- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

Asian Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of global trade tensions and economic uncertainties, Asian markets have shown resilience, with China's stock indices advancing on the expectation of increased stimulus measures. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Jiayou International LogisticsLtd (SHSE:603871) | 19.3% | 25.5% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 34.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| BIWIN Storage Technology (SHSE:688525) | 17.7% | 59.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ascentage Pharma Group International (SEHK:6855)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ascentage Pharma Group International, a clinical-stage biotechnology company, focuses on developing therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China, with a market cap of HK$17.64 billion.

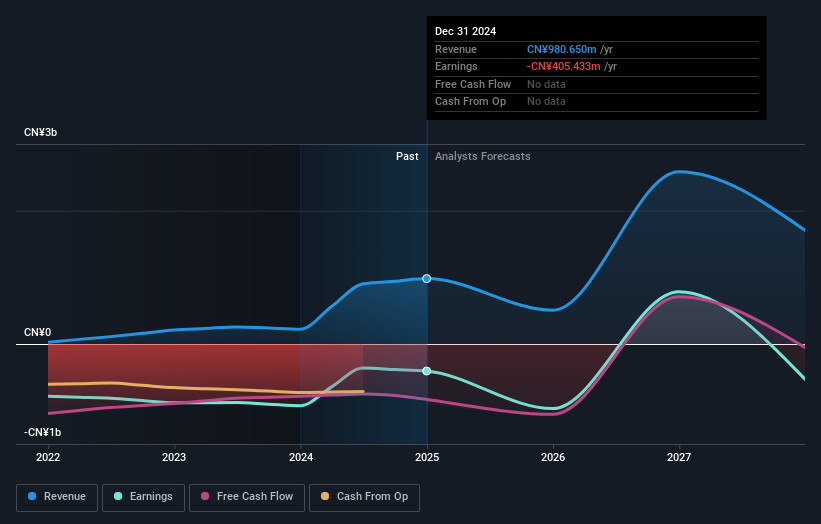

Operations: The company generates revenue from the development and sale of novel small-scale therapies, amounting to CN¥980.65 million.

Insider Ownership: 13.5%

Revenue Growth Forecast: 22.2% p.a.

Ascentage Pharma Group International, a growth-focused biotech company in Asia, showcases high insider ownership and robust R&D capabilities. Recently, its novel drugs lisaftoclax and olverembatinib received significant recognition in the 2025 CSCO Guidelines, enhancing their clinical credibility. Despite past shareholder dilution and share price volatility, Ascentage's revenue is forecast to grow at 22.2% annually, outpacing the Hong Kong market. The company reported CNY 980.65 million in sales for 2024 with a reduced net loss of CNY 405.43 million compared to the previous year.

- Click to explore a detailed breakdown of our findings in Ascentage Pharma Group International's earnings growth report.

- Our valuation report here indicates Ascentage Pharma Group International may be overvalued.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd operates in China, specializing in the manufacturing of auto parts, with a market capitalization of CN¥9.13 billion.

Operations: The company's revenue is primarily derived from the Auto Parts Industry, contributing CN¥2.37 billion, with an additional CN¥23.18 million coming from the Precision Machining Industry.

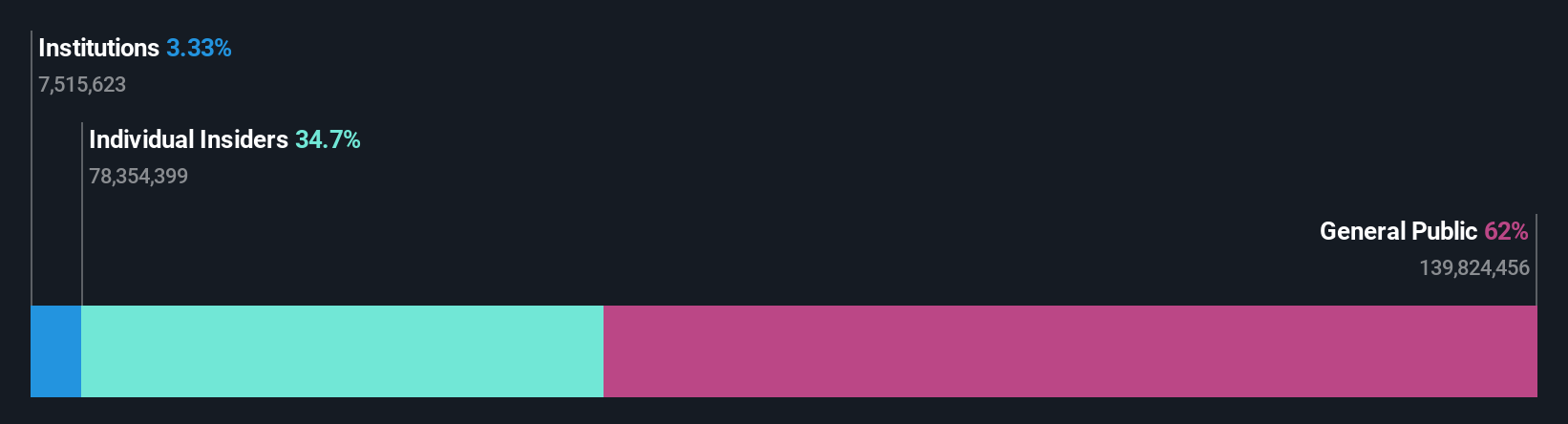

Insider Ownership: 34.8%

Revenue Growth Forecast: 23.7% p.a.

Wuxi Longsheng Technology Ltd. demonstrates strong growth potential with its earnings and revenue expected to grow significantly above the market rate at 28.9% and 23.7% per year, respectively. Despite a volatile share price, the company reported robust financial results for 2024, including CNY 2.40 billion in revenue and CNY 224.36 million net income, supported by substantial insider ownership but no recent insider trading activity. A recent share buyback further indicates management's confidence in its future prospects.

- Dive into the specifics of Wuxi Longsheng TechnologyLtd here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Wuxi Longsheng TechnologyLtd is priced higher than what may be justified by its financials.

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chroma ATE Inc. is engaged in the design, assembly, manufacturing, sales, repair, and maintenance of software and hardware for computers and peripherals as well as various electronic testing and power supply systems across Taiwan, China, the United States, and other international markets with a market cap of NT$118.42 billion.

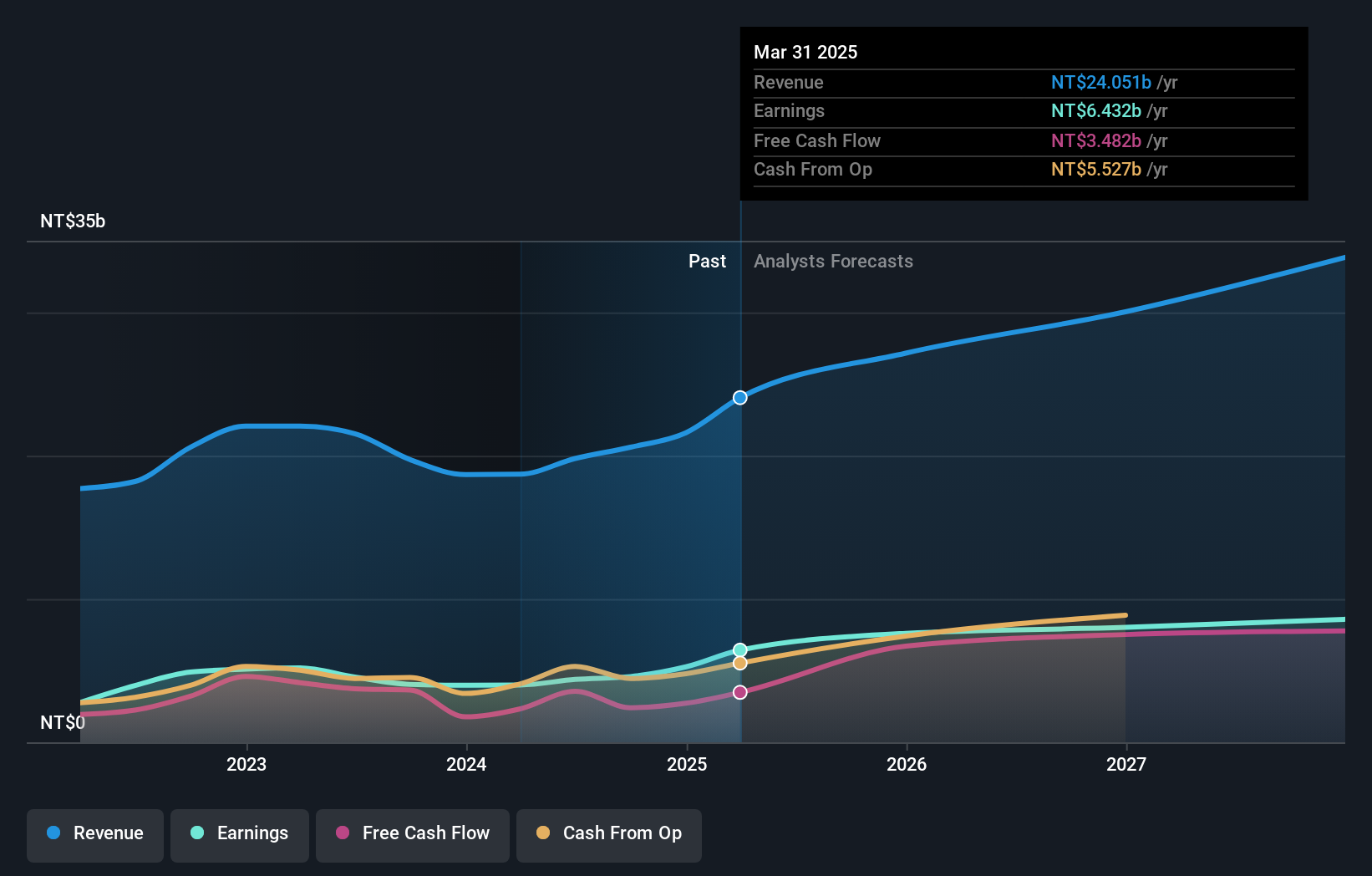

Operations: The company's revenue segments consist of NT$33.42 billion from the Measuring Instruments Business and NT$1.45 billion from Automated Transport Engineering.

Insider Ownership: 14.5%

Revenue Growth Forecast: 16.1% p.a.

Chroma ATE shows promising growth potential, with earnings forecasted to grow significantly at 20.1% annually, outpacing the Taiwan market. The company trades at a substantial discount of 36.9% below its fair value estimate and was recently added to the FTSE All-World Index. Despite a dividend not fully covered by free cash flows, it reported strong financials for 2024 with TWD 21.60 billion in revenue and TWD 5.26 billion net income, reflecting robust business performance without recent insider trading activity.

- Take a closer look at Chroma ATE's potential here in our earnings growth report.

- The analysis detailed in our Chroma ATE valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 645 Fast Growing Asian Companies With High Insider Ownership now.

- Curious About Other Options? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives