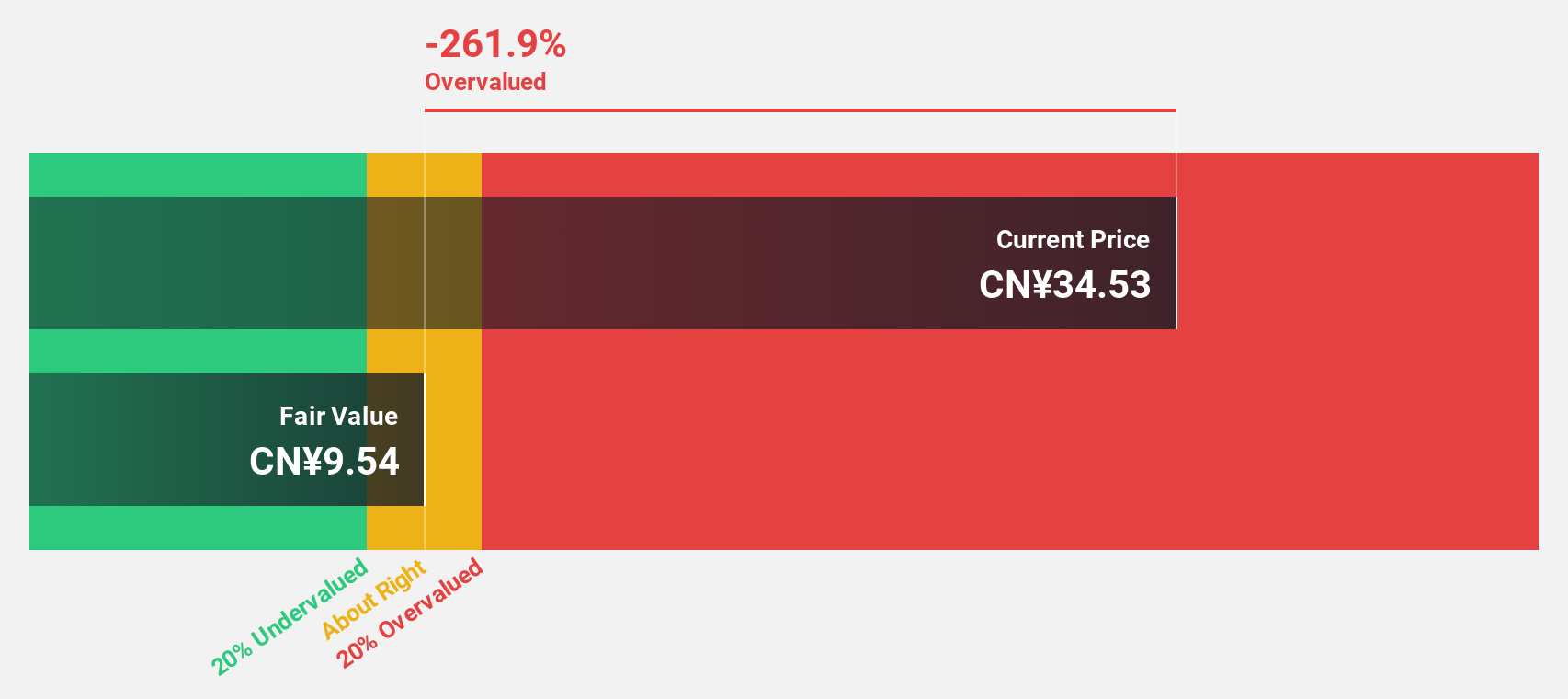

Ganfeng Lithium Group (SZSE:002460)

Overview: Ganfeng Lithium Group Co., Ltd. manufactures and sells lithium products globally, with a market cap of CN¥46.25 billion.

Operations: The company generates revenue from manufacturing and selling lithium products across Mainland China, the rest of Asia, the European Union, North America, and internationally.

Estimated Discount To Fair Value: 29.0%

Ganfeng Lithium Group, trading at CN¥27.84, is undervalued with a fair value estimate of CN¥39.21. Despite a challenging first half of 2024 with sales dropping to CN¥9.54 billion and a net loss of CN¥760 million, the company's revenue is forecast to grow 15.2% annually, outpacing the market's 13.2%. Earnings are expected to grow significantly at 62% per year, making it an attractive option based on future cash flows despite current setbacks.

- Our expertly prepared growth report on Ganfeng Lithium Group implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Ganfeng Lithium Group with our detailed financial health report.

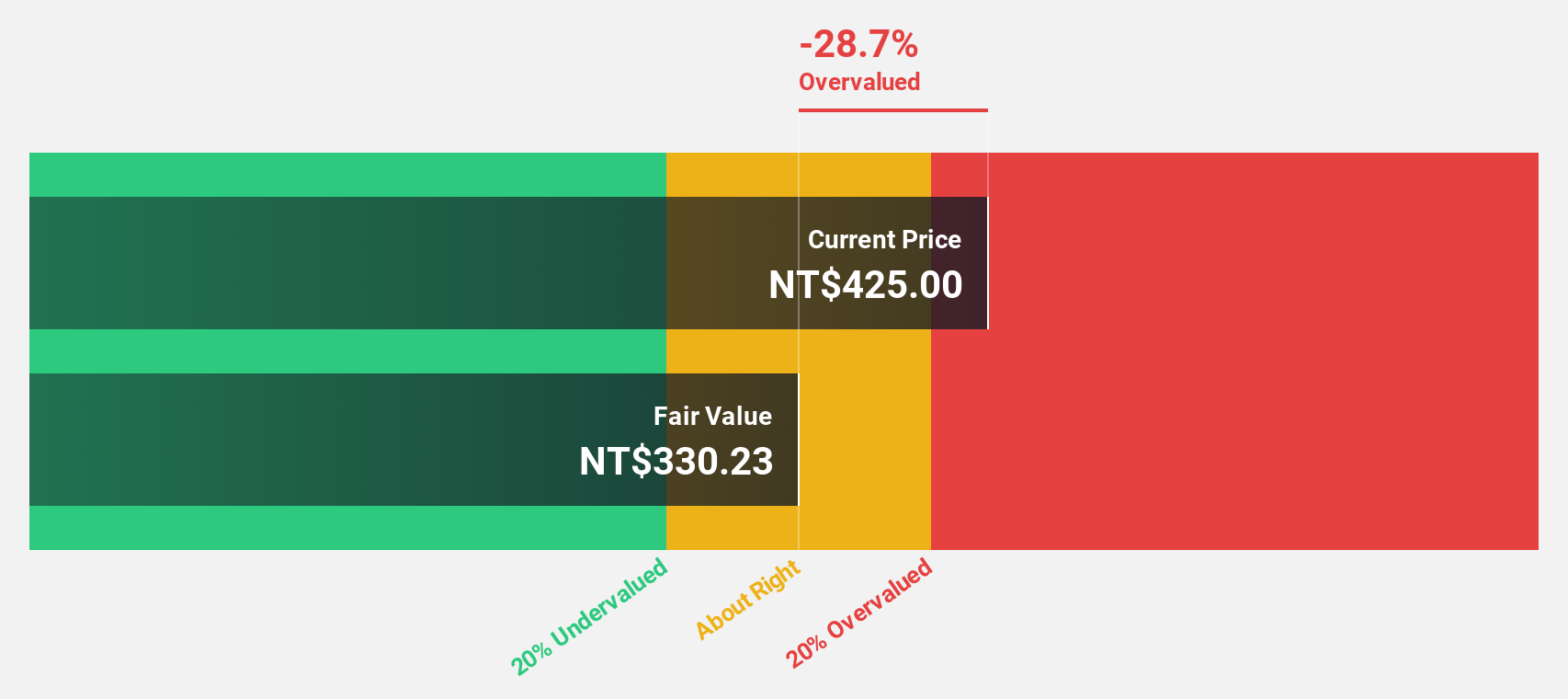

Chroma ATE (TWSE:2360)

Overview: Chroma ATE Inc. designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies globally; it has a market cap of NT$146.60 billion.

Operations: Revenue Segments (in millions of NT$): Measuring Instruments Business: 29.52 billion, Automated Transport Engineering: 1.58 billion

Estimated Discount To Fair Value: 11.8%

Chroma ATE, trading at NT$338 and estimated to be worth NT$383.01, appears undervalued based on cash flows. Recent earnings show strong performance with Q2 revenue rising to NT$5.52 billion from NT$4.42 billion year-on-year and net income increasing to NT$1.41 billion from NT$1.02 billion. Despite a volatile share price, its forecasted annual earnings growth of 21% outpaces the TW market's 18%, indicating robust future cash flow potential despite some instability in dividend history.

- The growth report we've compiled suggests that Chroma ATE's future prospects could be on the up.

- Get an in-depth perspective on Chroma ATE's balance sheet by reading our health report here.

Key Takeaways

- Click this link to deep-dive into the 933 companies within our Undervalued Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002460

Ganfeng Lithium Group

Manufactures and sells lithium products in Mainland China, South Korea, Europe, Rest of Asia, North America, and internationally.

Reasonable growth potential with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives